VinaCapital Fund Management Joint Stock Company has announced that its mutual funds finished 2024 on a high note, with VINACAPITAL-VMEEF being the top performer.

HCM CITY — VinaCapital Fund Management Joint Stock Company has announced that its mutual funds finished 2024 on a high note, with VINACAPITAL-VMEEF being the top performer.

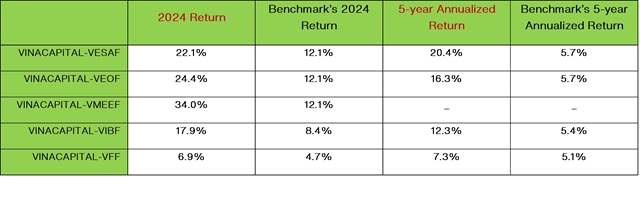

The funds significantly outperformed their respective benchmarks on both one- and five-year bases, it said.

The funds include VinaCapital Equity Special Access Fund (VINACAPITAL-VESAF), VinaCapital Equity Opportunity Fund (VEOF), VinaCapital Modern Economy Equity Fund (VMEEF), VinaCapital Dynamic Dividend Equity Fund (VDEF), VinaCapital Insights Balanced Fund (VIBF), and VinaCapital Enhanced Fixed Income Fund (VFF).

Equity funds VESAF, VEOF and VMEEF gave returns of 22.1 per cent, 24.4 per cent and 34 per cent as against the VN-Index’s 12.1 per cent.

Balanced fund VIBF and bond fund VFF also outperformed their benchmarks with returns of 17.9 per cent and 6.9 per cent.

Since its inception on June 24, 2024, equity fund VDEF returned 4.9 per cent while the VN-Index gained just 1 per cent during the period.

On a five-year annualised basis VESAF and VEOF retained their first and third positions among the market’s best-performing mutual funds.

The six funds had assets under management of over VNĐ 7.8 trillion (US$309 million), an increase of 124.6 per cent from 2023, and 88,800 investors.

Brook Taylor, CEO of VinaCapital, said: “2024 has been a pivotal year for VinaCapital as we continue to focus on delivering value and sustainable growth for our investors.

“Our open-ended funds have outperformed expectations, a testament to the resilience of the Vietnamese market and our strong investment philosophy.” — VNS