Despite accounting for a small share, Viet Nam’s agriculture exports have boomed, providing some much-needed support. It has enjoyed a diverse base in its agriculture exports, with both rice and durians outperforming this year, HSBC Vietnam released a report on Wednesday.

Despite constituting only a modest proportion, agriculture exports from Viet Nam have surged, providing essential support. The country boasts a varied portfolio in terms of agricultural exports, with rice and durians particularly excelling this year, as disclosed in a report by HSBC Vietnam on Wednesday.

The report highlights Viet Nam’s commendation as an exemplary model in developmental terms, transitioning from an agriculture-centric economy to emerge as an ascending force within the global manufacturing supply chain. Nonetheless, with 90 per cent of its exports experiencing adverse impacts due to this year’s trade slump, the residual 10 per cent from agriculture exports have astonishingly contravened the trend. Economists at HSBC posit that Viet Nam has reaped substantial benefits from the heterogeneous assortment in its agricultural export array.

They believed that, in particular, Viet Nam enjoys the benefits of being a traditional exporter as well as an emerging one. As the world’s third-largest exporter of rice, Viet Nam’s rice exports have risen on the back of soaring demand from regional peers and the recent rally in global rice prices. Meanwhile, Viet Nam’s durian farmers have seen skyrocketing growth (up 1,400 per cent year-on-year as of 3Q23) in its exports, due almost entirely to Chinese consumers’ new preference for the king of fruits, and the implementation of the Regional Comprehensive Economic Partnership (RCEP).

Viet Nam started 4Q23 on a positive note, with exports continuing to stage a gradual turnaround. That being said, the recovery is quite uneven. While some consumer electronics (except phones) have bottomed out, textiles and footwear continue to suffer from a decline in orders, leading to ongoing layoffs. In addition, inflation momentum has cooled, thanks to lower oil and food prices. Despite upside risks to inflation, we expect inflation to remain well below the State Bank of Vietnam’s (SBV) 4.5 per cent inflation ceiling. Our central case is for the State Bank of Vietnam to hold its policy rate steady at 4.5 per cent.

The only bright spot in exports

For a poster child like Việt Nam, 2023 is no doubt a challenging year for its key trade growth engine. Despite some nascent green shoots in the global trade cycle, Viet Nam has suffered from a 7 per cent decline in exports in 2023 y-t-d, a significant drag on its growth. As demand from the West for goods has slumped, Viet Nam’s major shipments, spanning from consumer electronics and textiles/footwear to wooden furniture and machinery, are all in the doldrums. That being said, agriculture exports have emerged as the only bright spot, defying a trade downturn.

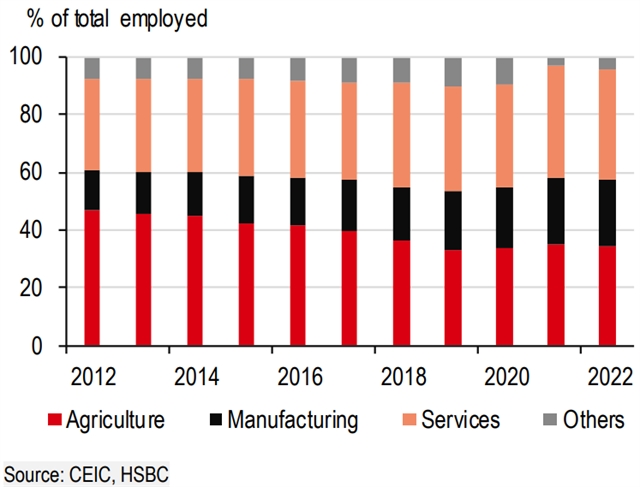

While its primary sector only accounts for 10 per cent of its total GDP, its significance cannot be underestimated. After all, one-third of Viet Nam’s employment is still concentrated in the agriculture sector, albeit this has declined from its peak of more than 40 per cent a decade ago, as more of its young labour force has switched to the manufacturing and services sectors. Unlike other sectors that saw double-digit declines, agriculture exports have weathered the storm well, rising almost 20 per cent year-on-year on a 3-month moving average basis.

Given its abundant resources, Viet Nam enjoys a diverse agricultural base. Seafood makes up almost 40 per cent of its agriculture export mix, followed by robusta coffee (14 per cent), rice (12 per cent), and fruits/vegetables (11 per cent). However, it is not always the same mix: Viet Nam has been strategically diversifying away from rice exports, whose share has halved over the past decade. Instead, it has been proactively cultivating fruit and vegetables exports. Among the destinations, Asia is a dominant buyer, with China (25 per cent) and ASEAN (18 per cent) combined accounting for more than 40 per cent of Viet Nam’s total agriculture exports, followed by the West with a 27 per cent share.

Broadly speaking, demand from China is not sufficient to offset ASEAN’s export weakness, although it is true that the lift from China has started to strengthen. In Viet Nam’s case, exports to China have returned to decent growth levels since 2Q23, half of which is due to the outperformance of its agriculture shipments. This is also largely facilitated by the implementation of the RCEP since January 2022.

While China is an important buyer of Viet Nam’s rice and seafood, it holds a dominant share of 65 per cent in its fruits/vegetable products – a reason why the share has increased threefold over the past decade.

After China’s re-opening, Viet Nam’s tropical fruit exports have increased significantly, partly in response to the signing of the fruit protocols in 2022.

Nowadays, 80 per cent of Viet Nam’s dragon fruits and 90 per cent of its lychees are shipped to its northern neighbour. In particular, Chinese consumers’ new preference for durians has benefitted durian exports in ASEAN significantly. Viet Nam has enjoyed a record high level of durian exports to China (up 1,400 per cent year-on-year) as of 3Q23, which has ensured that this category of fruit now takes top spot in its overall fruit exports with a share of close to 40 per cent. — VNS