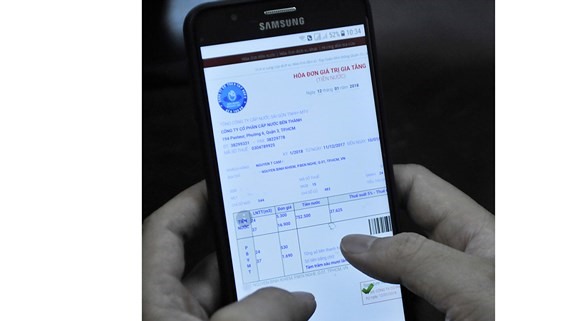

Sellers of goods and service providers must provide buyers with e-invoices with a standard data format regulated by the Ministry of Finance, according to a Government decree issued recently.

Sellers of goods and service providers must provide buyers with e-invoices with a standard data format regulated by the Ministry of Finance, according to a Government decree issued recently.

Under Decree 119/2018/ND-CP, there are two types of e-invoice: one with a verification code of the tax authority and one without the code. E-invoices with verification codes can be used for tax declarations.

Enterprises must use e-invoices with the verification code, except those operating in specific sectors such as power, petrol, telecommunications, transportation, insurance, healthcare, finance and e-commerce

For individuals and business households, those operating in agriculture, forestry, fishery, industry and construction sectors with annual revenue over VND3 billion (US$130,400) and 10 or more regular workers must use e-invoices with verification codes.

For individuals and business households operating in trade and services, they must use e-invoices with the tax authority code if their annual revenue tops VND10 billion.

E-invoices could be converted into paper form.

Viet Nam is promoting the use of e-invoice with a target that 90 per cent of enterprises would use e-invoices by 2020. — VNS

- Tags

- e-invoices

- tax