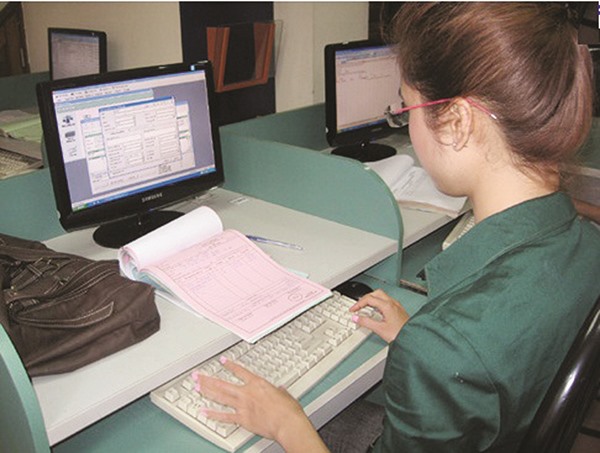

The number of firms using e-invoice has increased significantly in recent years due to its convenience and cost effectiveness.

The number of firms using e-invoice has increased significantly in recent years due to its convenience and cost effectiveness.

Statistics of the General Department of Taxation show that currently, some 3,000 firms use e-invoice, an increase from 656 firms in 2016.

Nguyen Van Phung, director of the Large Taxpayers Management Office under the General Department of Taxation, said the use of e-invoice helped save time and costs for businesses while limiting billing frauds and simplifying administrative procedures.

The general department estimated with some 2.5 billion invoices used in a year, firms could save VND1 trillion (US$43.9 million) if they switched to e-invoice.

According to Tran Thi Lan Anh, general secretary of the Viet Nam Chamber of Commerce and Industry, the application of information and technology (IT) in business, specifically e-invoice, was a common trend among advanced economies in the world.

The improving IT infrastructure system was creating favourable conditions for the use of e-invoices, she said.

Anh also said Vietnamese firms needed to promote the application of new technology solutions to enhance management and competitiveness.

There are more than 500,000 businesses in Viet Nam. Thus, the number of firms using e-invoice is still modest.

Compulsory from July 1?

The Ministry of Finance is drafting a new circular on e-invoice which is likely to come into effect from July 1.

The draft will make e-invoice compulsory for enterprises, organisations and State agencies.

In some special cases where an e-invoice cannot be used, tax authorities will print the invoice for enterprises. — VNS