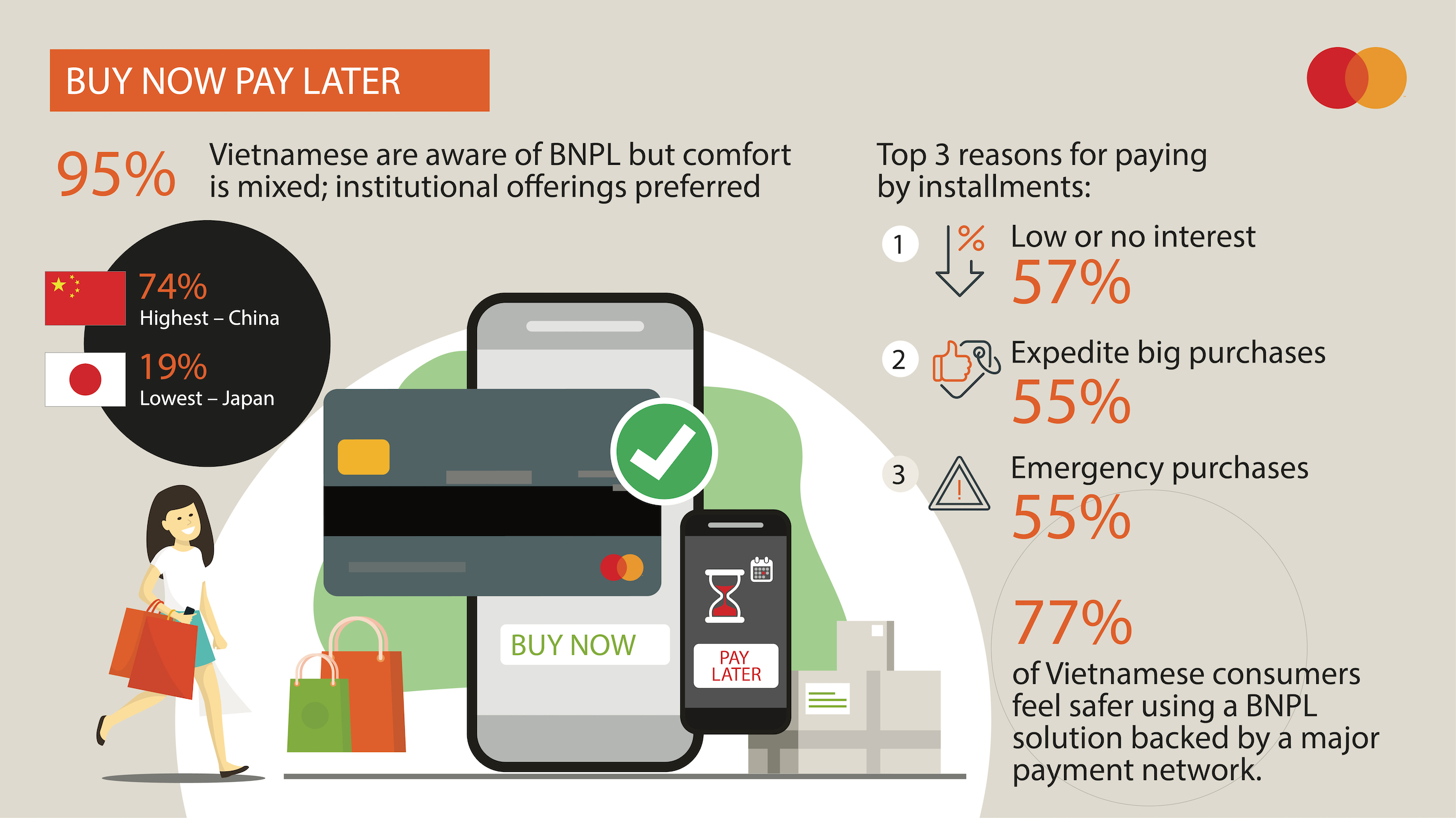

Most Vietnamese consumers (95 per cent) are aware of Buy Now Pay Later (BNPL) or installment plan as a payment option, though only a minority have used it in the last year, according to the Mastercard New Payments Index 2022.

Most Vietnamese consumers (95 per cent) are aware of Buy Now Pay Later (BNPL) or installment plans as a payment option, though only a minority have used it in the last year, according to the Mastercard New Payments Index 2022.

At the same time, an overwhelming majority said that backing from established financial institutions such as banks would increase their trust and comfort using installments.

The latest data on payment habits, attitudes and preferences was published in Mastercard’s second annual New Payments Index, a global consumer survey spanning 40 markets across five regions, including seven in APAC: Viet Nam, Australia, China, India, Japan, New Zealand and Thailand.

The research finds that BNPL or installment plans have plenty of room for growth in Viet Nam, with only 32 per cent of those surveyed having used the digital payment method in the last year. More than half of the respondents (57 per cent) stated they were more likely to use BNPL or installment plans for a large or emergency purchase, while 78 per cent were interested in paying off bills using BNPL or installment plans.

Though only 62 per cent were comfortable with the idea of using BNPL or installment plans today, the survey made clear that more robust backing for installment payments would encourage consumers to tap into BNPL or installment plans offerings. 77 per cent agreed that they would feel safer using BNPL or installment plans backed by a major payment network, while 78 per cent would be more interested in BNPL or installment plans offered by their current bank.

"Vietnamese consumers have been enthusiastic adopters of emerging forms of digital payments. The Mastercard survey shows that BNPL or installment plans have the potential to become a more widely adopted payment option — with the right conditions. If greater institutional support for BNPL or installment plans is provided, it will help to expand access to a payment option that can significantly increase financial inclusion and purchasing power for Vietnamese consumers,” said Winnie Wong, Country Manager, Vietnam, Cambodia, and Laos, Mastercard.

Among those in Viet Nam who had used BNPL or installment plan services in the last year, the most common reasons for doing so were low or no interest repayments (57 per cent), it helps them save money for a purchase without needing to wait (55 per cent), and it frees them up to make more purchases at specific times of the year (55 per cent). — VNS