Uncompetitive prices of imported sugar after anti-dumping taxes will boost demand for locally produced sugar.

Businesses in the sugar industry will rebound, buoyed by higher sugar prices and anti-dumping measures on some sugar cane products originating from Thailand.

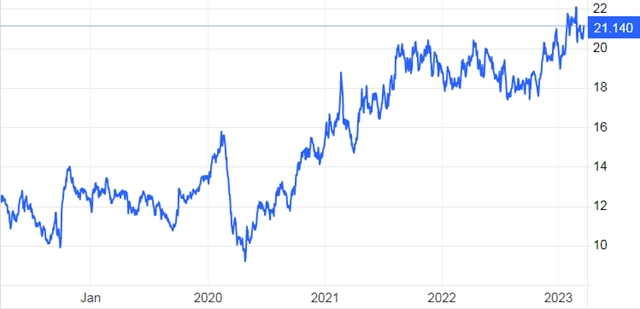

In February, raw sugar futures hovered at the 6-year high of roughly US 22 cents a pound set on February 27.

Specifically, February's average raw sugar price was US 20.23 cents a pound, compared to US 18.87 cents per pound in January and US 18.93 cents in December 2022.

According to the Food and Agriculture Organisation of the United Nations, the average sugar price was US 18.5 cents per pound during the first ten months of 2022.

The Rome-based agency forecast that by 2029, the average sugar price will reach US 21.3 cents but the fact is that the price exceeded the figure in January.

In the international market, raw sugar futures tracked by tradingecnomics.com were traded at US 21.14 cents per pound on Thursday, continuing the rally trend after hitting the bottom at 9 cents per pound in April 2020.

Following the increase of global sugar prices, the prices of Vietnamese sugar advanced 8-10 per cent year-on-year in 2022.

The strong rallies of sugar prices in the first months of 2023 bring bright prospects for sugar producers.

Vietcombank Securities Company (VCBS) reported that sugar production for the whole crop year 2021/22 reached 949,200 tonnes, of which, sugar production from sugarcane was 746,900 tonnes, accounting for 78.6 per cent, a gain of 8.3 per cent over the previous season.

Even though the harvested area of sugarcane decreased slightly by 4 per cent on-year, the sugarcane yield was higher at 64.6 tonnes per hectare. As a result, the sugarcane output for production rose by 11.8 per cent.

The total sugar supply was estimated at 2.8 million tonnes in 2022, while total demand was just 2.1-2.3 million tonnes. Notably, the market share of domestic sugar was modestly at 27 per cent, due to sharp gains in smuggled sugar, mostly from Thailand, last year.

Despite the oversupply, local sugar prices still advanced significantly thanks to the anti-dumping policy.

Before the anti-dumping tax, Việt Nam's sugar price was close to that of Indonesia and China, half the price of Philippine sugar and about 25 per cent higher than Thailand's sugar.

However, the price of sugar imported from Thailand and originating from Thailand after the anti-dumping tax is estimated at about VNĐ22,000 a kg, 10-15 per cent higher than the price of sugar in China, Indonesia and Viet Nam.

After applying measures against evasion of trade remedies, the amount of some sugar products imported from ASEAN countries, particularly Thailand, Laos and Cambodia, into Việt Nam has dipped markedly.

The total sugar import volume for the whole of 2022, then, declined by 12.6 per cent year-on-year, with the main sources of replacement being Australia and Indonesia.

The buying price of sugarcane from farmers also recovered to an average of VNĐ1.05-1.1 million per tonne due to scarcity of supply. This is a premise to motivate farmers to expand yield areas in the coming years.

The Ministry of Industry and Trade has officially applied anti-dumping and anti-subsidy tax rates of 47.64 per cent for sugar products using Thailand's sugar material and from five ASEAN countries, including Indonesia, Malaysia, Cambodia, Laos, and Myanmar, since last August.

Sugar imported from the five countries, if proven to be produced from local sugarcane, will not be subject to anti-evasion measures.

VCBS believes that the new tax measures create positive changes for the sugar industry and boost local sugar prices for the long term.

The securities firm expects the price of white sugar to remain high, hovering around VNĐ18,000-18,500 per kg, as sugar demand in the country is forecast to increase slightly to 2.3-2.4 million tonnes a year.

Nevertheless, in the short term, sugar prices may be under pressure due to temporary excess supply in 2022, approximately 6 million tonnes, and a potential increase in import quota by the Government to supplement domestic sugar in 2023.

Quảng Ngãi Sugar JSC forecasts that due to high oil prices, major sugar-producing countries such as Brazil, Thailand and India will switch to using sugarcane to produce ethanol, helping global sugar prices remain high in the first six months of 2023.

In the February report, the Vietnam Sugarcane Association (VSA) said that the country's planting area and output of sugarcane and sugar production in the 2022/23 crop year are likely to increase.

It is expected that the sugarcane area will increase by 3 per cent while the output of processed sugarcane and sugar both increased by over 16 per cent. — VNS