An average of nine projects in power generation and distribution were registered every month since June 2017, according to the Viet Nam Renewable Energy Report 2018.

An average of nine FDI projects in power generation and distribution were registered every month since June 2017, according to the Viet Nam Renewable Energy Report 2018.

The report was released by the financial and business information corporation, Stoxplus.

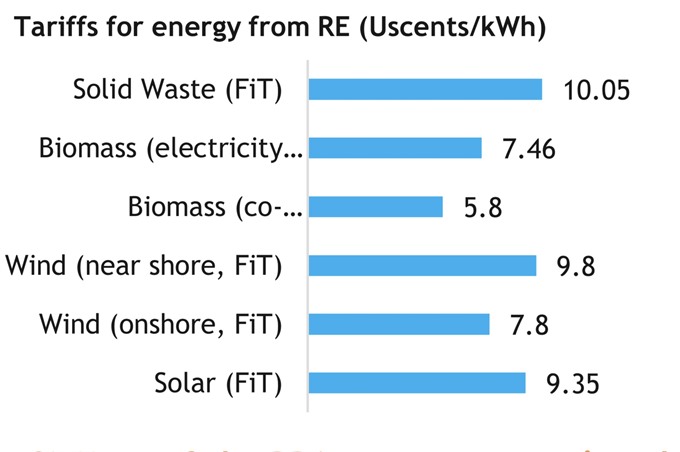

The registration of projects followed the Government’s approval of the price of 9.35 US cents per kilo-watt hour Feed-in Tariff (FiT) for solar projects.

According to Stoxplus, foreign and local investors are excited about renewable energy in Viet Nam, which is expected to grow at 23.2 per cent annually during 2020-30.

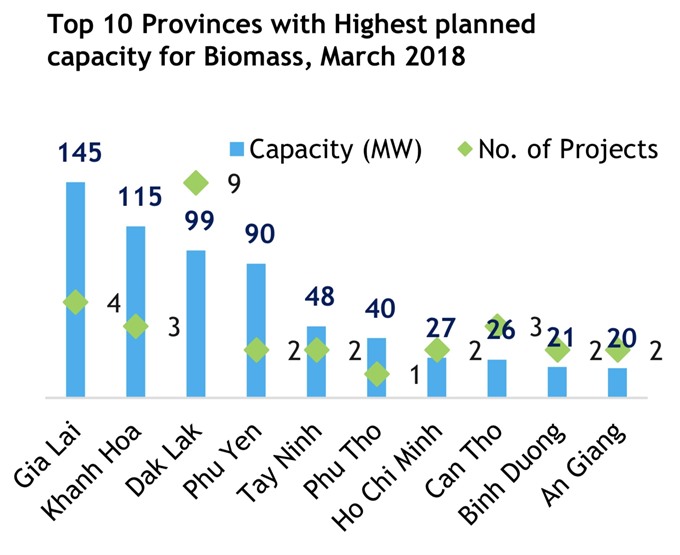

StoxPlus has identified 245 renewable energy projects in Viet Nam at the moment, including wind and solar power as well as biomass electricity, which are being deployed at different stages.

If all these projects begin operation, the total capacity of the country’s renewable energy should reach 23.2GW, which is nearly 10 times higher than the target of 2.65GW by 2020 as indicated in the Revised National Master Power Plan VII, effective March 18, 2016.

However, of the total projects, only 19 per cent have reached the construction stage and 8 per cent have begun operation. Most projects are still in the preparation phase.

Vu My Dung, senior analyst at Stoxplus, said the lack of comprehensive information was the first challenge for investors and developers to maneouvre renewable energy opportunities. Even though information about renewable energy projects in Viet Nam has been floating around the market, there is no clear information on the number of projects or development status, creating confusion and uncertainty among investors, developers and other stakeholders, Dung said.

Moreover, although many projects were announced, their progress has been slow due to challenges in the operational phase, such as credibility of the power purchase agreement and lack of credit rating of Viet Nam Electricity, besides other operational risks.

To address the bottlenecks and facilitate the completion of projects before June 2019, Dung suggests the model of domestic-foreign joint venture.

Foreign partners can make up for the deficit of technology, experience and financial capacity that domestic partners are facing. They can choose to increase their investment in each phase of the project until they hold 100 per cent of the joint venture capital for better control and management.

The co-operation between BIM Group and the Philippines’s Ayala’s AC Energy is one example. This joint venture is for a 300MW solar power project in the south-central coastal province of Ninh Thuan. While BIM Group deals with the legal issues, AC Energy provides technology and financial solutions. The project is expected to be complete this year. — VNS