E-commerce is expected to grow by 63 per cent to $62 billion in 2020 and is poised to hit $172 billion in 2025.— Photo thoibaokinhtesaigon

Southeast Asia’s digital economy remains resilient at $100 billion in gross merchandise value (GMV) despite headwinds and is on track to cross $300 billion in GMV by 2025, according to a report from Google, Temasek and Bain & Company.

Indonesia and Viet Nam continued to grow at double-digit rates, and Singapore remains a regional enabler for growth, despite short term GMV decline due to the online travel sector.

The report, which covered Indonesia, Malaysia, Viet Nam, Singapore, Thailand and the Philippines, showed that Internet usage in the region continues to multiply, with 40 million new users this year alone. That pushed the total number of internet users in these Southeast Asian countries to 400 million or nearly 70 per cent of the population.

The coronavirus brought about a permanent and massive digital adoption spurt, with more than one in three digital service consumers (36 per cent of total) new to the service. Of the number, 90 per cent intend to continue their newfound habits post-pandemic, it said.

Many of the new users came from non-metropolitan areas in Malaysia, Indonesia and the Philippines.

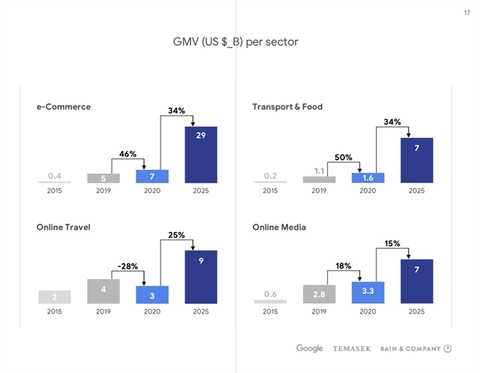

The report looked at seven internet economy sectors in Southeast Asia, including e-commerce, transport and food delivery, online travel, online media, financial services, health technology and education technology, with health and education technology added to the 2020 version.

E-commerce is expected to grow by 63 per cent to $62 billion in 2020 and is poised to hit $172 billion in 2025.

Digital financial services are also gaining momentum as more small-and-medium-sized businesses have become receptive to accepting online payments. Digital payments are set to grow from $600 billion in 2019 to $620 billion in 2020 and could reach $1.2 trillion by 2025.

The health technology and education technology sectors received a boost from the pandemic as many people turned to online health consultations while schools shifted to remote learning. Investments in those sectors are growing.

Gross merchandise value per internet economy sectors in Viet Nam. The country's digital economy is expected to reach US$14 billion in 2020 and $52 billion in 2025. — Source from Google, Temasek and Bain & Company report.

Online travel and transport sectors were hit the hardest as the pandemic ground international travel to a halt while many people began to work from home or became concerned about sharing transport. Still, the report predicted online travel to rebound to $60 billion by 2025.

In Viet Nam, with its various stages of lockdowns, users turned to the internet for solutions to their sudden challenges. A significant number tried new digital services: 41 per cent of all digital service consumers were new (higher than the SEA average), with 94 per cent of these new consumers intending to continue their behaviour post-pandemic.

The report said e-commerce has driven significant growth in Viet Nam, at 46 per cent, alongside strong growth across most sectors, except for travel.

Overall, Viet Nam's digital economy is expected to reach $14 billion in 2020, a year-on-year increase of 16 per cent, and will likely reach $52 billion in 2025, re-accelerating to nearly 29 per cent in compound annual growth rate.

This year’s seismic consumer and ecosystem shifts have advanced the internet sector in unimaginable ways, putting it in a stronger position than ever.

“In our 2019 report, we identified six key barriers to growth - internet access, funding, consumer trust, payments, logistics and talent - and this year has seen significant progress on most (payments and consumer trust, especially). Talent, however, remains a key blocker that all parties will need to keep working on to ensure that the momentum gained this year is sustained.”

The report also pointed out that new frontiers' dealmaking activity across the region continued to grow unabated in the first half of 2020.

Investors are remaining cautiously optimistic and are doing fewer deals at more attractive valuations, in hope for higher returns in the long run. Whereas the goal of years prior has been “blitzscaling”, investors are now looking for sustainable, profitable growth. — VNS