There is a noticeable shift in capital flows toward deep-tech sectors like AI, energy and semiconductors — all aligned with the Government’s long-term strategic vision.

HÀ NỘI — Việt Nam is quickly becoming a key player in innovation and high technology, and the Government is urging global investors to act fast to take advantage of the country’s rapid growth.

At the Việt Nam Innovation and Private Capital Summit (VIPC Summit 2025) on Tuesday, Deputy Prime Minister Nguyễn Chí Dũng stressed the Government’s strong support for investors and its commitment to creating the best possible business environment.

Now in its fifth year, the summit drew over 10,000 participants and more than 100 investment funds. Dũng emphasised the increasing interest from major global investment funds and stressed innovation and technology as key to Việt Nam’s green and sustainable growth.

The world is undergoing unprecedented transformations, driven by high technology, artificial intelligence (AI), big data, clean energy and green development. In this context, the Deputy PM reiterated the importance of sustainable development and circular economy models — priorities Việt Nam shares with leading global economies.

“Investors must act quickly to seize the moment, as Việt Nam’s market is evolving rapidly. The Government is fully committed to accompanying and facilitating a favourable environment for successful investments,” he said.

VPCA Board Member and Golden Gate Venture Founding Partner, Vinnie Lauria, attributed Việt Nam's growing strength to its resilient, educated population and its rapidly expanding GDP.

He highlighted the importance of community, risk-taking and time in nurturing innovation, drawing parallels between Việt Nam’s current stage and the early days of Silicon Valley.

Việt Nam’s emergence as a regional hub for high-tech investment is becoming more evident.

The Vietnam Innovation and Capital Report 2025 report, released at the forum by the Vietnam Private Capital Agency (VPCA), National Innovation Centre (NIC) and the Boston Consulting Group (BCG), confirmed Việt Nam’s readiness not only to receive capital, but to lead it.

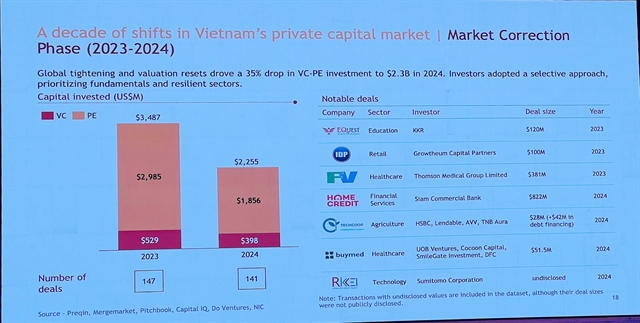

Việt Nam’s innovation sector attracted nearly US$2.3 billion from foreign funds through 141 investment deals in 2024.

Although overall investment dropped by 17 per cent compared to the previous year, this decline was modest next to the 35 per cent plunge globally – highlighting Việt Nam’s resilience and growing appeal.

Larger deals worth $100–300 million rose by 2.7 times, reflecting investor interest in mature, lower-risk firms. Meanwhile, early-stage activity also picked up, with sub-$500,000 deals jumping 73 per cent – evidence of a vibrant start-up scene.

Hotspot for next-generation technology investment

There is a noticeable shift in capital flows toward deep-tech sectors like AI, energy and semiconductors — all aligned with the Government’s long-term strategic vision.

The country saw about $1.7 billion in M&A activity in the innovation sector, while investments in next-generation technologies surged.

AI start-ups secured eight times more funding and Agritech grew nine fold, driven by global demand for food security and digital supply chains.

The report highlights Việt Nam’s rare mix of growth drivers.

Real GDP rose 7.1 per cent in 2024, ahead of most Asian economies. The economy is projected to hit $1.1 trillion by 2035 — 2.5 times today’s size.

FDI disbursement reached $25 billion, up 9 per cent year-on-year. The middle class is expected to make up 46 per cent of the population by 2030.

The digital economy now contributes 18.3 per cent of GDP, with a goal of 35 per cent by 2030.

NIC’s Director Vũ Quốc Huy, described private investment as the “decisive lever” for Việt Nam’s innovation breakthrough.

“Việt Nam is entering a golden period to enhance its global competitiveness through innovation,” he said.

The Chair of VPCA and CEO of Do Ventures, Lê Hoàng Uyên Vy, said: “Việt Nam has shifted from a potential market to a nation ready to break through.

“This is a defining decade and the time to act is now.”

The Government is actively building the foundation for high-scale innovation. Through the National Master Plan 2021–30 and Resolution 57, it is prioritising digital transformation, the green economy and high-tech sectors.

Reforms in capital markets and financial infrastructure, including legal frameworks for blockchain and international finance hubs, aim to lower investor risk and improve transparency.

At the forum, NIC and VPCA signed a series of Memorandums of Understanding (MoUs) with three major Asian investment associations – the Korean Venture Capital Association (KVCA), the Singapore Venture Capital & Private Equity Association (SVCA) and the Hong Kong Venture Capital and Private Equity Association (HKVCA).

This collaboration, with combined assets of $5 trillion, marks the first official alignment of these organisations. The MoUs aim to foster co-investment, support start-up expansion, enhance access to training and policy dialogues, and harmonise legal standards across key Asian markets. — VNS

- Tags

- NIC