The Government hopes to continue receiving feedback from experts, scholars, financial institutions, investment funds and domestic and international investors to ensure the draft resolution is completed to the highest standard and lays a strong legal foundation aligned with global practices.

HÀ NỘI The National Assembly could review a draft resolution on the development of an International Financial Centre (IFC), aiming to create a legal framework to guide its establishment and growth, as early as May, said Deputy Prime Minister Nguyễn Hòa Bình.

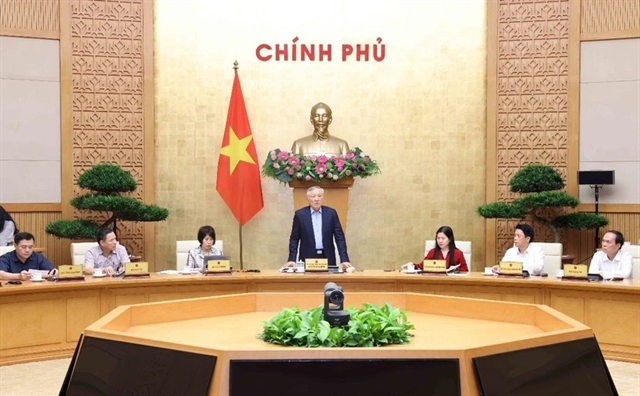

He was speaking at a meeting with representatives from ministries, sectors, banks, investment funds and international investors in Hà Nội yesterday.

The Government hopes to continue receiving feedback from experts, scholars, financial institutions, investment funds and domestic and international investors, to ensure the draft resolution is completed to the highest standard and lays a strong legal foundation aligned with global practices, said Bình.

At the conference, participants compared the draft resolution's policies to those of IFCs in other countries. They offered suggestions on specific mechanisms, financial products to be offered at the IFC, foreign exchange management, land policies, and dispute resolution procedures.

They said that the draft resolution represents remarkable progress of the project and aligns well with international standards for the development and operation of modern financial centres. Improvements include policies regarding the use of languages, applicable entities, tax incentives, foreign exchange management, labour policies, oversight mechanisms and organisational principles.

A representative from Temasek Holdings commented that the draft resolution closely follows international norms, establishing a strong legal framework for the formation, operation and development of an IFC in Việt Nam. The resolution introduces innovative policies, a separate arbitration mechanism, attractive tax incentives, and modern asset management provisions.

However, it was recommended that the draft be further strengthened with stricter regulations on the confidentiality of investor information and clearer international dispute settlement procedures.

Representatives from Standard Chartered Bank, ADB, HSBC, SSI Fund, and JICA suggested that the draft should better clarify anti-money laundering regulations and the application of legal frameworks within the IFC, ensuring consistency between Vietnamese and foreign laws in line with international practices.

They also called for more flexibility regarding membership registration, recognition and termination, the operation of international arbitration bodies and mechanisms for promoting investment and managing risks, especially market, insurance, commodity derivatives and information risks.

Deputy PM Bình said representatives from foreign companies and international organisations have valuable experiences investing and operating in Việt Nam, and their feedback was highly appreciated. According to the Government leader, the National Assembly’s resolution on the IFC will hold legal status similar to a law, but will be easier to amend than a full-fledged law.

The Deputy PM called on international organisations, financial institutions and reputable experts at home and abroad to continue contributing not only to the drafting of the National Assembly's resolution but also to the subsequent development of related Government decrees.

"We aim for Việt Nam not only to have an excellent resolution but also a comprehensive and high-quality system of decrees for the International Financial Centre," he said.

He asked the Ministry of Finance and relevant ministries to incorporate all the valuable feedback into the draft resolution and the drafting of subsequent decrees.

"The Government of Việt Nam is committed to always accompanying businesses, creating the most favourable conditions for them to expand investment not only in the International Financial Centre but also in other ecosystems that investors are interested in," said the Deputy PM. VNS