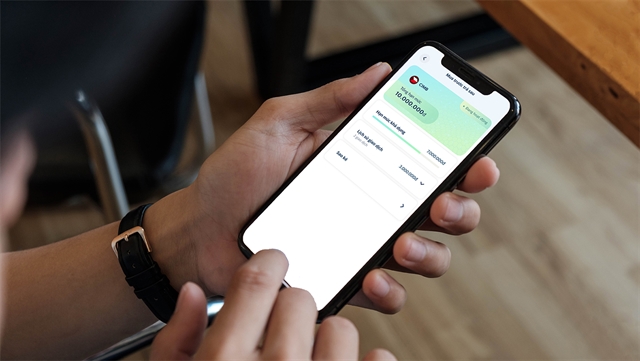

CIMB Vietnam and SmartPay have announced a buy now, pay later service that allows consumers to make instant payments when shopping in-store and waiting for payday.

CIMB Vietnam and SmartPay have announced a buy now, pay later (BNPL) service that allows consumers to make instant payments when shopping in-store and waiting for payday.

BNPL has been an explosive consumption trend in recent years in many countries, developed by financial technology companies (Fintech), financial institutions and banks.

This short-term consumer loan product without collateral allows users to shop online and spend on essential services daily.

Depending on the granted limit, customers will then pay the spent amount at one time or in instalments. As a low-commitment, user-friendly and budget-focused alternative to credit cards, BNPLs are particularly favoured by tech-savvy Millennials and Generation Z, who are wary of credit cards.

The product is developed with the 3 NO - principles: no maintenance fees, no upfront fees and no loan payment fees.

A representative from SmartPay said: “While the BNPL model has so far focused mainly on retail and e-commerce, the business model applies to various other industries. Thus, SmartPay is eager to promote BNPL services to other sectors, such as groceries and physical stores, paving the way for more omnichannel applications.

As the market matures, BNPL may also transform into more holistic platforms where SmartPay users can get insights into their spending habits, receive personalised budgeting tips, and discover new products based on purchase history.”

A representative from CIMB Viet Nam said: “The BNPL product is a strong connection between retailers and customers. While we always advocate making smart financial decisions and spending within your means, we know these services are awfully attractive given these dark economic times. Even if you can afford the full amount, you might still want to pay by instalment just to free up your cash flow for urgent use.”

CIMB Vietnam is under CIMB Group - one of the leading ASEAN banks in digital technology with safety, security, convenience and speed criteria. It offers individuals a wide range of banking products and services based on a strong financial future.

SmartPay (owned by SMARTNET) has more than 740,000 merchants and a community of more than 40 million users nationwide. — VNS

- Tags

- CIMB Vietnam

- SmartPay