A project titled "Reach to Excel: Promoting Financial Inclusion for Ethnic Minority Women" has supported the development of more than 500 self-managed village credit savings groups (VSLA) with more than 11,000 women participating in savings mobilisation and small-scale lending.

A project titled "Reach to Excel: Promoting Financial Inclusion for Ethnic Minority Women" has supported the development of more than 500 self-managed village credit savings groups (VSLA) with more than 11,000 women participating in savings and small-scale lending.

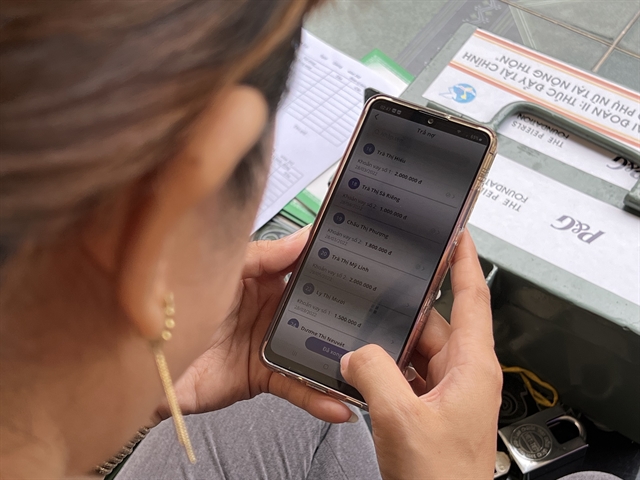

With the support of P&G Group, through CARE International in Vietnam and the Central Committee of the Viet Nam Women's Union, the project has been implemented in 18 provinces in the past four years.

The VSLA model effectively supports women and families in livelihood development activities, contributing to ensuring household financial security.

From January 2018 to December 2019, CARE cooperated with Procter & Gamble (P&G) to implement the project in four mountainous provinces in northern Viet Nam (Hoa Binh, Son La, Dien Bien and Bac Kan).

Through cooperation with P&G, CARE has established 260 self-managed VSLA groups, directly helping 5,196 ethnic minority women access loans and become more economically independent.

Many members of the VSLA group said they could save more money and invest better in their children's education, household livelihoods, and income-generating activities.

In the project's second phase, from December 2020 to the end of December 2021, 287 VSLA groups were established with 4,185 female participants.

In the first year, the groups mobilised VND9.35 billion in savings and gave 2,427 members loans to develop their livelihoods. In the first half of 2022, there were 269 groups with 4,058 members, which mobilised VND5.62 billion in savings, and 1,416 members received loans to finance their livelihoods.

Le Thi Tuyet Mai, Corporate Communications Director of P&G Vietnam, said The “Reach to Excel” project is an important community programme in the company's long-term development plan in Viet Nam.

“With a commitment to always accompany the advancement of Vietnamese women, over the years, P&G has not only strived to create high-quality consumption products to improve the quality of consumer lives but also persistently implemented many programs to promote the advancement of women, remove gender barriers and promote the development of Vietnamese women," she said.

Data from the World Bank in 2017 (Findex) shows that only 30 per cent of adult men and 31 per cent of adult women in Viet Nam have access to formal financial services, one of the lowest rates in East Asia.

Based on gender analyses conducted by CARE, women face more difficulties in accessing finance and are negatively impacted by gender inequality and traditional cultural norms. Studies have also shown that with financial decision-making and agricultural production in the family, the husband often has a decisive say in the livelihood and significant expenditures.

Started by CARE in 1991 in Nigeria and implemented in Viet Nam in 2010, up to now, the Village Credit Savings Model (VSLA) has been introduced in more than 20 provinces/cities.

The operating model is based on the three principles of Voluntary Participation, Self-Management and Self-Responsibility, promoting the principles of openness, transparency, and equality for all members.

Evaluating the project's activities in recent years, the representative of the Vietnam Women's Union, Pham Thi Huong Giang, Member of the Women Union Presidium - Head of the Committee to support women in economic development, said, "this model is very suitable for ethnic minority women, helping them to form the habit of saving and self-management to support and help each other in difficult times. Through the model, the women's union has also communicated on the state's legal policies related to ethnic minority areas and other necessary knowledge for women such as organising their lives, growing their family income and promoting gender equality."

Le Kim Dung, Country Director, CARE International in Viet Nam, affirmed the organisation's commitment to cooperation with the Viet Nam Women's Union.

"The VSLA model is considered the starting point to help group members connect and access other forms of financial services and be part of an inclusive financial ecosystem in which everyone has the right to participate,” she said. “The approach and characteristics of the VSLA model are very consistent with the goals of the Women's Union. CARE commits to accompany and provide technical support with the Central Committee of the Women's Union in the next five years to carry out activities to achieve the set goals effectively."

K’Luyen of the ’Ho ethnic group in the Central Highlands province of Lam Dong said her VSLA group mobilise savings and offers loans to members to plant coffee and mulberry, raise silkworms, and buy petrol to operate water pumpers to water plants or rice.

“Our members use the loans for the right purposes like buying notebooks or paying school fees for their children,” said Ho Thi Nho of the Van Kieu ethnic group from the central province of Quang Tri. “With the loans, they can buy buffaloes, cows or goats to raise at home or buy seedlings of cajeput, cassava or rice to plant.”

According to Nguyen Duc Thanh, project manager of CARE in Viet Nam, in the next phase, the project will support women to produce, do business and provide services to empower women of ethnic groups.

“The project will also aim to organise economic activities for women leaders like establishing co-operatives,” he said. VNS