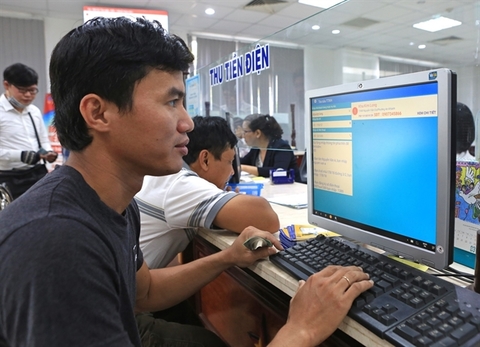

People search for information and invoices at the electricity office in the southern city of Can Tho. — VNA/VNS Photo Ngoc Ha

Fourteen months before electronic invoicing will be made mandatory in Viet Nam, which is set for November 1, 2020, there is still much work for the Government to do. Among the most crucial tasks to be completed is providing businesses with guidelines on how to issue and use e-invoices and across-the-board implementation among key State agencies such as the Tax Department, the State Treasury, the Vietnam Directorate of Market Surveillance and insurers.

The absence of guidelines and lack of co-operation among State agencies have proven to be a major hurdle for business to completely switch to e-invoices. For example, while the tax authorities encourage business to switch to using e-invoices they may not be accepted at the State Treasury or by insurers, said BKAV head of corporate client department Nguyen Kho Din. The company is a leading Vietnamese firm in the field of cybersecurity, software and e-solutions for governments.

“Without guidelines, businesses currently have many questions over how to issue e-invoices, including small details such as what date to issue them, whose signature to include or whether it is necessary to include a signature,” Din said.

He said Government agencies must quickly lay down a roadmap with all the tasks for businesses to complete from now until 2020 to ensure a smooth implementation of e-invoices on a national scale.

It’s also more complicated to correct mistakes made in e-invoices compared to traditional paper invoices.

“Businesses used to just issue another invoice to replace one with mistakes. With e-invoices they will have to issue separate adjustments for each mistake made in the original,” said Nguyen Hoai Huong from the Defence Economic Technical Industry Corporation.

This, in turn, would create further problems for their customers when they need to file those in other transactions, she added.

Mac Quoc Anh, deputy director of the Ha Noi SME Association stressed the need to create a different policy for SMEs and traditional family businesses. He said such economic enterprises often faced severe financial and infrastructure limitations, which might make it very difficult for them to adopt e-invoices.

While experts had pointed out that e-invoices would help businesses significantly cut costs and speed up transactions, Anh said many SMEs would still need convincing to make the switch to using e-invoices. He urged for more effort to be put in raising awareness about e-invoices and their economic benefits among small business owners. — VNS