Many Asian countries including Việt Nam have benefited from the China+ approach, which has seen companies looking to improve supply chain resilience by diversifying their production bases beyond China, according to the Cushman & Wakefield’s 2022 Manufacturing Risk Index.

Many Asian countries including Viet Nam have benefited from the China+ approach, which has seen companies looking to improve supply chain resilience by diversifying their production bases beyond China, according to the Cushman & Wakefield’s 2022 Manufacturing Risk Index.

The report says that trends are benefiting Viet Nam, which has seen a rapid expansion of its industrial sector over recent years.

The Vietnamese market also benefits from geographical connectivity both within the region and with markets outside of the region.

As a result of burgeoning demand for new manufacturing facilities in Viet Nam, major shipping lines such as MSC, Maersk and CMA CGM are investing in new capacity in the country to expand their operations.

The report admits that Asian markets have dominated the annual study that ranks the top manufacturing destinations according to baseline, cost and risk scenarios.

The report assesses the most suitable locations for manufacturing among 45 countries in Europe, the Middle East, the Americas, and the Asia Pacific region based on variables grouped by cost, risk and general business conditions.

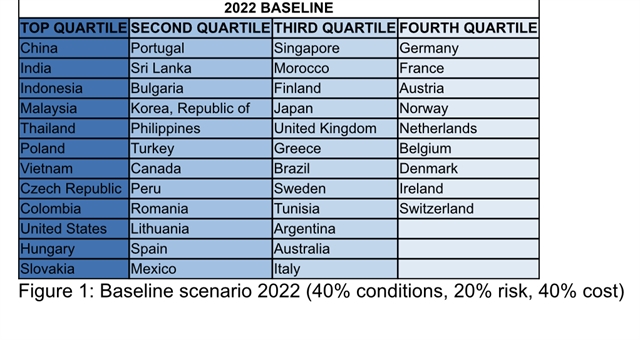

In the baseline scenario, which attributes a 40 per cent weight to both business conditions and cost, and 20 per cent to risk, Asian markets accounted for six of the top 12 positions, including all of the top five.

The report notes that India, Indonesia, Malaysia and Thailand all benefited from the availability of relatively low-cost labour combined with governments actively seeking both domestic and foreign investment in manufacturing and production.

When measuring on a cost basis, a 60 per cent weight was attributed to cost and 20 per cent each to conditions and risk, and Asia’s dominance increased further, with Thailand, Sri Lanka and the Philippines bringing the regional total to eight of the top 12 locations.

The same seven markets from 2021 reappeared, albeit mildly reordered, in the top quartile this year; all experienced relatively stable costs year-on-year, especially compared to markets in the US and Europe which have seen significant cost increases for the key variables of electricity and labour.

Globally, increased risks saw some markets in Europe – traditionally holders of strong risk profiles – slide down the rankings, most notably as a result of the war in Ukraine and its impact on economic risks and energy costs.

‘While Asia Pacific traditionally performs well under the cost scenario, this year has seen it make significant improvements under the risk scenario. Advanced markets have typically tended to dominate the risk scenario given their maturity and stability, but as global shocks continue, the risk differential between markets has narrowed. Risks in Europe are significantly elevated from a year ago, which has had the effect of making Asia Pacific more attractive as a manufacturing destination,” Cushman & Wakefield’s Head of Insight and Analytics Asia Pacific Dr. Dominic Brown said. — VNS