A logo of VIB.—Photo courtesy of the bank

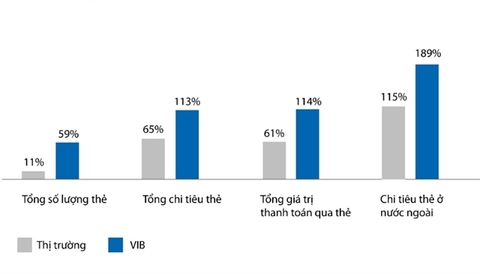

After only three years, Vietnam International Bank (VIB) has surpassed its rivals to enter the top of the credit card market. Currently, VIB accounts for over 35 per cent of Mastercard's total spending in Viet Nam. VIB also leads in the growth rate of Mastercard credit cards, five or six times higher than the average of the whole market.

Figures confirm the leading position

In the past five years, the card market in Viet Nam has grown tremendously in quantity and quality. VIB is a prominent name because it is always leading in new trends, with new lines of credit cards which are bringing outstanding benefits to each group of customers, offering them a seamless, convenient, and safe spending experience thanks to modern card technologies.

VIB joined the credit card market in 2019 but after only three years, the bank has seen impressive performance. As of December 31, the number of VIB's newly-opened cards reached over 2.4 million, including over 600,000 credit cards, 6.6 times higher than 90,000 cards recorded in 2018.

The spending made by Vietnamese people through VIB credit cards has increased 8.6 times, from VND8.4 trillion (US$360 million) each year in 2018 to VND75 trillion (over $3 billion) each year in 2022.

A chart shows the number of VIB cards and the total spending of Vietnamese people via VIB credit cards. — Photo courtesy of the bank

VIB is one of the leading banks in digitising the credit card issuance process. More than 50 per cent of VIB's new cards have been issued entirely from the digital channel.

The bank has also introduced the concept of "virtual card", "virtual switchboard" and "virtual financial expert" which has been welcomed by local clients.

Impressed the card market with LazCard

Recently, VIB continues to give a big push to the market with the launch of LazCard which offers cardholders up to 50 per cent cashback when they shop online. This is a co-branded card line that has marked two first-ever technology events of Visa and Lazada in Viet Nam. Visa has implemented integrated card technology for the first time while Lazada has co-operated with Miniapp to implement embedded financial technology.

In early 2023, VIB's new card line – LazCard caused a fever in the online shopping market, with unprecedented offers and technologies that were first deployed by Visa and Lazada in Viet Nam. — Photo courtesy of the bank

LazCard's 50 per cent cashback includes 20 per cent points accumulation for cashback on spending and 30 per cent from online shopping vouchers via Lazada every Friday and special days exclusively for LazCard cardholders.

Accordingly, cardholders will be able to accumulate bonus points corresponding to 20 per cent on birthdays and 15 per cent every other day of the year for spending through Lazada, up to 800,000 bonus points per statement period.

With a 30 per cent discount on shopping vouchers, LazCard cardholders using vouchers will receive an immediate discount of VND150,000 for orders worth VND450,000 or more every Friday, and VND1 million for orders worth at least VND3 million on special days such as Lazada's birthday.

With technologies first deployed by VIB in Viet Nam, LazCard provides customers with a convenient experience from opening cards to paying quickly, safely, and seamlessly.— Photo courtesy of VIB

LazCard is the first co-branded card that integrates international payment cards and credit cards on the same chip. With this technology, cardholders can always use multiple sources of funds from their credit card limit and payment account, which will provide them with a different cashless payment experience.

Integrated card technology also supports users to immediately own a LazCard card without having to prove income or have a credit history. If not eligible to open a credit card, customers can use LazCard for their regular payments to enjoy the privilege of completely free cashless payments for the first year. The credit limit will be automatically granted when customers meet VIB's conditions. The more spending they make, the higher limit they get.

According to VIB, customers can register to open LazCard cards completely online in just 15-30 minutes on the VIB website or at Miniapp integrated right on the Lazada application. Miniapp allows seamless connection from card registration to approval and use in just 15-30 minutes and maybe even faster. This is the application of embedded finance technology, one of the six fintech trends in 2022 alongside Blockchain, web3, cross-border e-commerce, super apps, and AI & machine learning. This application was jointly deployed by VIB and Lazada for the first time, helping to link the bank to the payment ecosystem of a leading Ecom partner in the country and the region.

A record in the number of newly-registered cards

LazCard which was launched during the last shopping peak of the year and the Lunar New Year quickly created a buzz and was welcomed by many users.

The launch of LazCard is the next step on VIB's journey towards a cashless society. — Photo courtesy of VIB

After only five days, nearly 1,000 LazCard cards were issued on the market and 99 per cent of them were opened online. This is the fastest speed of reaching thousands of cards ever recorded by VIB.

VIB has brought more value to customers, affirming its position as a leading bank in card trends thanks to the continuous investment, research, and cooperation with leading partners in Viet Nam and around the world in various fields to create card lines with modern technology, and different features, bringing outstanding and unprecedented benefits for every user.

The new line of LazCard cards can be seen as the bank's next step on the journey toward a cashless society. The card is expected to create a big boost for online shopping shortly. — VNS