More than VND68 trillion (US$2.9 billion) is expected to be spent on media advertising by companies in Viet Nam, with fast-moving consumer goods manufacturers to make up the bulk of the spending.

More than VND68 trillion (over US$2.9 billion) is expected to be spent on media advertising by companies in Viet Nam, with fast-moving consumer goods (FMCG) manufacturers to make up the bulk of the spending.

In its recent report, Kantar Worldpanel, a global company specialising in shoppers’ behaviour research, said: “It is very easy to appreciate why advertisers, media agencies and media owners continue to work tirelessly to better understand the media return on investment (ROI) of the dollars they spend.”

Isolating the impact of media on brands showed that the average impact of a media campaign in the uplift for any FMCG brand is 4.5 per cent of total sales during a campaign.

The study also showed that more than a third of the people attracted to the brand after seeing its advertising will be new shoppers, which will help determine the success of any media campaign, it said.

“As a result, getting the most out of any media investment starts with careful planning and accurate targeting of the target audience, be it potential new shoppers or existing shoppers for whom we want to increase loyalty.”

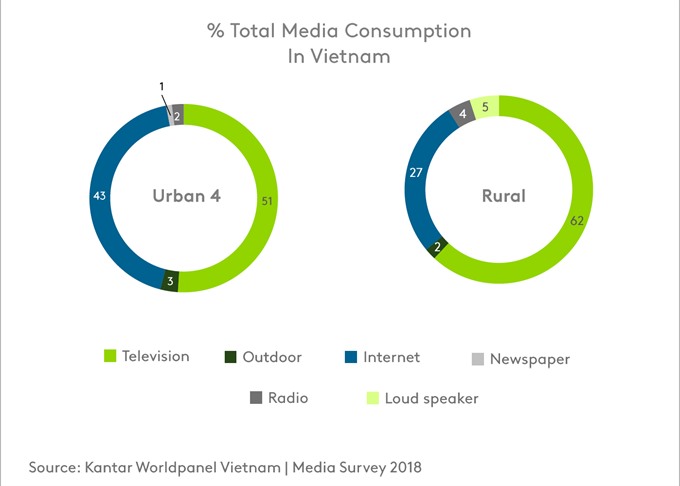

The media environment is changing rapidly with the rise of digital in Viet Nam. Despite that, TV remains the most relevant touchpoint for FMCG shoppers in both urban and rural areas.

Regarding the projected media spending for Viet Nam, the report said that TV advertising is expected to drop to 66 per cent share of spending in 2018, while online could increase to 30 per cent, reflecting that TV still offers the greatest potential in terms of total exposure.

In rural areas, loudspeakers can reach 76 per cent of key decision makers thanks to activities organised by the cultural centre of the commune who use loudspeakers to deliver social information, which can also include FMCG advertising.

Household shoppers by region

The study also pointed out that one of the most common ways to segment key target audience is by region, because in Viet Nam, the culture and shopping behaviours of each region can differ significantly, due to historical reasons and cultural background. And the same can be expected for media consumption.

HCM City skews slightly more towards traditional media channels, while Ha Noi is more skewed towards digital.

“Newspaper and magazine penetration is highest in HCM City with over a third of key decision makers reached by newspaper and almost a fifth by magazines – and if we add another filter to look at older decision makers, or the most affluent, these figures could soon rise to 40 per cent or more,” it said.

While the reach of digital in HCM City was slightly higher, those in Ha Noi were spending more time online. Hanoians spend on average 3.1 hours a day online compared to 2.6 hours on TV, so digital channels can work well in Ha Noi.

In rural areas, the southern part of Viet Nam accounted for a greater proportion of digital media consumption. Again, though penetration was slightly lower than in the Central or North, the amount of time spent online was higher, around 2.2 hours per day compared to 2.1 hours for TV. — VNS