Consumer finance growth shows clear signs of slowing down

In 2018 consumer finance increased its share of overall credit in the market to 19.7%, 3% more than in 2017. But whereas the previous five-year period the consumer credit market saw a CAGR of 59%, in 2018 growth cooled down, declining to 30.4%. Finance companies (fincos), despite experiencing strong growth in previous years, could not sustain such a pace in 2018. Their growth slumped to 15% compared to 38% in 2017.

Figure 1: Growth YoY (%) of CF market

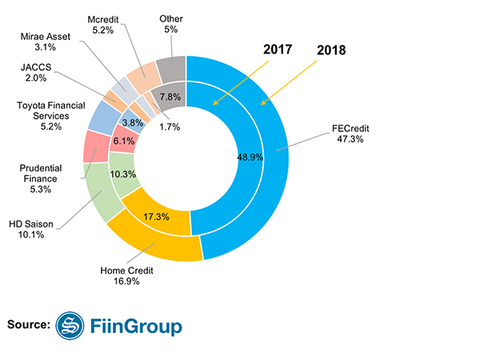

Competition intensified as new players entered the picture. If in 2015 there were only a handful of fincos active in the consumer finance (CF) market, in 2018 there were 16 not counting the alternative lending and pay-day loan platforms. MCredit put in an impressive performance, acquiring over a 5% market share by the second year of launch thanks to its strong focus on cash loans, followed by SHB Finance and Easy Credit. FE Credit, though still the biggest player, suffered a slight decrease in market share from 48.9% in 2017 to 47.3% in 2018. Competition intensified, but the product offerings remain almost the same across the board.

In this article, we aim to divide finCos based on their growth strategies and briefly compare indicators of their financial and operating efficiencies.

Figure 2: Market share of fincos 2017 vs 2018

CF players generally fell into two groups with differing growth strategies. While some prioritize profitability at the risk of high NPLs, some prioritize better asset quality and capital adequacy.

The group of companies which prioritize market share growth and profitability over asset quality are aggressive players.

- With the unique characteristic of a company which offers collateralised loans for buying Toyota cars, Toyota Finance has limited NIM and profitability. Nevertheless, thanks to the strong demand for cars in the country, the company recorded a robust loan book growth.

- FE Credit has been a pioneer in this aggressive strategy, launching new products and investing in technology innovations. Its considerable loan growth of 19% was accompanied by high NPL of 6%. Accordingly, its provision for bad debts was a high 65% of total operating income.

- MCredit with growth of 254% is also an aggressive player. It still has room for growth judging from its loan/debt coverage of only 96%. But the focus on only cash loans increases the risks for the company since its NPL is currently at a high 6%.

- In contrast to these three, HD Saison experienced a decline in growth due to its change of direction from expanding coverage to focusing on existing customers within its ecosystem (HDBank – Vietjet – HD Saison).

Figure 3: Financial ratios of selected fincos - aggressive group

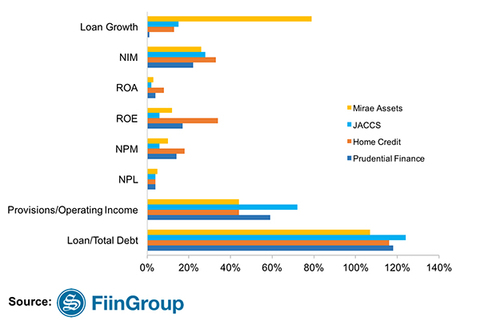

In contrast, cautious players are characterised by relatively slower growth rate and lower NPLs but higher asset quality and capital adequacy.

- The outlier in this group is Mirae Asset, which achieved dramatic growth of 79% as it started to focus on cash loans as the growth driver while NPL remained at a average rate of (you mean moderate?) 5%. Nonetheless, this did not translate into higher profitability.

- Home Credit’s continued high NIM, ROA, ROE, and NPM and low NPL of only 4% is thanks to its robust risk management and technology platform. In the near future stronger growth is expected due to its strategic partnership with e-wallet issuer Momo.

- JACCS is another case of conservative player with the company experiencing modest credit growth due to the decreasing number of new contracts and automobile loans. Also, being the pioneer in credit cards among fincos does not guarantee JACCS can retain its pre-eminent position since its conservative approach has allowed newer entrants (FE Credit, Home Credit) with more aggressive strategies to take over the credit card and other segments.

- Currently under transition to the management of Shinhan Bank, Prudential Finance’s growth slowed to the lowest level of 1% in the group because there were no new loans. This enabled a decrease in costs, which resulted in better operational efficiency. However, we expect the indicators to change drastically once Shinhan Bank actively takes over the company’s management, which could mean new products, strong financial support and a change in strategy.

Figure 4: Financial ratios of selected fincos - cautious group

Clearly, there is no one way to do consumer credit in Vietnam, and players following these two strategies are constantly adjusting to find the sweet spot for sustainable growth amid fierce competition. Our 2019 Consumer Finance Market Report reviews the performance of each player in terms of product market share and financial efficiencies besides assessing the new trends that are capturing the market.

More detailed information about the CF market can be found in our 7th comprehensive report on Consumer Finance in Vietnam, which offers the most up-to-date data on consumer finance companies and practical market trends and news to aid your decision making. Please visit website https://biinform.com/Reports/1EDEE-vietnam-consumer-finance-market-2019-report-8770.html for more details.

Source: FiinGroup

|