As Tết approaches, real estate companies in Việt Nam are boosting demand with promotions, while preparing for an increased property supply to meet rising demand.

HÀ NỘI — As the Tết (Lunar New Year) holiday season approaches, real estate companies in Việt Nam are ramping up their efforts to stimulate demand through various promotional programmes.

This period is viewed as a prime time for potential buyers to invest in properties at more favourable prices. Meanwhile, the market is preparing for an increase in supply to meet the rising demand in 2025.

Several real estate firms are introducing attractive incentives to lure buyers.

Phát Đạt Corporation (PDR), for instance, has rolled out a policy offering a discount of up to 10 per cent to shareholders holding at least 50,000 PDR shares for a minimum of six months. This incentive is applicable to select projects such as the Bắc Hà Thanh Urban Area in Bình Định Province and the Thuận An 1 and 2 high-rise residential complexes in Bình Dương Province.

Similarly, DIC Corp has approved a business plan for 599 land plots at its DIC Victory City Hậu Giang project, with average prices set at around VNĐ12 million (US$472) per square metre. Shareholders holding from 200,000 to one million DIG shares, for specified periods, are eligible for discounts ranging from 9 to 16 per cent. This initiative underscores the company’s commitment to fostering strong ties with its long-term investors.

In the future, the Group will also offer discounts to DIG shareholders on key projects like ATA Phú Mỹ, Cap Saint Jacques, DIC Lantana City Hà Nam, and DIC Nam Vĩnh Yên City Vĩnh Phúc.

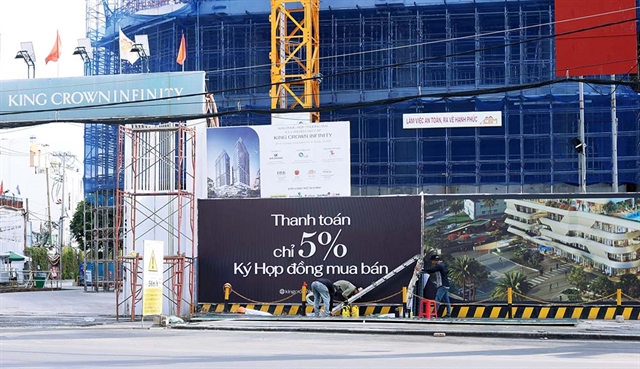

Other major players like Vinhomes and Khải Hoàn Land are also introducing flexible payment plans and discounts to stimulate sales. Vinhomes’ The Opus One project offers a 10 per cent discount for standard payment progress, while Khải Hoàn Land allows buyers of its Khải Hoàn Prime project to put just 20 per cent of the sale price as a down payment upfront and 1 per cent monthly until completion, along with a 24-month interest-free loan.

Growing supply

In addition to aggressive sales campaigns, real estate developers are also accelerating project timelines to boost market supply.

The southern region, in particular, is witnessing significant activity, with numerous projects slated for completion by 2025.

An Gia Group’s The Gió project in Bình Dương Province is advancing through key legal stages and is set to launch early this year. With its strategic location and competitive pricing, The Gió is anticipated to attract substantial buyer interest. Additionally, An Gia’s other projects, such as The Lá Village and West Gate 2 in Bình Chánh, are progressing through regulatory approvals.

In Vũng Tàu, Hodeco is preparing to initiate infrastructure development for the 75-hectare Phước Thắng Urban Area. Meanwhile, Khang Điền’s The Solina project in Bình Chánh has completed financial obligations for its first phase and is poised to commence infrastructure works, with a market debut expected sometime in 2025.

Experts from CBRE Việt Nam highlight that Bình Dương is a vibrant market, especially in terms of mid-range to high-end apartments, which offer more affordable options compared to HCM City. The area’s apartment prices range from VNĐ30 to VNĐ80 million per square metre, making it a preferred choice for many buyers.

As the market transitions into 2025, investors are keenly eyeing opportunities, particularly in the context of potential property price reductions of 10 to 12 per cent. Experienced investors are capitalising on this period to acquire properties at discounted rates, anticipating a market rebound around key holidays like April 30 and May 1.

Director of TQ Land Ngô Bá Trọng told tinnhanhchungkhoan.vn that seasoned investors are strategically acquiring properties from sellers in need of liquidity. This trend is anticipated to drive market recovery as regulatory processes and project approvals become more streamlined by 2025.

The apartment segment remains a focal point for both end-users and investors, given its promising outlook and stable demand. The expected surge in supply will provide greater options, improving market liquidity and potentially leading to significant growth in this segment.

“When choosing apartments to generate cash flow, investor should focus on three key factors: location, legal status and price. If these are met, investors can invest confidently, as this segment remains attractive in the medium and long term,” said Trọng. He added that the housing market, including townhouses, villas and land plots, will heat up, but with some variations depending on location. — VNS