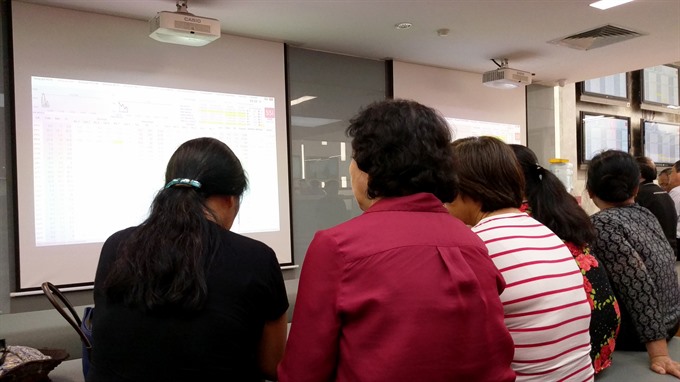

Vietnamese shares extended gains for a second session on Monday thanks to the growth of large-caps, but liquidity remained low signaling an unsustainable trend for the market at the moment.

Vietnamese shares extended gains for a second session on Monday thanks to the growth of large-caps, but liquidity remained low signaling an unsustainable trend for the market at the moment.

The benchmark VN-Index on the HCM Stock Exchange gained 0.75 per cent to close at 990.52 points. It rose 1.42 per cent last Friday.

The HNX Index on the Ha Noi Stock Exchange ended almost flat at 111.99 points compared to last week’s end of 111.98 points.

More than 171.6 million shares were traded on the two local exchanges, worth nearly VND3.8 trillion (US$168.7 million).

Of all 20 sectors, key industries such as financial-banking, energy, agriculture and consumer staples helped boost the stock market.

The six industry indices were up between 0.6 per cent and 2.9 per cent, data on vietstock.vn showed.

Investor sentiment seemed good as investors focused their purchases on blue chips to lift the large-cap VN30 Index up 0.93 per cent to 982.09 points, with 23 gaining stocks out of the 30 largest stocks by market capitalisation.

Gainers in the large-cap group included FLC Faros (ROS), Mobile World Investment (MWG), Bank for Investment and Development of Viet Nam (BID), Masan Group (MSN), Bao Viet Holdings (BVH) and Petrolimex (PLX) with their growth rates ranging from 2 per cent to 6.9 per cent.

Some investors were also interested in mid-cap and small-cap stocks such as property developer FLC Group (FLC) and Hoang Quan Consulting-Trading-Service Real Estate Corp (HQC), trading 11.58 million and 5.8 million shares of the two companies on Monday.

FLC and HQC finished Monday up 5 per cent and 4.5 per cent.

After a positive opening in the first half of Monday’s session, the benchmark VN-Index had a less-than-expected ending as investors were reasonably cautious with the market’s short-term trend, Viet Dragon Securities Co (VDSC) said in its report.

According to Sai Gon-Ha Noi Securities Co (SHS), a moderate increase, along with modest liquidity and slightly positive market breadth, indicated Monday’s growth was more like “an extended technical rising session to last Friday”.

“The market’s recovery on low liquidity and strong buying demand in large-cap stocks were not reliable signals for the end of the overall market’s downtrend,” Bao Viet Securities Co (BVSC) said in a note.

Therefore, the stock market may continue to fluctuate in the coming sessions as the market’s overall performance will depend on listed corporate earnings reports for the second quarter of the year, BVSC said. — VNS