Recent adjustments to Việt Nam's economic growth forecasts from major financial institutions highlight growing confidence in the country's economic trajectory.

by Việt Thắng

Recent adjustments to Việt Nam's economic growth forecasts from major financial institutions highlight a growing confidence in the country's economic trajectory.

The Asian Development Bank (ADB) maintains positive views of Việt Nam’s economic growth in 2025. The bank has upgraded its projection for Việt Nam’s growth in 2025 at 6.6 per cent, up from 6.2 per cent forecast in September 2024.

ADB Country Director for Vietnam Shantanu Chakraborty made the prediction during his recent interview with the government portal about Việt Nam's economic outlook in 2025.

Chakraborty said the revision was based on Việt Nam's strong export performance, including manufacturing, robust foreign direct investment (FDI) performance, supported by a global pivot towards monetary easing and moderate global commodity prices (including crude oil).

Việt Nam is aspiring to reach its goal of becoming an upper middle-income country by 2030. This ambitious aspiration necessitates an average annual growth rate of 7 per cent.

To compensate for the low economic growth during the COVID-19 pandemic, it was understandable that the growth target for 2025 is set at 8 per cent, which will contribute to Việt Nam's 2030 goal.

"However, it is essential for Việt Nam to prioritise not only the quantitative aspects of economic growth but also its qualitative aspects, as the country's growth foundations need further consolidation. Such a growth target should therefore be taken as directional guidance for the government's efforts to boost economic growth in 2025", said Chakraborty.

Việt Nam's strategic positioning in the global value chain has been recognised by the World Bank, highlighting its ability to connect with major trading partners. This connection has significantly benefitted domestic enterprises, particularly those exporting to the US, which experienced revenue growth nearly 25 per cent faster than exports to other markets from 2018 to 2021.

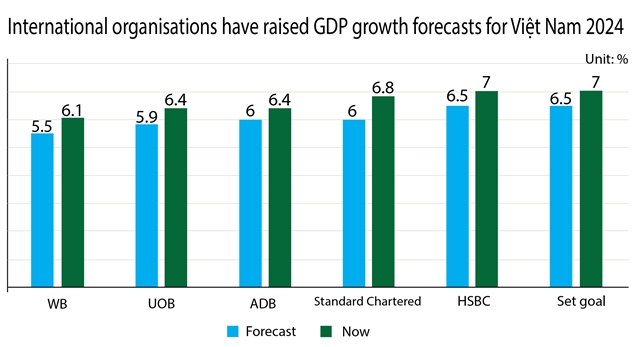

As a result of these developments, Việt Nam's GDP growth was projected to reach 6.1 per cent in 2024, increasing to 6.5 per cent in 2025. These figures surpass the World Bank's earlier forecasts of 5.5 per cent and 6.0 per cent for those years. This positive trajectory positions Việt Nam's economy favourably against eight other ASEAN countries and China, underscoring its emerging role as a key player in the region.

VNS Graphic Đoàn Tùng

A recent report "'Towards 2025" by VinaCapital presents an optimistic outlook for Việt Nam's economy, projecting a growth rate of 6.5 per cent for the coming year. Key domestic factors contributing to this growth include a focus on infrastructure development. It said a rebound in this sector will likely stimulate related industries. Meanwhile, rising consumer confidence and spending will further bolster the economy.

Michael Kokalari, director of Macroeconomic Analysis and Market Research at VinaCapital, highlighted a significant increase in Vietnamese exports to the US, which surged over 20 per cent in 2024, reversing a 10 per cent decline in 2023. This growth was largely attributed to a 40 per cent rise in exports of electronics and high-tech products.

However, he cautioned that export growth to the US might slow this year due to a potential 'soft landing' of the US economy, which could affect demand for Vietnamese goods.

Meanwhile, Standard Chartered Bank revised up its forecast for Việt Nam’s 2024 GDP growth to 6.8 per cent from the previous 6 per cent, reflecting the stronger-than-expected expansion in the third quarter of the year. In its recent macro-economic updates about Việt Nam, the bank said growth was expected to moderate to 6.9 per cent in the fourth quarter. The bank maintained its 2025 forecast at 6.7 per cent, with projected growth of 7.5 per cent year-on-year in the first half and 6.1 per cent year-on-year in the second half.

Explaining this forecast, Nguyễn Thúy Hạnh, general director of Standard Chartered Bank Vietnam, said that along with solid growth in production, appropriate monetary policy had also contributed to the economic recovery since the beginning of the year. Specifically, in 10 months, exports increased by 14.9 per cent compared to the same period of 2023; while imports increased by 16.8 per cent with the electronics import-export industry continuing to recover. Foreign direct investment (FDI) continued to increase strongly when disbursed capital increased by 8.8 per cent and commitments increased by 1.9 per cent compared to the same period.

According to HSBC Vietnam’s Markets and Securities Services expert Ngô Đăng Khoa, the National Assembly aims for a 2025 GDP growth target of 6.5-7 per cent, asking the Government for efforts to achieve 7-7.5 per cent, equalling the actual target of 7 per cent for 2024, reflecting high hopes for improvement of the economy next year.

In fact, the expectation is reasonable. The manufacturing sector has emerged strongly from last year’s woes. This has supported export growth at double digit pace, with broadened growth in other sectors including agriculture products. Given the strong recovery momentum in 3Q24, HSBC Global Research raised its GDP forecast for 2024 to 7.0 per cent from 6.5 per cent, while maintaining GDP forecast for 2025 at 6.5 per cent.

2024 - a look back

According to HSBC’s economists, these upward revisions reflect the country’s resilience and robust economic recovery, driven by strong domestic demand, export growth and increasing foreign investments in sectors such as manufacturing, green energy and technology. The adjustments indicate optimism about Việt Nam's ability to meet or exceed its economic targets for the year.

Việt Nam has experienced a lot of ups and downs given its open economy and integration to the world. From a challenging 1Q24, the domestic economy outlook turned more positive as the recovery continued, returning Việt Nam to its position as ASEAN’s growth star.

In particular, growth improved and surprised on the upside, rising to 6.9 per cent and 7.4 percent in 2Q24 and 3Q24, respectively. The recovery in the external sector has started to broaden out beyond consumer electronics, although the domestic sector remained relatively muted despite seeing incremental improvements.

There were concerns that the impact of Yagi, the strongest tropical storm Việt Nam faced in 70 years, would weigh on growth. The northern provinces were hit particularly hard in early September with damage estimated at over US$3 billion. However, the impact has been primarily concentrated in the agriculture, forestry and fishery sectors. Meanwhile, manufacturing and trade remained resilient and continued to lead the recovery.

The momentum of the second half of 2024 economic recovery continued to be led by manufacturing, with IIP growing 8.4 per cent year-on-year in 11 months. This was corroborated by healthy trade data, with exports rising 15.4 per cent year-on-year in 11 months. Encouragingly, the trade recovery that was initially centred around electronics was showing signs of broadening out, with textiles and footwear exports rising 16.7 per cent year-on-year in 3Q24.

On FDI, Việt Nam continued to attract foreign inflows as fundamental prospects remained positive. Although growth in newly registered FDI moderated in 3Q24, sectors beyond manufacturing such as real estate and energy saw increases in investment. A total of $21.68 billion was disbursed, up 7.1 per cent year-on-year. This marks the third consecutive year in which Việt Nam’s FDI disbursement exceeded $20 billion. Intra-ASEAN investments are leading the way, making up 40 per cent of inflows to date.

Last but not least, Việt Nam should continue to invest more in infrastructure, which is fundamental to its economic growth and quality FDI attraction. The Government is committed to pushing public investment, focusing on strategic infrastructure projects which connect economic hubs. This will be a key booster to take Việt Nam into the new era. VNS