Nguyen Hong Duong, Deputy Director of the European-American Market Department (Ministry of Industry and Trade), talks to Vietnam News Agency about solutions to maintain sustainable exports to this market

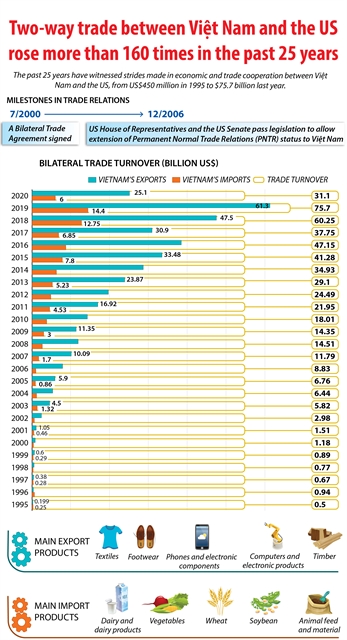

After 25 years of diplomatic relations between Vietnam and the US (July 12, 1995, to July 12, 2020), the import-export turnover between Viet Nam and the US has increased year by year. The US has always been a leading partner in importing goods from Viet Nam. However, this is also a fastidious customer and requires strict testing of product quality and origin.

Nguyen Hong Duong, Deputy Director of the European-American Market Department (Ministry of Industry and Trade), talks to Vietnam News Agency about solutions to maintain sustainable exports to this market

Can you give an overview of the changes in the structure of exports between Viet Nam and the US after 25 years of diplomatic relations?

In 2019, Viet Nam's goods export turnover to the US exceeded US$66.6 billion, an increase of more than 35 per cent compared to 2018.

The total value of Viet Nam's exports to the US accounts for about 25 per cent of Viet Nam's total goods exports.

Although the US has always been a very important market in Viet Nam's commodity export markets, there are two perspectives when looking at the structure of export goods.

In quantity, the export speed of Vietnamese goods has grown significantly, impressively and is among the leading countries in the US.

Previously, textiles, footwear and light industrial products were top export products, but by 2019, textile and apparel topped with export turnover of US$14 billion. Next are phones, electronic components and auxiliary products.

This change shows the level of added value and high technology products of Viet Nam exported to the US has changed greatly.

In addition, Viet Nam previously exported only about 60 goods groups to the US, by 2019, it exported up to 90.

However, among the 10 largest export goods groups to the US, nine goods groups are light industry, manufactured mostly by foreign-invested firms. Viet Nam’s profit from such exports is not remarkable.

Currently, the US Government is increasing protectionism to protect domestic production. When the policy of a large country like the US changes, the world must change as well.

In the short-term, if we look at the statistics of Vietnamese goods exported to the US in the first quarter of this year, it’s not very positive because only a few groups of goods have positive growth. The rest have seen negative growth. When the COVID-19 pandemic is over, exports won’t be the same as before.

Although agricultural products are Viet Nam’s strength, how can businesses access a potential but very difficult market like the US?

Agricultural products are Viet Nam's strengths such as pepper, cashew and rice, and Viet Nam is also an exporter of some single items in the world. However, the US is a large market and its agricultural exports are even larger than imports.

Therefore, it is necessary to consider carefully whether Viet Nam's exports suit the taste of the US market or not. Although the number of Vietnamese living in the US amounts to more than 2 million, it is a small part of the country's population.

Moreover, Viet Nam's total export turnover to the US is quite large, but agricultural products account for a low proportion, mainly crude exports and through intermediaries so the value-added is not high.

There are six types of fresh fruits of Viet Nam exported directly to the US in modest quantities because of high transportation costs and high demand for storage technology, which reduces price competitiveness.

However, there are still many strong and adaptable products such as pangasius (tra fish) that can compete by meeting strict US production and regulations.

The export potential of Vietnamese agricultural products to the US is huge, but to make it successful, businesses must consider their approach. To do business with the US, firms must have large-scale production capacity and support from the Government.

Therefore, businesses must build transhipment warehouses and storage facilities to meet extended orders, not only seasonal production. It is also necessary to take into account the capacity of supervising the production process to meet the strict requirements of partners.

In the face of tense US-China trade relations, there will be an investment shift. What does Viet Nam need to do to attract investment?

The tension in US-China relations that changes the supply chain is something that has been calculated because, in trade, no country puts all its eggs in one basket.

The shift and rotation of the world's investment flows will benefit Viet Nam but it will not be as many people expect. A large US company coming to Viet Nam will require infrastructure, labour and management mechanisms in accordance with the standards of a large country. What matters then is whether Vietnamese businesses can meet these needs or not.

Moreover, when it is difficult for investors to transfer, it is difficult to identify whether the transfer is due to the COVID-19 pandemic or their new business strategies. However, regardless of the situation, the shift of investment wave to Viet Nam will still benefit the country and businesses here. Therefore, Vietnamese enterprises need to improve their competitiveness and create new forces to seize opportunities. VNS