By the end of June 10, 2021, the banking industry accounted for 34 per cent of Hồ Chí Minh Stock Exchange's market capitalisation with the stock prices growing 18 per cent in one month, 40 per cent in three months and 77 per cent in six months, respectively.

Vietnam Report Joint Stock Company has recently announced Viet Nam’s Top 10 prestigious and effective public companies in 2021 with six of them in banking and finance sectors including Vietcombank, ACB, VPBank, VIB, MBBank and Techcombank.

Over the past two years, these enterprises have been recognised by economists and investors for their financial strength and communication capacities, their growth potential, level of sustainable development, quality of corporate governance and the positions in their industries.

According to analysts, these above-mentioned banks have helped the banking industry affirm its position as one of the major pillars of Viet Nam’s economy as the sector has contributed to regulating financial supply and demand for businesses and individuals, especially in the context of the economy which has encountered many challenges due to the COVID-19 pandemic.

By the end of June 10, 2021, the banking industry accounted for 34 per cent of Ho Chi Minh Stock Exchange's market capitalisation with the stock prices growing 18 per cent in one month, 40 per cent in three months and 77 per cent in six months, respectively.

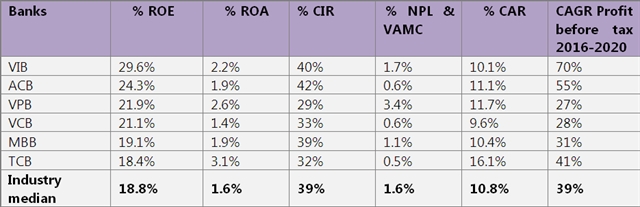

A JP Morgan report showed that Vietnamese banks offer the best combination of growth and return on equity (ROE) in ASEAN with 18 per cent, doubling that of other countries in the bloc.

Analysts said there are three growth drivers for the strong growth of the banking industry in the medium and long term including the strength of the local economy, self-improvement and digital transformation.

Bright prospect of local economy

According to the World Bank, though Viet Nam has been affected by the COVID-19 pandemic, the local economy has still gained many positive achievements, demonstrating its sustainable internal strength.

Meanwhile, Viet Nam is among the few economies that are predicted to grow positively in the coming years with major drivers being domestic production and consumption and exports. The banking industry, with its role as a financial support for the whole economy, is also forecast to continue growing in resonance with the national economy.

At the same time, Viet Nam's population is expected to reach 120 million people by 2050, an increase of over 20 per cent compared to the present, and the proportion of the middle-class will double from 13 per cent to 26 per cent by 2026. That will open up golden opportunities for banks especially those that have considered retail business as a core area.

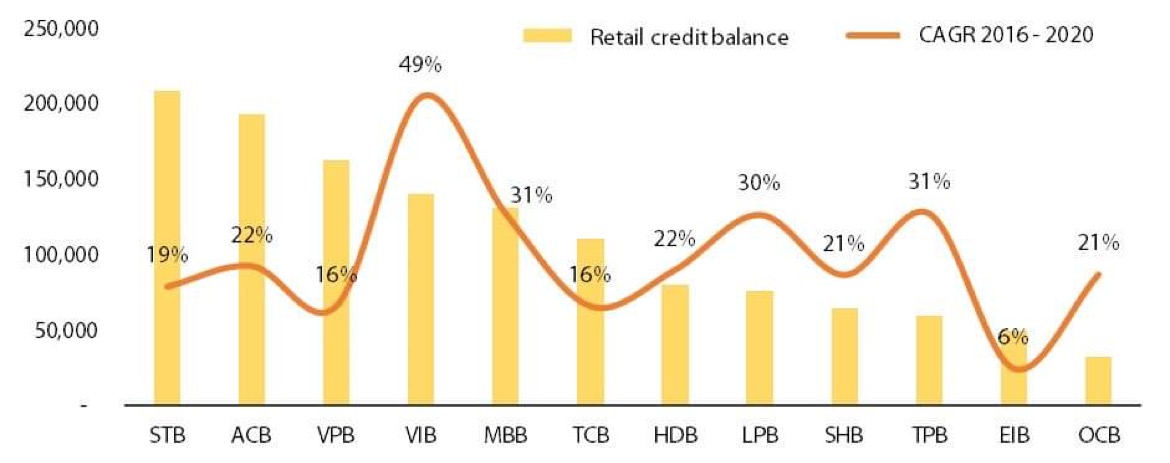

Currently, Vietnam International Bank (VIB), Asia Commercial Bank (ACB), Sai Gon Thuong Tin Commercial Joint Stock Bank (STB), Vietnam Prosperity Joint Stock Commercial Bank (VPBank) and Military Commercial Joint Stock Bank (MBBank) are recognised as five leading private banks with the top retail loans.

Notably, VIB and MBBank rank top with compound growth rate of 49 per cent and 31 per cent respectively over the past five years. VIB has been also considered the leading retail bank as its outstanding retail balance has accounted for over 86 per cent of total outstanding balance, of which over 95 per cent of retail loans have collateral.

The sector’s strong self-improvement

The banking industry has been experiencing positive changes in recent years. The dynamic business model, the effective application of digital transformation and the significant improvement in internal strength have brought impressive business results.

In addition, the State Bank of Viet Nam has accelerated the application of international risk management standards. That has contributed to improving the transparency of information, enhancing the prestige of local banks to domestic and international investors.

The below table mentioned about key financial indicators which clearly show that the top six banks obviously stand out of the industry median performance

Quickly embracing digital transformation

The banking sector’s strong growth in recent years is also attributable to the endless efforts of local banks in quickly embracing digital transformation. These banks which have actively participated in digital transformation will meet the increasing needs of customers while launching new products and services to both better serve their clients and increase their business efficiency.

Among them are VIB, MBBank and Techcombank which have launched digital product packages such as digital accounts, bank cards and completely free digital banking services to better facilitate their customers.

Amid the COVID-19 pandemic, digital solutions offered by these banks have assisted customers who can make transactions and other basic banking services online instead visiting banks’ branches or transaction offices.

Analysts said banks which have a clear digitalisation strategy will soon boost their market share and quickly lead the sector in terms of the growth rate and quality of services offered to customers. That has happened in markets like the US, Australia and Singapore.

They added with the three above-mentioned growth drivers, the sustainable development with many distinctive imprints of the six banks in the Top 10 is expected to be a bright spot for the banking industry and the Vietnamese economy as well in the future. — VNS