Several of VinaCapital’s funds achieved remarkable results in the first half of the year.

Several of VinaCapital’s funds achieved remarkable results in the first half of the year.

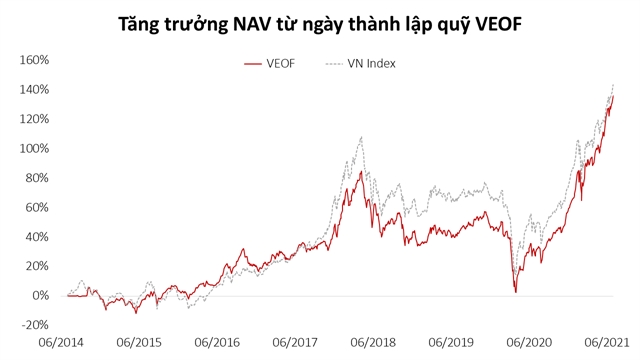

VinaCapital VN100 ETF reported a return of 38.5 per cent and VEOF and VIBF ranked among the top three performers in their respective categories with returns of 39.1 per cent and 26.6 per cent.

As of June 30 the three funds had assets under management of over VND855 billion (US$37.2 million) and nearly 6,000 subscribers.

VinaCapital VN100 ETF was established a year ago and replicates the VN100 Index, which is comprised of the 100 leading stocks listed on the Ho Chi Minh Stock Exchange (HOSE).

It is traded on HOSE under the ticker FUEVN100.

Over 80 per cent of the fund’s assets are invested in the financial, real estate, consumer staples, and materials sectors.

The top holdings are Hoa Phat (HPG), Vingroup (VIC), Techcombank (TCB), VP Bank (VPB), and Vinhomes (VHM).

Launched in July 2014, VEOF is one of VinaCapital’s longest established open-ended funds. It invests in large and mid-cap companies with the growth potential to earn higher profits than the VN-Index.

VIBF is a two-year-old open–ended balanced fund that combines bonds and listed stocks.

Brook Taylor, CEO of VinaCapital Fund Management Joint Stock Company, said, “After just one year, the VinaCapital VN100 ETF has delivered on our expectations that the fund would mirror the performance of the VN-Index better than any other ETF currently on offer in Viet Nam.

“The ETF, as well as VEOF and VIBF offer local and foreign investors exposure to a range of growth stocks that are positioned to benefit from Viet Nam’s continued macroeconomic stability, rising corporate profits, and positive growth of the stock market, which could see a number of new listings in the year ahead as the equitisation process of State-owned enterprises accelerates as planned.

“Viet Nam [was] one of the rarest countries in the world with positive GDP growth in 2020 (+2.9 per cent) which continued into the first half of 2021 (+5.6 per cent), boosting the confidence of domestic and foreign investors. As a result, Viet Nam’s stock market has become one of the best growth markets in Asia, increasing by 15 per cent in 2020 and 27.6 per cent in the first six months of 2021.” — VNS