Interest rate cuts and a 50 per cent reduction in automobile registration fees are seen as positive factors for the industry in the second half of 2023.

Despite poor results in the first quarter of 2023, auto stocks are still expected to perform well on supportive policies, including interest rate cuts and a 50 per cent reduction in automobile registration fees.

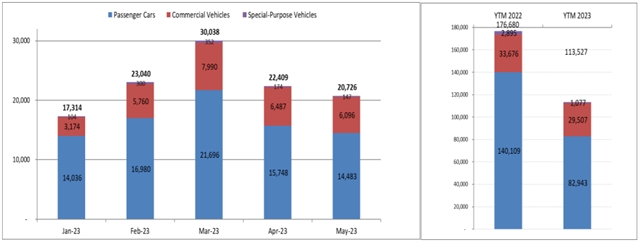

In the first five months of the year, total automobile sales dropped 36 per cent on-year to 113,527, according to a monthly report from the Viet Nam Automobile Manufacturers’ Association (VAMA).

Notably, sales of domestically-assembled cars (CKD) tumbled by 43 per cent over last year.

The developments have clearly been reflected in the business results of listed automobile companies in the first quarter of 2023.

Statistics from VNDirect Securities Corporation showed that the group's revenue and net profit decreased by 14.8 per cent and 11 per cent over last year, respectively.

Saigon General Service Corporation (SVC) posted revenue of over VND4.79 trillion in the first quarter, an increase of nearly 14 per cent year-on-year, but profit after tax dipped 85 per cent to VND14.7 billion.

The company said that the poor result was due to large supplies while purchasing power was weak, leading to a strong rise in the value of inventory.

It also said that a jump in operating expenses and higher interest expenses caused a fall in the company's profits.

Similarly, City Auto Corporation (CTF) and Haxaco (HAX) witnessed significant slumps in profits during the period due to persistently high inflation and weak demand.

SSI Research forecasts that auto consumption will fall in 2023 due to economic risks. While electric vehicles promise to make a breakthrough in sales, it is still too early to assess their impact on the country's automobile industry.

Bright prospects

However, the industry is welcoming supportive news as the Government has directed the Ministry of Finance to urgently develop a draft decree on a 50 per cent cut in registration fees for cars manufactured and assembled in Viet Nam, applied for the second half of 2023.

This is the third 50 per cent cut in the past three years.

Statistics from VAMA showed that after the policy takes effect, the sales of CKD almost always increase strongly over those of imported cars (CBU). For CKD alone, average sales jump about 30-60 per cent over months without applying the registration tax reduction policy.

Therefore, the application of the above registration fee reduction policy is expected to contribute to stimulating consumer demand for domestically manufactured and assembled cars and supporting automobile manufacturing and assembling enterprises.

VNDirect expects Haxaco stock to benefit from the policy as most of HAX's models are assembled domestically.

Yuanta Securities Vietnam said that the continuous decline in interest rates since the beginning of the year is another positive for the industry.

The securities firm expects the rates to drop in the third quarter of 2023, when major central banks stop raising rates, supporting customers who purchase cars with loans.

According to a survey by Yuanta, commercial banks have also sharply lowered interest rates on preferential loans for the first year for customers buying cars at certain firms.

As Viet Nam is one of the automobile markets with the fastest growth rate in Asia, the long-term outlook for auto stocks is positive.

According to statistics from the International Organisation of Motor Vehicle Manufacturers (OICA), the average growth rate of Viet Nam's auto sales in the period 2018-2022 reached 7.5 per cent a year, just below Saudi Arabia's 8.8 per cent.

On the stock market, automotive stocks performed well last month. For example, SVC shares rose more than 12 per cent, CTF climbed 9 per cent, HAX was up 0.61 per cent, and Giai Phong Motor Joint Stock Company (GGG) soared nearly 27.8 per cent. — VNS