Caution has recently been the watchword of Vietnam banking sector

With only six months to go until 2020, Vietnam government regarded 1H2019 as a critical time to speed up restructuring with multiple regulatory changes throughout the financial system. The government has continued its target to develop a sustainable and more balanced capital market structure with strong pillars from both monetary market (i.e the banking sector) and capital market (i.e fixed income and equity market). The sectors that could threaten the stability of the entire banking system are to be closely monitored and even tightened, such as non-production or highly risky loans to real estate, BOT/BT transport projects, consumer loan. SBV is also considering a pilot programs for P2P lending to facilitate the financial inclusion goals while minimizing the its potential risks. As a result, growths in 2019 are considered to be slow and steady, following government directions of policies.

Credit growth continues its downward trend, especially lending to non-production sectors

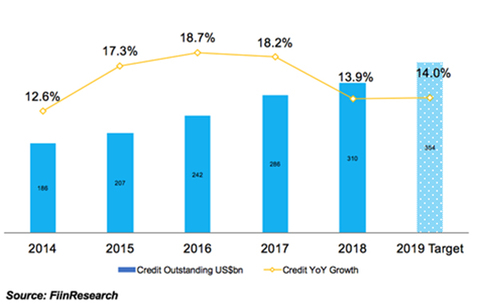

Credit growth remained slow in 2018 as commercial banks are more conservative amid tightening credit policies. In 2018, credit growth moderated to around 13.9%, reflecting a dramatic decline y-o-y from 18.2% in 2017 and the peak of 18.7% in 2016.

While 2018 growth figure stood far below target (18%), regulators widely regarded this as a sign of stability. On the basis of the government’s orientation towards a sustainable and more balanced capital market structure and in line with financial system stability goals, SBV has been holding a tight grip on credit growth.

In particular, SBV launched some tightening of credit in 2018 by setting credit growth limits for commercial banks and controlling lending to high-risk sectors including real estate, security investments, or risky areas such as consumer loans, BOT/BT transportation projects. As a consequence, real estate loans have grown at a slower pace, about 37% Y-o-Y, compared to the previous years’ 2x growth. Besides, consumer finance’s development experienced a slowdown at 28% YoY growth in 2018 from CAGR of 56% over the last five years.

For 2019, SBV set the credit growth target at 14% YoY, requiring commercial banks to maintain their loan portfolio more conservatively.

Credit outstanding & YoY growth, 2014-2019 (Target)

Capital adequacy: The deadline 2020 is coming, but only 9/45 banks have met Basel II standards

Undercapitalization has continued to be a pressing issue to the banking sector as the Basel II compliance deadline of 2020 is just six months away. Up to present, only 9 out of 45 banks including Techcombank (TCB), Vietnam International Bank (VIB), Asia Commercial Bank (ACB), Vietnam Prosperity Commercial Bank (VPB), Vietcombank (VCB), Orient Commercial Bank (OCB), Military Commercial Bank (MBB), Tien Phong Commercial Bank (TPB), and Vietnam Maritime Commercial Bank (MSB) were officially given approvals from SBV to apply Basel II Standards.

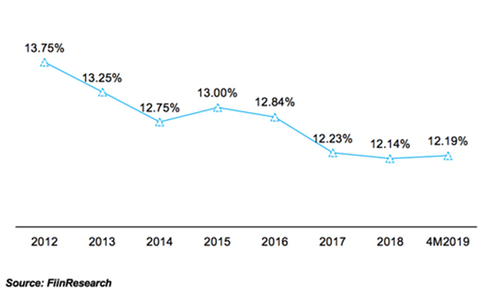

By end-2018, the CAR of the banking system fell slightly to 12.14%, down by 9 bps since YE2017. CAR’s downward trend was attributable to strong credit growth in the last three years at around 18% Y-o-Y, gloomy stock market with no more banks listed while bank stocks declining, plus banks’ difficulties in mobilizing capital. In 2018, many efforts made to raise capital ended up unsuccessful. While 22 banks aimed to raise US$3.7bn in charter capital to enhance Tier 1 capital, the actual addition was only US$2.3bn, achieving 63% of the targeted amount. Only four banks, including Techcombank (TCB), Sai Gon Commercial Bank (SCB), Military Commercial Bank (MBB), and Southeast Asia Commercial Bank (SeABank) confirmed meeting 100% of their capital raise targets.

State-owned commercial banks face more severe constraints on raising capital. Foreign ownership limit is currently capped at 30%, making it difficult for SOCBs to mobilize capital from foreign strategic investors who tend to acquire sizeable stakes. Prolonged negotiations on deal valuation and delays in the approval process count another reason, for instance, the case of Bank for Investment and Development of Vietnam (BIDV) and Vietcombank (VCB) raising capital from foreign investors recently. In addition, SOCBs are usually required to pay cash dividends instead of retaining cash earnings - a source for increasing charter capital. These banks also have limited capacity on bonds and CD issuances as Tier 2 capital must not exceed Tier 1 capital. Consequently, SOCBs currently have the lowest CARs with Vietinbank (CTG) and Agribank (AGRB) registering 10% and 9.54% respectively.

Capital Adequacy Ratio, 2012-4M2019

Prospects from improving non-performing loan resolution

Despite the central bank’s credit tightening policy, banks reported positive operating performance thanks to enhanced bad debt resolution and rising fee and commission income from retail banking. This has offered bright prospects for banks earnings. The initially positive impact can be seen in CAR’s slight increase of 5bps in the first four months of 2019.

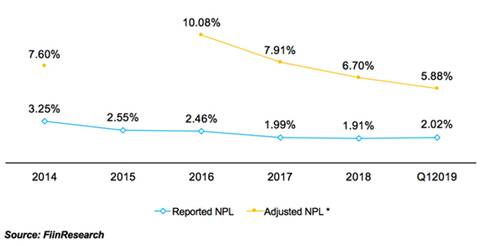

Specifically, asset quality was improved in 2018 as the overall non-performing loan (NPL) dropped to 1.91% from 1.99% in 2017. This positive outcome firstly results from the fact that debts related to real estate have been gradually resolved thanks to the recovery of the property market. Also, banks and VAMC have ramped up their efforts to resolve bad debts in accordance with Resolution No 42. During the period 2012-Q12019, these parties resolved about VND 907,300bn or USD39.02bn of bad debt, 25% of which were attributed to the implementation of Resolution 42.

NPL of banks (%), 2014-Q12019

(*) Adjusted NPL include reported NPL, VAMC, and hidden debts as reported by the Governor of SBV to the National Assembly

Moreover, Cost-to-Income ratio of the sector has been on a downward trend since 2016 thanks to bank’s optimization via retail strategy and fintech applications. Banks’ retail strategy and investments in technology are showing results with 161 bps decrease in operating efficiency over 2018, registering 43.7% on average at YE2018. Commercial banks which have a focused retail orientation, such as Techcombank, VPBank, or Vietcombank posted a lower-than-average ratio of 32-35% in 2018 and around 37% in 1Q2019.

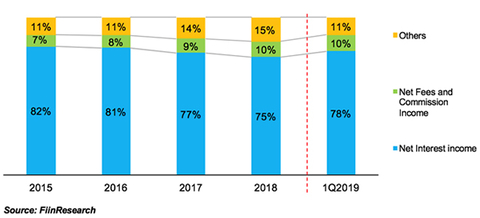

Retail segments set to be the key growth drivers

Income from retail segments including those from fee & commission will continue to be the key growth drivers for the banking sector in Vietnam in the time to come. In alignment with banks’ strategy toward promoting retail banking, non-interest incomes from bancassurance and card services have steadily increased. By YE2018, non-interest income accounted for 10% of total net revenues, up from 7% at YE2015. Growth of these segments is further supported by the government’s orientation to develop the insurance market and promote cashless transactions, in the context of ever-growing disposable income and tech-savvy population.

Source: FiinGroup from the financial statements of 27 banks whose assets is equivalent to 73% of total banking assets in Vietnam at YE 2018.

Incomes of Vietnamese banks breakdown, 2015-1Q2019 (YoY

More detailed information about the banking system as well as its key issues and trends could be found in our Vietnam Banking Report 2019. Please visit our website at http://fiinresearch.vn/Reports/17DC2-vietnam-banking-report-2019-.html for more details.

|