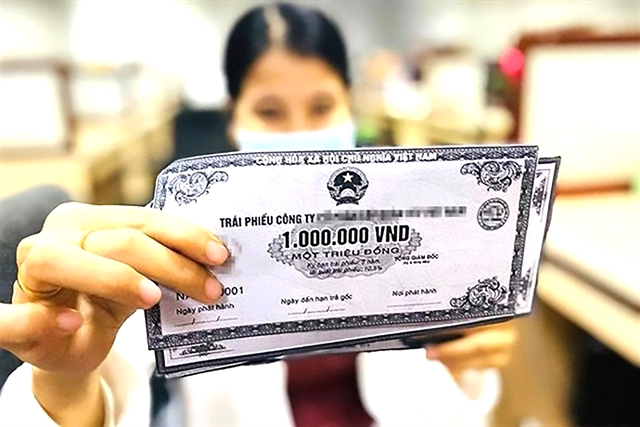

Việt Nam's corporate bond market is undergoing a significant transformation, driven by regulatory reforms and evolving market dynamics.

HÀ NỘI — As the country aims to bolster capital markets and reduce systemic risks, a crucial focus lies in addressing the dominance of banking institutions in bond issuance and fostering a more diversified investment landscape.

Following a period of market restructuring in 2023, the Vietnamese corporate bond market rebounded rapidly in 2024.

The Vietnamese Government has been proactive in addressing challenges in this market.

Decree No. 65/2022/NĐ-CP introduced stricter disclosure requirements, enhanced investor protection measures and higher standards for bond issuers.

These regulatory adjustments are designed to restore market confidence and mitigate risks associated with information asymmetry and speculative activities.

Moreover, to support market transparency, the Ministry of Finance (MoF) and the Vietnam Bond Market Association (VBMA) have ramped up efforts to publish detailed market reports, providing stakeholders with essential insights into issuance trends, risk profiles and credit ratings.

This increased flow of information aims to empower investors, enabling them to make more informed decisions and encouraging diversified capital allocation.

Statistics from FiinRatings showed that the total issuance value surged to approximately VNĐ443.7 trillion (US$17.3 billion), up 26.8 per cent year-on-year. By the end of 2024, the size of the market had reached VNĐ1.26 quadrillion, equivalent to 11.2 per cent of the country’s GDP.

This growth was especially pronounced in the latter half of the year, as businesses capitalised on improved economic conditions and investor sentiment.

However, despite this resurgence, the market remains heavily concentrated.

According to data from FiinRatings, in 2024, credit institutions maintained their leading role, accounting for 69 per cent of the total issuance value, up sharply from 56 per cent in the previous year, raising concerns about capital flow concentration and potential systemic vulnerabilities.

This overreliance on bank-issued bonds underscores the need for more balanced participation from non-bank enterprises, as well as a stronger presence of institutional investors.

In January, data from the Việt Nam Bond Market Association reported four public issuance rounds, totalling over VNĐ5.5 trillion. All of the issuance volume came from the banking and securities sectors, with the securities sector contributing only VNĐ300 billion.

According to Associate Professor Dr Nguyễn Hữu Huân, a financial and banking expert, the current challenges in the Vietnamese bond market arise from both the businesses and various external factors.

Small and medium-sized enterprises (SMEs) face weak management capabilities, which limits their access to capital markets.

When SMEs struggle to access the bond market, they often turn to banks for high-interest loans.

Instead of enabling companies to raise funds directly from investors, banks use the bond market to attract medium- and long-term capital, which they then lend back to these businesses. Huân said this would create a risk of monopolistic behaviour and cause high interest rates in the financial market.

The existing distortion in the issuance structure would need time for self-correction and regulatory intervention. Enhancing transparency in issuance and trading, while encouraging businesses to use bonds for long-term financing, would be immediate steps to foster a healthier market.

Nguyễn Tú Anh, director of the Centre for Economic Information, Analysis and Forecasting, emphasised the need to strengthen the legal framework for investment banking activities.

Separating investment banks from commercial banks is also crucial to mitigate risks that could affect the broader financial system, according to Anh.

From 2025 to 2030, significant public investments in key projects will create substantial capital demands, requiring contractors to have strong financial resource mobilisation capabilities. Encouraging all domestic enterprises to participate will offer key opportunities to revitalise the corporate bond market.

To achieve the Government’s goal of a market size equivalent to 20 per cent of GDP, several bottlenecks must be addressed.

Key measures include improving the legal framework, enhancing transparency, broadening credit rating practices and attracting more institutional investors. These steps are essential for promoting sustainable growth in the corporate bond market. - VNS