Two years after the COVID-19 outbreak began in Viet Nam, people believe the end is in sight and they are in good shape healthwise, but concerns around personal finances remain, particularly among single women, according to a new research from Manulife.

Two years after the COVID-19 outbreak began in Viet Nam, people believe the end is in sight and they are in good shape healthwise, but concerns around personal finances remain, particularly among single women, according to new research from Manulife.

Manulife did the third Asia Care Survey, and more than two thirds (69 per cent) said it would be gone within a year and 77 per cent expected restrictions to be lifted within that timeframe.

Vietnamese had the most optimistic outlook in the region, including about the time it will take for the economy to recover with just a quarter (26 per cent) fearing it would take a long time, the lowest in the region.

The survey was done just as the Omicron variant was starting to spread.

Despite the generally sanguine outlook, 15 per cent said they had experienced job loss and 70 per cent said their income had fallen as a result of COVID.

Only 19 per cent of single women had savings on hand to last more than a year, well below the 33 per cent national average. It also found that three quarters (75 per cent) of single women were struggling to cope with COVID.

“Vietnamese, especially single women, have clearly experienced challenges during the pandemic, but many have adapted and taken control by actively managing their own finances,” Sang Lee, CEO of Manulife Vietnam, said.

“What is also good is that they are taking more care of their own health and protection. That includes insurance.”

Despite low insurance penetration rates in Viet Nam, of those surveyed, 72 per cent had insurance, the most popular being health (47 per cent), life (42 per cent) and accident (38 per cent).

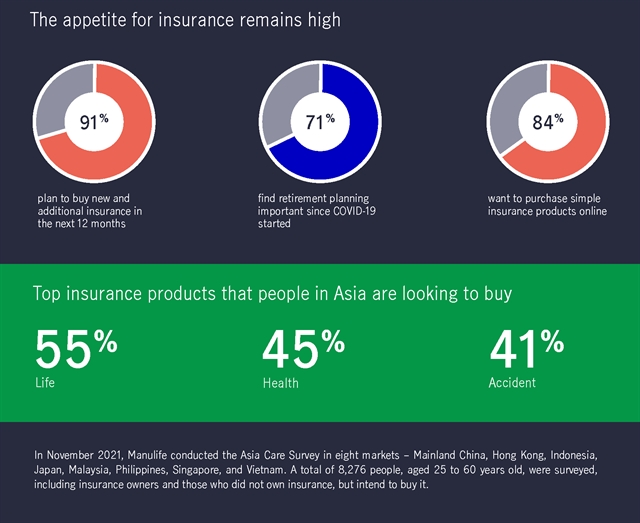

Remarkably, 91 per cent said they plan to buy insurance in the next 12 months, with life (55 per cent), health (45 per cent) and accident (41 per cent) again at the top of the list.

Addressing the growing demand for health protection and the rising costs of critical illness and medical care in the new normal, Manulife Vietnam recently launched a new generation of supplementary insurance products.

The critical illness plus rider and medicash plus rider deliver pioneering solutions in the market with features like extending entry age for both riders up to 69 years as protection benefits for up to 85.

In addition, the safety net benefit pays out claims for customers based on certain criteria for treatment or surgery without having to meet the disease definition. — VNS