Banks have issued warnings to customers about growing risks tied to online and black market gold transactions, as scammers deploy increasingly sophisticated tactics to defraud investors and buyers.

HÀ NỘI — Several banks, including BIDV, Military Bank (MB) and Sài Gòn-Hà Nội Bank (SHB), have issued warnings to customers about growing risks tied to online and black-market gold transactions, as scammers deploy increasingly sophisticated tactics to defraud investors and buyers.

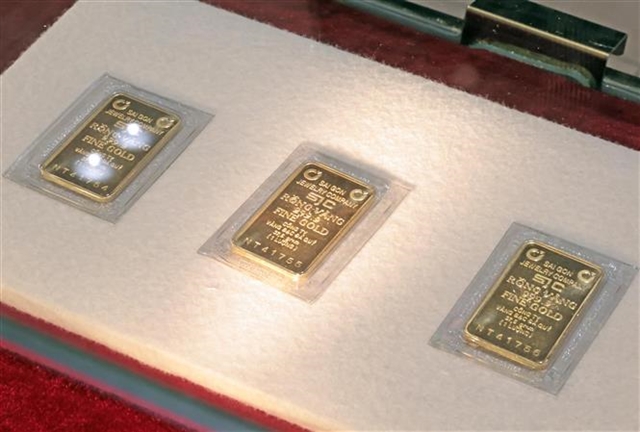

As credit institutions licensed by the State Bank of Vietnam (SBV) to trade gold bars, these banks have raised alarms over a surge in fraud cases involving fake websites, social media accounts, and deceptive online platforms mimicking reputable gold businesses and financial institutions.

BIDV and MB reported that many victims have been tricked by fake websites and fan pages designed to resemble those of legitimate gold trading companies. These fraudulent platforms often use domain names, layouts, and logos nearly identical to official sites, making it difficult for users to distinguish between real and fake sources.

Exploiting these fake identities, scammers post false gold and silver price updates, promote non-existent promotions and offer unusually high discounts and rewards. They lure victims into online gold trading schemes that promise attractive daily or weekly returns, tactics that are illegal and often linked to pyramid schemes or outright fraud.

The risk was particularly high in online transactions, where buyers are encouraged to transfer money without meeting sellers or seeing the physical gold. In many cases, after the money is transferred, the buyer does not receive anything, or is sent fake or low-quality gold.

SHB has also noted a wave of scams using the names and branding of trusted gold businesses such as SJC, DOJI, Bảo Tín Minh Châu and Phú Quý. Fraudsters create fake platforms under these names and trick users into transferring funds or sharing personal information.

Black market gold trading also poses severe risks. Without legal protections or regulatory oversight, buyers are vulnerable to counterfeit products, pricing manipulation and criminal schemes. Transactions conducted outside licensed gold outlets may involve gold of unclear origin, and participants may face legal consequences.

Scammers often follow up by impersonating gold companies or their executives through messages or emails, falsely notifying recipients of prize winnings or asking for personal and banking information. Some exploit leaked data to pose as relatives or employees, contacting victims via phone or social media to commit fraud. — BIZHUB/VNS

- Tags

- gold price