Việt Nam’s EV market races ahead amid falling prices and infrastructure hurdles

BMI expects passenger EV sales in Việt Nam to average annual growth of 8.9 per cent over our long-term forecast period to reach an annual sales volume of 53,900 units.

HÀ NỘI — Việt Nam's electric vehicle (EV) market is set for rapid growth over the next decade, driven by fleet electrification, increasing competition and decreasing EV prices, according to the latest report from BMI Country Risk & Industry Research.

VinFast remains the dominant player, benefitting from State support and its strong brand identity. The company has played a pivotal role in boosting EV adoption, with nearly half of its deliveries in 2023 going to Green and Smart Mobility, a Vingroup subsidiary operating electric taxis.

However, according to the report, as taxi fleets reach full electrification, the growth momentum from this segment may slow, shifting focus to private buyers and new players entering the market.

The local industry is witnessing a surge in new entrants, with established brands and newcomers alike vying for market share. The arrival of more affordable EVs, such as those from BYD, Wuling HongGuang, Škoda and Hyundai, is expected to make electric vehicles accessible to a broader consumer base.

In addition, battery leasing will boost VinFast’s EV sales and Việt Nam’s market by cutting upfront costs.

Local assembly of mini EVs is also projected to increase, further driving market expansion. Geely's recent announcement of plans to assemble 75,000 vehicles annually in Việt Nam underscores the growing appeal of the country as a regional EV production hub.

“We currently expect passenger EV sales in Việt Nam to average annual growth of 8.9 per cent over our long-term forecast period to reach an annual sales volume of 53,900 units,” the report said.

“Vietnam's local EV market could see stronger growth with cities and urban centres looking to reduce pollution levels by restricting older and heavy polluting vehicle use.”

Hurdles

According to BMI, despite the positive outlook, the EV market still faces significant hurdles.

Low consumer income levels and the limited availability of incentives are dampening adoption rates.

Battery leasing, while not a major factor in 2023, is expected to attract more fleet operators from 2024 onwards as the Government intensifies efforts to transition the transportation sector toward greener alternatives.

In the last quarter of 2023, Việt Nam’s prime minister approved a plan to cut carbon and methane emissions in transport, including phasing out fossil-fuel vehicles. From 2030, all new taxis must be electric, a move that will further stimulate demand.

Charging infrastructure remains a critical component in the EV transition.

While Việt Nam's EV charging network is expanding, most stations currently cater to electric two-wheelers rather than passenger cars. VinFast holds a dominant position in this sector, but other players, including EBOOST and Foxconn, are investing in charging networks and component production.

The Government is expected to support further expansion over the next five years, particularly as the adoption of EVs among private consumers increases. In 2023, Việt Nam had around 150,000 EV charging points, but given the prevalence of electric motorcycles, this number will need to grow substantially to support wider passenger EV adoption.

The development of battery-swapping technology could mitigate infrastructure challenges, particularly for motorcycles, allowing for a faster shift toward electrification.

According to the report, the success of Việt Nam's EV market will also depend on broader developments in the power sector. Under the Power Development Plan VIII, the country requires an additional US$28 billion in investments for power generation and grid infrastructure by 2030. The Government's push for transport electrification will place further strain on the grid, necessitating accelerated investment and collaboration with private investors.

While Government funding and international financial assistance have driven infrastructure projects so far, fiscal constraints highlight the need for increased private-sector involvement. If successfully implemented, these measures will not only facilitate the growth of Việt Nam's EV market but also strengthen the country’s position as an emerging EV production hub in Southeast Asia.

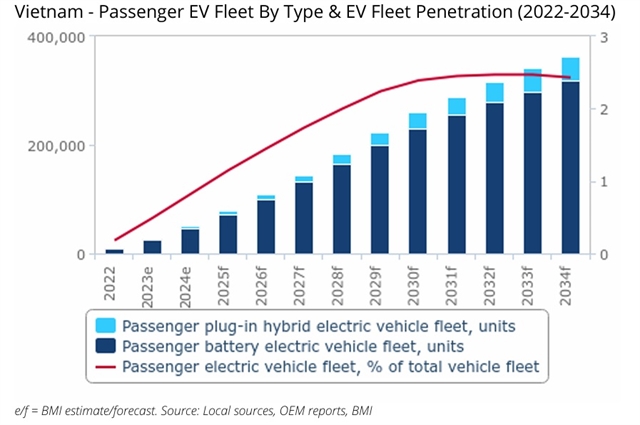

“Việt Nam's EV fleet is expected to grow from 52,000 in 2024 to 381,800 by 2034, reaching 2.6 per cent of the total vehicle fleet, up from 0.8 per cent in 2024,” the report said. — VNS