The stock market is forecast to have a positive week with supportive information from exchange-traded fund (ETF) restructuring for the third quarter together with continued cash flow pouring into the market.

The stock market is forecast to have a positive week with supportive information from exchange-traded funds (ETFs) restructuring for the third quarter together with continued cash flow pouring into the market.

Each quarter, the ETFs, comprising of four foreign ETFs and two domestic ETFs, restructure their portfolios by adding stocks that meet their requirements on capitalisation and liquidity, and remove those that do not to ensure profitability.

Nguyen Hong Khanh, head of market analysis at Viet Nam International Securities Joint Stock Company (VIS), told tinnhanhchungkhoan.vn that investors were waiting for the outcome of the ETF restructuring because stocks added to the lists were likely to shine and encourage foreign investors to stay in the Vietnamese market.

Hoang Thach Lan, head of the individual investor division at Viet Dragon Securities, said the prices of stocks added to ETF portfolios would increase significantly.

“As far as I know, three stock codes are expected to be added to the FTSE ETF: VHM, GEX and HNG. Among them, GEX is likely to increase. VHM may gain but foreigners are always net sellers on this stock. HNG has experienced a correction in August after a sharp increase in the previous two months, so the trend for this stock is unclear,” Lan said.

The VN-Index on the HCM Stock Exchange added 0.48 per cent to close Friday at 968.88 points. It rose 0.3 per cent in the previous session. The index gained 0.04 per cent for the week.

On the Ha Noi Stock Exchange, the HNX-Index inched up 0.09 per cent to 108.02 points after losing more than 1.7 per cent in the last three sessions. It rose 2.66 per cent week on week.

The HNX Index decreased 0.52 per cent on a weekly basis.

An average of more than 227.3 million shares worth VND4.9 trillion (US$212.3 million) were traded in each session last week, up 4 per cent in volume and no change in value compared to the previous week.

Khanh told tinnhanhchungkhoan.vn that the market had gained for five consecutive weeks with liquidity remaining stable and cash flow spreading evenly.

The information that would likely impact the market the most was still the fluctuation of the exchange rate, which seemed to still be going up, Khanh said.

After continuous increases, the market may experience several short-term corrections this week but the target for the short-term was still rising to approach the 1,020 point, he said.

According to market expert Ngo Quoc Hung at MB Securities Joint Stock Company (MBS), cash flow increased and blue-chips in the bank stock group were still market drivers.

Foreigners had also reduced their net sales, he said.

“In the next week, I think that the market will trade positively. However, the VN-Index will face significant challenges when it reaches 980 to 985. If it successfully overcomes this resistance, it is expected to return to the 1,000-point level,” Hung said.

VN stock market offers great investment opportunities: analysts

Despite the volatility in the stock market and risks caused in part by the US-China trade war, there are still buying opportunities in the Vietnamese stock market this year, with the trick being to identify good companies, according to analysts.

Nguyen Thanh Lam, head of analysis at Maybank Kim Eng Securities Limited, said the Vietnamese stock market posted the highest gains in Asia in the first quarter of this year but lost the most in the second quarter.

When information about the US-China trade war spread, the VN-Index fell sharply, even more than indices in China, which were affected directly by the trade war, but this was an overreaction by investors, he said.

In recent weeks, the market has seen some recovery, though it is still off previous highs, he told a seminar on the stock market last week.

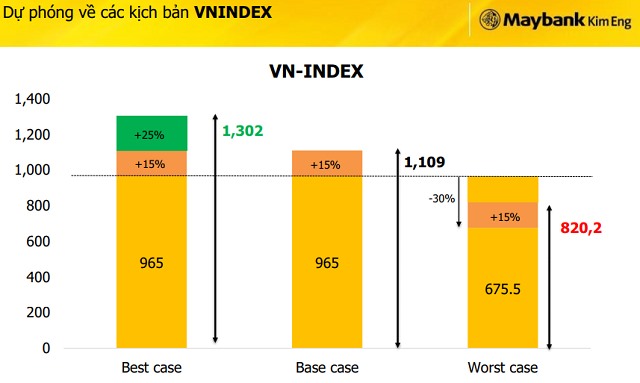

He offered three scenarios for the Vietnamese market in the second half.

In the base scenario, in which the outcome of the trade war was not too bad, the index would likely reach 1,100 points.

In the worst-case scenario, with the US imposing a 25 per cent tariff on $200 billion worth of Chinese imports in September, there would be a big impact, with regional markets plunging 30 per cent and the Vietnamese market to 820 points.

In the best-case scenario, if the US and China ended their trade war, regional markets would increase by 20 per cent and the VN-Index to around 1,300 points, he said.

Dr Chua Hak Bin, senior economist at the Maybank Kim Eng Group, said in a globalised world, the trade war affected many countries, but many, including Viet Nam, also benefited from the demand diversion.

Lam said stocks would see great divergence during the rest of the year, so investors needed to choose the right ones.

Le Hong Lien, head of institutional research at Maybank Kim Eng Securities Limited, said despite facing difficulties, the top 70 listed companies had enjoyed over 30 per cent profit growth this year, indicating that the Vietnamese stock market remained attractive. — VNS