Viet Nam’s motorcycle market stumbled in the first three months of 2023 as demand dropped. The market had an impressive 2022 with sales of 3.38 million units following a two-year slump due to the COVID-19 pandemic.

Viet Nam’s motorcycle market stumbled in the first three months of 2023 as demand dropped. The market had an impressive 2022 with sales of 3.38 million units following a two-year slump due to the COVID-19 pandemic.

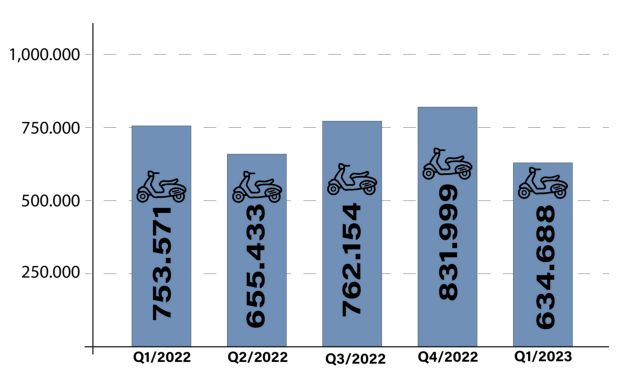

Sales fell 23.7 per cent in the first quarter this year compared to the previous quarter and 15.8 per cent over the same period last year, according to data released by the Vietnam Association of Motorcycle Manufacturers (VAMM).

A total of 634,688 units from five manufacturers including Honda, Yamaha, Suzuki, Piaggio and SYM were sold in the first three months, the data showed.

Experts attributed the fall to the fact that January coincide with the Tet (Lunar New Year) holiday and many people reduced their spending, particularly in the days leading up to and after Tet.

Two motorcycle manufacturers accounting for large market shares, Honda and Yamaha, also saw sales slide by 12.3 per cent and 25.5 per cent, respectively, against the same frame last year. The best-selling models in the first three months of 2023 were Honda Vision, Honda Wave Alpha, Honda LEAD, Honda Air Blade, Yamaha Grande, and Yamaha Sirius.

With low purchasing power and dismal sales, many motorcycle models immediately dropped in price compared to previous months. Honda Vision, the best-seller scooter model, also saw a decrease in price, selling at VND33.5-VND40 million per unit. The selling price was lower than the suggested retail price from manufactures. In mid-2022, after COVID-19, the selling price of Vision approached VND60 million per unit. Despite strong purchasing power and high prices for Vision, many Honda dealers refused to accept deposits because they no longer had enough inventory. The sharp increase in the price of motorbikes was attributed to the chip shortage and production costs after the COVID-19 pandemic.

Currently, the Vario 160 and AirBlade, among the best-seller models of Honda, are also offered at a price lower than the suggested retail price.

Another reason for the poor sales came from the fact that in the first quarter, not many new models were launched by manufacturers, making the local motorbike market less attractive, which affected buyer psychology.

In addition, the motorcycle market entered a period of saturation and has been gradually shifting from motorcycles equipped with internal combustion engines to electric bikes with beautiful designs, reasonable prices and costs saving from petrol prices. Meanwhile, the mid-range and high-end electric motorcycle segments now have more options for local customers.

In this segment, electric bikes are usually similar in size to mass scooters, with the same carrying capacity and longer travel distances than low-segment electric motorcycles.

Experts are forecasting a weaker economy and poor consumption in the remaining months this year. 2023 could still be an exciting year for Viet Nam's motorcycle market with the launch of many new models of electric bikes. — VNS