Viet Nam is very likely to benefit from the upward trend in rice prices which is fueled by limited supplies and a shift away from the Indian supply.

Decreasing input costs as Europe eases sanctions against Russia and increased fertiliser supply will benefit rice export businesses, said Vietcombank Securities Company (VCBS).

A recent report on the rice sector from VCBS showed that the global rice output is estimated at 519.7 million tonnes at the end of the 2021/2022 crop. China, India, and ASEAN are key consumption markets, while India, Viet Nam, and Thailand are the largest rice exporters.

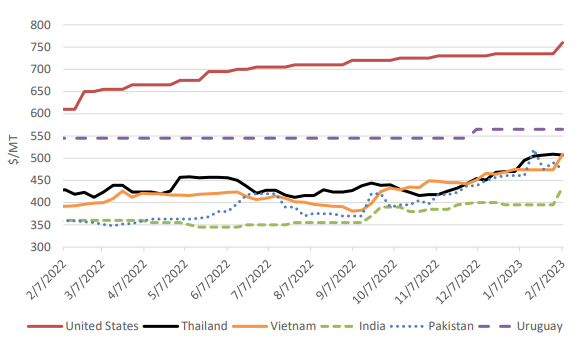

Rice prices witnessed an uptrend in global markets last year as the Indian government's ban on rice export, floods in Pakistan, and adverse weather in China and the Philippines caused reductions in rice output in these countries.

While depleted inventories in the Philippines will result in higher imports in 2023, rice production will drop due to prolonged droughts in China and India. On the other hand, due to heavy rain in Viet Nam over the past year and gradually neutral weather in the first half of 2023, the country's rice output is forecast to be stable this year, according to the US Department of Agriculture (USDA).

Therefore, VCBS said that Viet Nam is very likely to benefit from the upward trend in rice prices which is fueled by limited supplies and a shift away from the Indian supply.

Meanwhile, input costs are also expected to go down in 2023 as Europe eases sanctions and welcomes back Russian fertiliser exporters, increases reservations, and aggressively reduces gas consumption.

The availability of fertiliser on a global scale is anticipated to rise, boosting rice industry profit margins.

According to VCBS, the business growth prospects of Loc Troi Group are positive thanks to the promotion of rice exports to the European market, starting with the French market. The merger with Loc Nhan Food also increased the company's capacity.

With three production facilities under its control, Loc Nhan can now dry more than 12,000 tonnes of rice per day and export 6,000 tonnes of rice a day. Its projected revenue for 2022 was close to VND8 trillion ($336.8 million).

This company also has a wide partner network. In particular, it has signed contracts to supply up to 350,000 tonnes of rice to Vinafood 1 in 2023.

VCBS said that the food segment will be the main growth driver for Loc Troi this year, making up for the decrease in revenue in the pesticide sector. However, it noted that the company still struggles with the plan for issuing private placement bonds and transferring from the current listing exchange - UPCoM - to the Ho Chi Minh Stock Exchange (HoSE).

The securities firm expects that Loc Troi's net revenue and profit after tax will grow by 28 per cent and 15 per cent year-on-year, respectively, this year to VND14.9 trillion and VND475 billion. The growth for 2024 is projected to advance 1 per cent in revenue but fall by 17 per cent in profit.

Meanwhile, Vietnam National Seeds Group posted a positive growth in business results in 2022, mainly boosted by the rice segment, with a gross profit margin of about 40 per cent.

VCBS believes that the company's rice and fruit crops will grow well in the next five years.

In the national key product development project, the government plans to increase the rate of high-tech cultivation from 70 per cent to 75 per cent, the rate of using certified varieties from 78 per cent to 90 per cent, the area of fruit trees from 1,067 million ha to 1.2 million ha, and the yield from 10 tonnes/ha to 12 tonnes/ha.

Vietnam National Seeds also has an ambitious business plan to double its size in the next five years, with an annual growth rate of approximately 20 per cent/year.

By doing so, the market share of plant varieties across all fields can rise from 21 per cent to 25 per cent of the entire nation. The market shares will rise to nearly 60 per cent of the national market, particularly for grain corn.

It is forecast that the company's net revenue and profit after tax will rise by 11 per cent and 25 per cent on-year, respectively, this year, to more than VND2.09 trillion and VND282 billion. — VNS