As many as 412 e-commerce platforms have registered their tax information with Việt Nam’s tax authorities, according to information on a portal under the General Department of Taxation (GDT).

As many as 412 e-commerce platforms have registered their tax information with Việt Nam’s tax authorities, according to information on the special portal under the General Department of Taxation (GDT).

The general department said in a report that in the first ten months of 2024, tax revenues from organisations and individuals engaged in e-commerce activities across the country reached VNĐ94.6 trillion or US$3.73 billion, a 17 per cent increase compared to the same period last year. Over 191,000 traders operating on the platforms recorded business transactions amounting to VNĐ72 trillion.

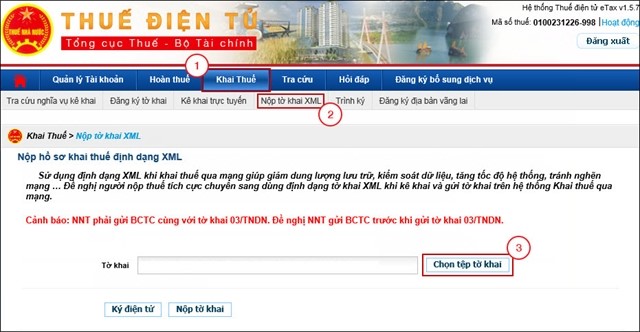

The report said nearly 950,000 businesses nationwide are currently operating, a 2.8 per cent increase compared to the end of last year. Of those, 99.6 per cent of these businesses have used electronic tax filing services, with 13.5 million e-tax returns filed.

B2C e-commerce revenue in the Southeast Asian economy surged from $5 billion in 2017 to $10 billion in 2019. The forecast is for it to reach $29 billion by the end of next year, a likely outcome according to the e-commerce and Digital Economy Agency under the Ministry of Industry and Trade as internet shopping has been rapidly gaining in popularity in recent years.

The agency said in 2020, the number of online shoppers in Việt Nam reached 49.3 million or 88 per cent of all Internet users with the most popular check-out items including food (52 per cent), clothing items, shoes and cosmetics (43 per cent) and household appliances (33 per cent).

Internet giants including Facebook and Google take the lion’s share in advertising revenue, accounting for 70 per cent of the entire market. The general department had previously said measures must be taken to make sure they meet their tax obligations, in an adequate manner. Other major foreign businesses with e-commerce operations should expect the same.

In addition, only a handful of the hundreds of thousands of Facebook accounts that conduct business transactions online have registered with the tax authorities. For instance, despite their effort to contact and inform nearly 13,500 Facebook accounts with business activities of their tax obligations, collection has been modest at best.

Meanwhile, manufacturing businesses have made significant inroads into e-commerce with reported sales increased by 60 per cent annually. Other industries including hospitality, marketing and affiliate marketing have also reported growth rates of 100-200 per cent annually.

According to tax authority statistics, between 2018 and 2020, Vietnamese organisations and businesses signed advertising contracts with foreign businesses, paid taxes on revenues totalling VNĐ3,082 trillion: VNĐ770,6 billion in 2018, VNĐ1,1679 trillion in 2019, and VNĐ1,1437 trillion in 2020.

During the COVID-19 pandemic, many businesses successfully transformed into or adopted e-commerce with its popularity now reaching far into the rural countryside, remote villages and mountainous regions.

The GDT said as business revenue generated on e-commerce platforms continues to rise, it’s critical that Việt Nam conduct reviews into the current tax policy and provide businesses with guidelines for completing tax registration and payment. — VNS

- Tags

- e-commerce platforms