A VIB building in HCM City. — Photo courtesy of VIB

Vietnam International Bank (VIB) has announced its business results for the first nine months of 2024, showing stable revenue and performance.

The bank achieved robust credit and funding growth, exceeding the industry average, along with improved asset quality and a strong, secure balance sheet.

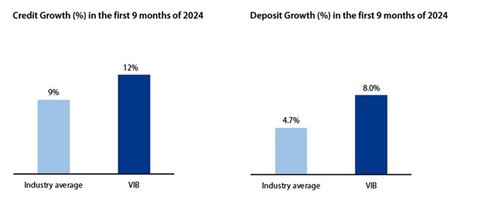

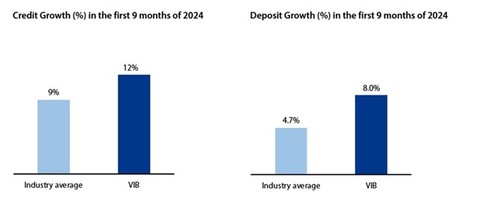

Credit and funding growth outperforms the industry average

As of September 30, 2024, VIB's total assets stood at VNĐ445 trillion (over US$17.52 billion), a nine per cent increase compared to the beginning of the year.

Total credit reached over VNĐ298 trillion, reflecting nearly 12 per cent growth, higher than the nine per cent industry average.

In the third quarter alone, VIB's credit growth was close to seven per cent, positioning VIB as one of the top-performing retail banks in terms of credit growth in the industry. Funding, grew by eight per cent in nine months of this year, nearly double the industry average, ensuring sufficient funding sources for the credit activities.

A chart shows VIB's credit and deposit growth in nine months of 2024. — Photo courtesy of VIB

Profit declines due to interest rate support, investment expansion, prudent provisioning

In the first nine months of 2024, VIB achieved total revenue of VNĐ15.3 trillion, with the net interest income down nine per cent compared to the same period last year. As part of its strategy, VIB focused on high-quality customers with strong collateral. The bank offered competitive interest rates and maintain a strong net interest margin at four per cent.

On September 21, at the Government Conference about the strategies to promote Việt Nam’s socio-economic development, Chairman of the Board of Directors of VIB Đặng Khắc Vỹ said that the bank significantly reduced lending interest rates across all customer segments.

Additionally, VIB’s leadership emphasised the importance of ensuring responsible and robust credit growth to maintain a healthy and sustainable development of the banking sector.

During the first nine months, VIB's non-interest income reached VNĐ3.5 trillion, an increase of five per cent, contributing 23 per cent to the bank's total revenue.

Operating expenses increased by 13 per cent year-on-year, driven by investments in human resources, new branch openings, technology, digital banking and marketing.

The cost-to-income ratio (CIR) temporarily rose to 36 per cent, but there has been improvement compared to the previous quarter, as cost-optimisation initiatives are being thoroughly implemented, and new branches are starting to operate efficiently.

As of September 30, the bank's provisioning stood at around VNĐ3.23 trillion, an increase of two per cent year-on-year.

Moreover, with improving asset quality, provisioning in Q3 decreased by over 25 per cent year-on-year.

Overall, VIB's pre-tax profit hit VNĐ6.6 trillion in January-September, down 21 per cent compared to the same period last year. The return on equity (ROE) stood at approximately 19 per cent.

Improvement in asset quality, lowest concentration risk in the industry

VIB's category 2 loans have decreased by over VNĐ4 trillion, equivalent to a 27 per cent reduction and the provisioning buffer has increased by 27 per cent compared to the beginning of the year. As of September 30, 2024, VIB’s non-performing loan (NPL) ratio stood at 2.67 per cent.

Key management indicators are at the optimal levels, with the Basel II capital adequacy ratio (CAR) at 11.5 per cent compared to the regulatory requirement at above eight per cent, the loan-to-deposit ratio (LDR) at 75 per cent compared to the regulatory cap which is below 85 per cent, the short-term capital for medium and long-term loan ratio at 26 per cent compared to the regulatory cap at below 30 per cent and the net stable funding ratio (NSFR) under Basel III at 111 per cent compared to Basel III standard at above 100 per cent.

Building a reputable brand

In October 2024, VIB was honoured by Enterprise Asia with the 'Corporate Excellence Award 2024', recognising its outstanding retail banking solutions and products, modern digital banking applications, transparent corporate governance and pioneering adoption of international standards.

Additionally, VIB became the first bank in Việt Nam to launch personalised card design services, supported by generative artificial intelligence (Gen AI).

VIB received two international awards. — Photo courtesy of VIB

VIB continues to make a strong impression as a leading retail bank, reinforcing its goal of leading the card trend with the 'Anh Trai Say Hi' programme. This show has garnered over 10 billion views across all platforms and all 100 per cent of its episodes on YouTube are in the official Trending category.

VIB sponsors the 'Anh Trai Say Hi' programme. — Photo courtesy of VIB

Responsibility and contribution to society, the community and the banking industry

For more than 28 years of establishment and development, VIB has consistently contributed to community development through various economic and social activities, especially in terms of contributing to corporate taxes and complying with international standards.

VIB recently ranked among the top four private banks with the largest corporate tax contributions to the national budget. In addition, the bank ranked 11th among private enterprises with the highest corporate tax contributions in 2023, totalling nearly VNĐ3.3 trillion.

VIB is among four top private banks with the largest corporate tax contribution to the State budget in 2024.— Photo courtesy of VIB

In the first nine months of 2024, VIB contributed VNĐ15 billion to the national programme to eliminate temporary and substandard housing, VNĐ5 billion to support recovery efforts from Typhoon Yagi, and VNĐ7 billion to fund student scholarships and various programmes aimed at honouring traditions and promoting cultural, educational and social development. — VNS