CBAM and the Vietnamese steel industry: Transforming to embrace the trend of international economic integration

CBAM, a policy tool designed to prevent "carbon leakage" – where companies move production to countries with laxer environmental regulations to avoid carbon costs – imposes a carbon fee on goods imported into the EU based on the carbon emissions generated during their production.

Dr. Trần Thị Mai Thành*

The European Union's (EU) Carbon Border Adjustment Mechanism (CBAM) is emerging as a critical factor reshaping the landscape of international trade. For an open, export-dependent economy like Việt Nam, understanding and adapting to CBAM is not merely a challenge but also an opportunity to enhance competitiveness and pursue sustainable development. The steel industry in particular – one of the four primary sectors (along with aluminum, cement, and fertilisers) most significantly affected by CBAM when exporting to the EU – faces direct impacts and requires appropriate response strategies.

CBAM, a policy tool designed to prevent 'carbon leakage' – where companies move production to countries with laxer environmental regulations to avoid carbon costs – imposes a carbon fee on goods imported into the EU based on the carbon emissions generated during their production. This mechanism is structured in three phases, with a transitional period beginning in October 2023, during which exporters are only required to report their emission levels, and a mandatory phase for purchasing CBAM certificates, along with the expansion to other sectors, is scheduled to commence after 2026.

Key characteristics and cluctuations in Việt Nam's steel exports

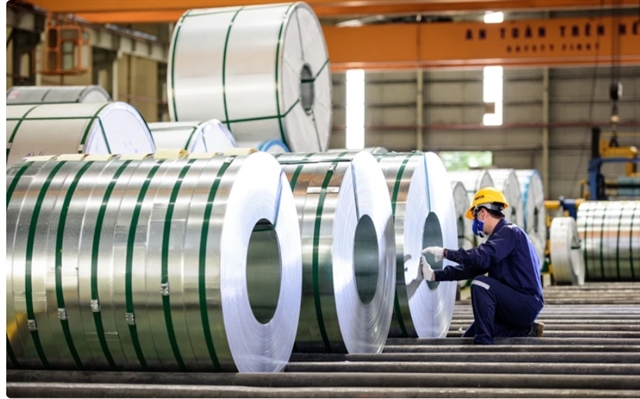

In recent years, Việt Nam's steel industry has experienced remarkable growth, establishing the nation as one of the leading steel producers and exporters in the region. Key characteristics of the industry include large-scale production and capacity, with numerous major steel plants manufacturing a diverse range of products from steel billets, coiled steel, and construction steel to steel plates.

In 2024, despite the global steel market facing numerous difficulties from geopolitical conflicts and trade tensions, Việt Nam achieved significant results. Specifically, Việt Nam exported approximately 12.62 million tonnes of steel with a total export value of US$9.08 billion, representing a 13.47 per cent increase in volume and an 8.78 per cent increase in value compared to the same period in 2023. However, the industry's recovery remains slow and has not yet reached the levels of 2021. Entering the first quarter of 2025, the Vietnamese steel sector saw a stark contrast between a recovering domestic market and stagnating exports.

Steel exports faced multiple challenges, declining by 18.83 per cent compared to the same period in 2024. The primary cause is the rise of global trade protectionism, including the United States expanding the scope of its Section 232 tariffs, the EU tightening trade defense measures, and India implementing safeguard measures on galvanised and cold-rolled steel. Although Việt Nam's steel export market is diverse, including major partners like the EU, ASEAN, the US, and China, and possesses a competitive price advantage, many domestic manufacturers still rely on outdated technologies with high energy consumption and emission levels. This presents significant challenges in the context of increasingly stringent environmental regulations.

Opportunities and challenges for Việt Nam's steel industry in the context of CBAM

Việt Nam's steel industry possesses a large production capacity capable of supplying a diverse range of products, which is a key advantage. Steel enterprises have also gained experience exporting to many demanding markets, including the EU, demonstrating their ability to adapt to increasingly high international standards. Furthermore, the Vietnamese government's commitment to achieving net-zero emissions by 2050 provides a strong impetus for economic sectors, including steel, to transition towards green practices.

However, a major weakness is the high carbon content in the steel production process at many plants due to the use of outdated, energy-intensive technology that generates significant carbon emissions, leading to potentially high CBAM costs. The absence of a precise and transparent system for monitoring and reporting carbon emissions also presents a major challenge. Additionally, the investment required for green technology demands substantial capital and a long timeframe, placing financial pressure on businesses. Despite a recovering domestic market, a high dependency on major markets like the EU and the US makes the industry vulnerable to trade defense measures and protectionism.

Regarding opportunities, CBAM acts as a powerful catalyst for steel enterprises to accelerate the greening of their production processes, improve energy efficiency, and reduce emissions. Producing "green" steel will enhance product value and create a competitive advantage, meeting the growing demand in the EU and global markets for environmentally friendly products. Investment projects in green technology within the steel sector could also attract foreign capital and sustainable development funds, while also promoting research and application of new low-carbon steel production technologies in Việt Nam. In the long term, aligned with the global shift towards a green economy, CBAM presents an opportunity for Vietnamese steel companies to improve product quality, meet international standards, and achieve sustainable development.

As for challenges, costs arising from CBAM could increase the price of Vietnamese steel products, eroding their competitive edge against rivals with cleaner production processes. Without timely adaptation, Vietnamese steel companies risk losing market share in the EU to competitors from countries with lower emission levels or equivalent carbon pricing mechanisms. Non-compliance with CBAM regulations could lead to trade disputes and legal barriers. Finally, the pressure to reduce emissions will extend throughout the entire supply chain, requiring cooperation and transformation from raw material suppliers. Additionally, global market instability and fluctuations in raw material prices pose significant risks.

Response strategies and future direction

To mitigate the negative impacts and capitalise on the opportunities presented by CBAM, Vietnamese steel enterprises need to implement a series of proactive response solutions.

Enterprises must proactively and accurately assess carbon emissions throughout their entire production chain. This is foundational for identifying emission hotspots, planning effective reduction strategies, and meeting CBAM's reporting requirements.

Investing in green technology and modern, low-emission production processes is imperative. This includes adopting energy-saving solutions, utilising renewable energy, and optimising production processes to reduce the carbon intensity of steel products.

Enhancing product quality and diversifying export markets are crucial strategies for risk mitigation. Businesses must continuously innovate to meet the increasingly high standards of demanding markets while actively seeking and penetrating new potential markets to reduce dependence on a few traditional ones.

Furthermore, collaboration with domestic and international partners to share expertise, access new technologies, and improve management capabilities is a key factor.

Raising awareness and training personnel on CBAM regulations, green technology, and sustainable production are also indispensable components.

The Government, in turn, plays a pivotal role in supporting and guiding this transformation.

First, the Government should accelerate the development and finalisation of the legal framework for carbon pricing and the establishment of a domestic carbon market. A transparent and efficient carbon market will help businesses manage emission costs more proactively and comply with international regulations.

Second, specific technical and financial support policies are needed for businesses undergoing a green transition, especially small and medium-sized enterprises. This could include preferential loan programs, support for research and development, or subsidies for investing in emission-reduction equipment.

Third, the Government and relevant agencies must promptly provide information and warnings about changes in international trade policy, particularly new green barriers. Concurrently, simplifying import-export procedures will create favorable conditions and reduce the administrative burden on domestic steel producers, allowing them to focus on their core business and adapt to the new environment.

CBAM is not just a new trade regulation but also a strong signal that the world is decisively shifting towards a low-carbon economy. Proactively addressing these challenges and turning them into opportunities will be decisive for the economy's position in the global value chain and will contribute to fulfilling the national commitment to achieve net-zero emissions by 2050, fostering a greener and more sustainable economy, and helping to usher Việt Nam's industry into a new era of strength and stability.

*Dr. Trần Thị Mai Thành is Vice Dean of the Faculty of International Business and Economics, Deputy Head of the Department of World Economics and International Economic Relations, VNU-University of Economics and Business