During the event, Hoàng Linh - VIB Deputy Chief Financial Officer shared insightful business information of the bank with impressive figures in the nine-month period such as return on equity at 29.3 per cent, helping VIB maintain the leading position among the top efficient banks in the industry and the strong profit growth of 33 per cent, exceeding VN Đ5.3 trillion (US$228 million) with the motivation from sustainable income sources.

The Vietnam International Bank (HOSE: VIB) last week held a webinar with investors and financial experts to share its business performance in the third quarter and breakthrough strategy for the fourth quarter.

The webinar attracted more than 250 representatives from investment funds worldwide, securities companies and individual analysts, discussing three main topics including the bank's financial performance, its resilience through the fourth wave of COVID-19 and diverse opportunities for growth.

During the event, Hoang Linh, VIB Deputy Chief Financial Officer, shared insightful business information of the bank with impressive figures in the nine-month period such as return on equity at 29.3 per cent, helping VIB maintain the leading position among the top efficient banks in the industry and the strong profit growth of 33 per cent, exceeding VND5.3 trillion (US$228 million) with the motivation from sustainable income sources.

Among activities aimed to support VIB’s customers to overcome the impact of COVID-19 included reducing interest rates on new and existing loans, waiving or reducing transaction fees, rescheduling debt repayments have reflected in the bank's net interest income (NII) and net interest margin (NIM) in the third quarter (Q3) that led to the slightly decrease compared to the second quarter (Q2).

However, VIB’s NII and NIM are expected to recover strongly from the fourth quarter as the majority of the supported customers repay sooner than scheduled, Linh said.

He added syndicated loans from the international market with great value, attractive interest rates, and terms will be a crucial resource to help VIB be ready to support credit expansion to meet customers' needs and optimise profit margins during potential growth periods.

A pioneering governance foundation with international standards

Passing through the fourth wave of COVID-19 that had various negative impacts on the national economy, investors and analysts at the event raised concerns about the quality of VIB's asset portfolio.

Ha Hoang Dung, VIB Chief Risk Officer, said that with prudent risk appetite, VIB has balanced growth factors and portfolio quality, ensuring credit quality from the source.

The non-performing loan (NPL) rate in Q3 slightly increased compared to Q2 but was still lower than 1.76 per cent seen in the same period last year thanks to 87 per cent of the portfolio focused on retail, that helped reduce the risk and the proportion of the secured portfolio at nearly 95 per cent, Dung said, adding that VIB’s portfolio was not affected by industries heavily impacted by COVID such as aviation and real estate projects.

Digitalisation is an answer

In her speech at the event, Tran Thu Huong, Head of Strategy and Head of Retail Banking, said that pioneering in product and service digitalisation has played a crucial role in helping the bank achieve positive business results.

Currently, customers can make various banking transactions online such as opening cards, accounts, opening saving deposits or loans.

Overcoming the pandemic, mortgages and auto loans maintained a steady increase. Current account and saving account (CASA) recorded an outstanding rise in the third quarter at 20 per cent. In which, the contribution rate of digital channels in CASA rose through the quarters.

Huong said VIB has pioneered in applying top-notch card technologies such as Big Data and AI to digitalise card services and analyse deeply to bring high quality card products with outstanding features that helped meet all needs of customers.

Card acquisition rate via VIB online channels saw an impressive growth of 55 per cent in Q3 from 9 per cent in Q1 and 48 per cent in Q2.

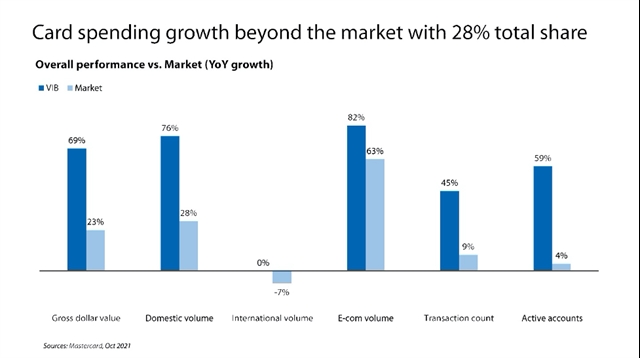

In terms of efficiency, the growth in spending per card rate and the card spending volume rate were three times and five times higher than the market average, respectively, according to Mastercard.

Mastercard said the total spending rate of VIB credit cards in October made a new record for the bank after 25 years and contributed 30 per cent to the total Mastercard spending rate in the whole industry in Q3.

Meanwhile, VISA said Family Link – the card line specialised for young families – experienced a strong increase of 200 per cent per month in terms of card activation and the average spending rate was two times higher compared to the market average. Family Link was introduced in August, marking the strategic collaboration between VIB and VISA.

Other multiple criteria that also showed increases of VIB credit cards from 3-4 times or even 9-15 times compared to the average of the market such as number of transactions, online transaction value and card activation rate, local and international spending.

"These are the dream numbers of every card business on the market. They have proved VIB's well-prepared investment and strategy for digital projects. We secure our leading position in Viet Nam in terms of credit cards,” Huong said.

With a strong governance foundation, steady increase rate through the years and the flexibility to adapt to the pandemic situation, VIB was placed in the top five leading joint-stock banks with the highest proportion of retail portfolio along with the highest retail increase rate.

‘For the past five years and in the future, retail banking will always remain the key-driven for our business activities, and will be the main resource for VIB to contribute to Viet Nam’s financial industry."

"We have overcome the difficulties of the pandemic and see the opportunities to apply our strategies in the new normal in order to gain new breakthroughs in the fourth quarter, the profit in the fourth quarter is expected to be a new breakthrough. Our goal is to remain the leading retail banking in terms of scale and quality, continuing to be in the most effective banks in Viet Nam," Huong noted.

A record of the webinar is available at https://vimeo.com/642563672 — VNS