Export growth has started to moderate in 2H22, even turning negative in November. — Photo courtersy of HSBC

Given lingering re-opening tailwinds, Viet Nam’s 2022 economic growth will likely reach 8.1 per cent, HSBC said in a report, more than the bank's previous forecast of 7.6 per cent growth. However, challenges will likely be more acute in 2023, particularly after the re-opening effect fades and the impact of high inflation starts to kick in.

In its Asian Economics Quarterly: Retooling Factory Asia report released on December 22, the bank said 2022 was a year of a booming recovery for Viet Nam, making the country likely to remain one of the outperformers in Asia. In the third quarter this year, Viet Nam’s GDP rose 13.7 per cent year-on-year, helped by a low base, a resilient external sector and robust domestic demand. That said, the growth outlook is now clouded by increasing trade headwinds.

After growing over 17 per cent year-on-year in the first three quarters of 2022, export growth sharply moderated in October, with November seeing the first meaningful year-on-year decline in two years. The primary drag came from electronics shipments, which account for 35 per cent of the country’s total exports. That said, recent data show that export weakness is more broad-based, including textiles, footwear, wood and machinery products. In particular, the economic slowdown in the US has exacerbated the woes, as the US is the largest market for many of Viet Nam’s goods exports.

On a positive note, domestic demand has come to a partial rescue, thanks to an ongoing recovery in the labour market. While the unemployment rate dropped to 2.3 per cent as of 3Q22, there is still potential for a further decline, as many jobs are concentrated in tourism-related sectors. Although tourists have started to return, arrivals are still less than 20 per cent of 2019’s level.

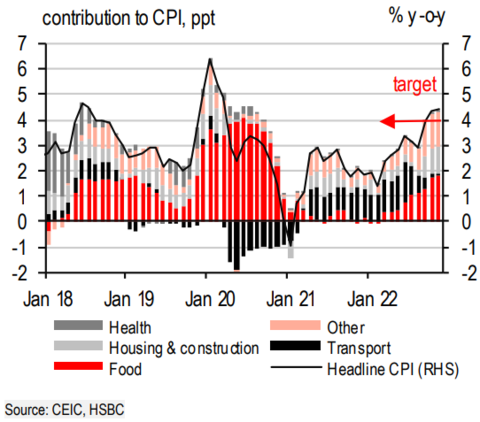

In addition, Viet Nam has started to see stronger inflation pressures, with the latest data exceeding the State Bank of Viet Nam's (SBV) 4 per cent “ceiling”. Not only has core inflation accelerated, but Viet Nam has also seen a domestic energy shortage, keeping headline prices elevated. The bank has recently trimmed its inflation forecast slightly to 3.2 per cent (previously: 3.4 per cent) for 2022, and raised its forecast to 4 per cent (previously: 3.7 per cent) for 2023. This means the SBV will likely continue its tightening cycle.

Policy issues

Unlike regional peers, such as Malaysia and Indonesia, Viet Nam has limited fiscal room to introduce immediate relief measures to alleviate the impact of high energy prices.

Since April, the authorities have been cutting various taxes, including fuel and environment taxes. To combat rising inflation pressures, the Ministry of Finance is seeking to extend the current environment tax cuts on various fuels until end-2023.

Inflation has started to pick up in 4Q22, breaching the SBV’s 4% ceiling. — Photo courtesy of HSBC

This suggests that, while global oil prices may cool down in 2023, the authorities may opt to reinstate the environment tax as early as 2024. In addition, other energy prices may rise in 2023. Viet Nam Electricity Group (EVN) has recently filed for a price hike in 2023, the first major price adjustment in almost four years, citing high energy import costs.

On the monetary front, as the last ASEAN central bank to move, the SBV has been actively “playing catch up” in the face of a weakening Vietnamese dong (VND) and rising imported inflation. Only starting in September, the SBV has delivered back-to-back rate hikes of 100bp each time, taking the refinancing rate to 6 per cent by end-October. For now, bolder rate hikes reflect more of a concern from external factors, such as the Fed’s rapid hiking cycle and FX volatility. Granted, external factors have turned more favourable in recent weeks, with the Fed likely slowing down its rate hikes and easing exchange rate pressure. However, rising core inflation increasingly suggests the SBV’s hiking cycle is still under way. We expect the SBV to raise its refinancing rate by 50bp each in 1Q23 and 2Q23, taking the refinancing rate to 7 per cent by mid-2023, according to HSBC’s experts.

Risks

The biggest downside risk to Viet Nam’s growth is intensifying trade headwinds. Viet Nam is not immune to a notable global trade slowdown – in other words, “pay-back” time has arrived. Since the advent of the US-China trade tensions, Viet Nam has been one of the biggest beneficiaries in terms of both trade and FDI diversion, boosting its export share in the US market in particular. As a result, Viet Nam has become increasingly vulnerable to a US economic slowdown.

The other risk comes from upward pressures to energy prices. Despite petroleum prices falling below June’s peaks, they remain at elevated levels. To reduce the risk of potentially volatile onshore fuel inventories, the Government has been directing domestic refineries and energy SOEs to plan to raise energy imports for at least the first half of 2023. This would likely squeeze Viet Nam’s current account advantage, on the back of higher import bills. — VNS