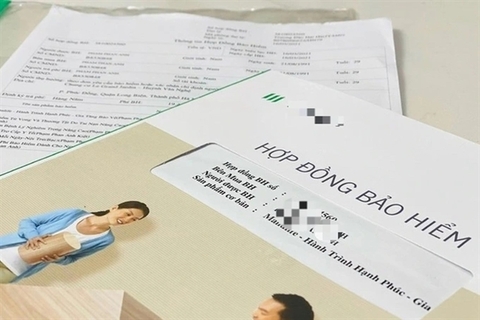

A contract of a life insurance policy purchased through a bank. Bancassurance has recently been severely criticised due to instances of fraud and coercion. — VNA/VNS Photo

Prime Minister Phạm Minh Chính has ordered the State Bank of Việt Nam (SBV) and the Ministry of Finance to report the findings of an investigation into bancassurance operations by the end of July.

Bancassurance, the practice of cross-selling insurance products at commercial banks, has come under severe criticism recently due to instances of fraud and coercion.

Customers have particularly raised concerns about the confusion between high-interest savings and life insurance.

Borrowers have also complained about being forced to purchase life insurance alongside their bank loans.

An employee at a state-owned bank in HCM City, who declined to be named, told Việt Nam News via a phone call that it is an ‘unwritten rule’ that any borrower must purchase life insurance alongside their bank loan otherwise their loan won’t be disbursed.

In recent years, bancassurance has become a key strategy for many banks, allowing them to generate substantial non-credit income through fees and commissions.

The cooperation between banks and insurance companies has led to the mis-selling of life assurance policies, with some customers having their savings deducted without their consent.

A recent investigation by the Ministry of Finance has already identified several violations committed by life insurers and banks.

The violations include a failure to provide direct advice to customers, inadequate guidance regarding procedures, and a lack of quality assurance in the advice given on insurance products.

In addition, insurance agents and bank employees have been found to be non-compliant with legal regulations during the sales process.

Experts have noted the comprehensive findings of the investigation are needed to protect the rights of customers and borrowers.

The mis-selling of life assurance policies through banks has raised serious doubts about the integrity and transparency of the bancassurance industry.

In addition to the investigation's findings, the Prime Minister has urged the SBV to review their credit granting procedures and conditions, aiming to expedite credit access for both businesses and individuals to ensure a swift and equitable lending process. — VNS