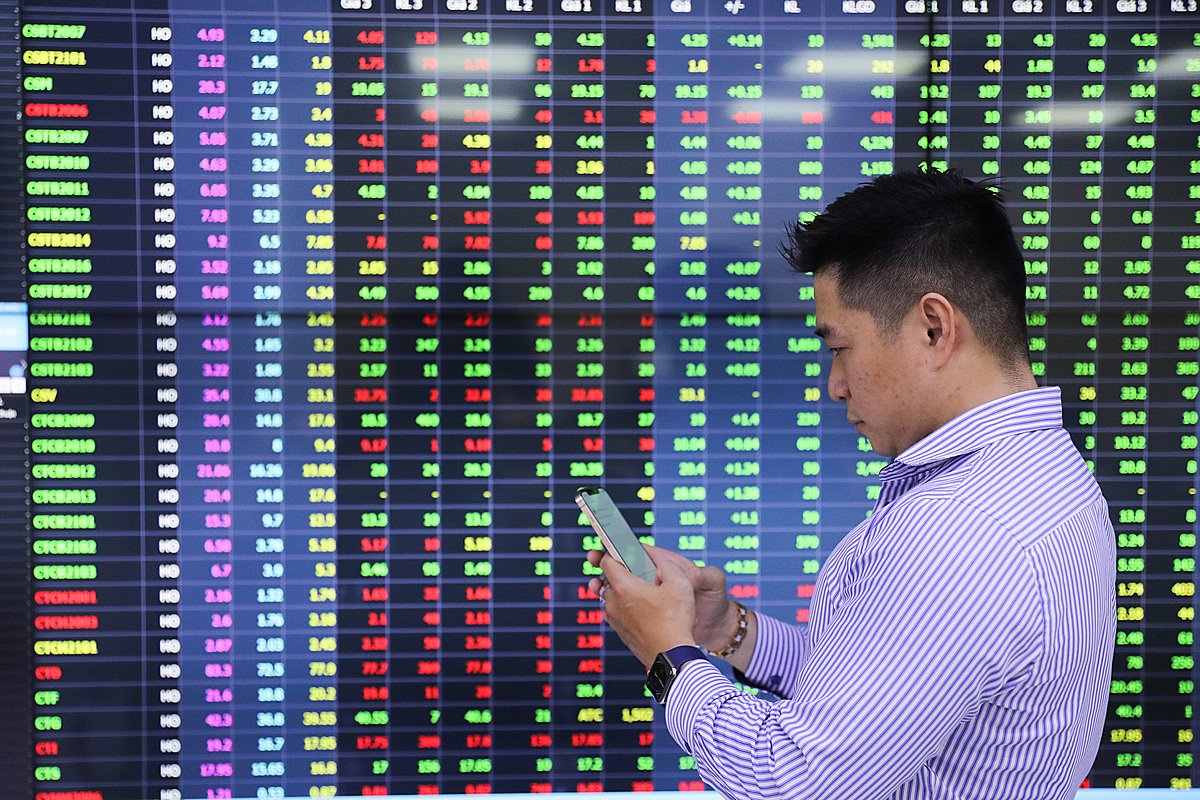

Despite market turbulence, the Vietnamese stock market experienced a gain on Monday. However, cautious investors were evident as the reserved cash flow indicated their wariness amidst the volatile market conditions.

Despite market turbulence, the Vietnamese stock market experienced a gain on Monday.

However, cautious investors were evident as the reserved cash flow indicated their wariness amid volatile market conditions.

The market benchmark VN-Index on the Hồ Chí Minh Stock Exchange (HoSE) gained 0.09 per cent to end at 1,125.50 points.

The market's breadth was negative with 215 stocks rising, while 302 slid.

Investors poured over VNĐ14.7 trillion (US$606 million) into the southern exchange, equivalent to a trading volume of 700.5 million shares.

The 30 biggest stocks tracker VN30-Index gained 0.22 per cent, to end at 1,117.34 points. Twelve in the VN30 basket climbed, while 14 decreased and four stayed flat.

In the VN-30 basket, the best performers were Masan Group (MSN), the Việt Nam Rubber Group (GVR), Vinhomes (VHM), PetroVietnam Gas JSC (GAS), SSI Securities Inc (SSI), Bảo Việt Holdings (BVH), FPT Corporation (FPT) and Vietjet (VJC).

Banking stocks suffered from selling force, with losers including Asia Commercial Bank (ACB), Bank for Investment and Development (BID), HDBank (HDB), Military Bank (MBB), Techcombank (TCB), Sacombank (STB) and VPBank (VPB).

The domestic landscape is exhibiting a positive trajectory, primarily driven by policy support aimed at economic recovery through credit disbursement and year-end public investments, said Bùi Văn Huy, Director of HCM City branch of DSC Securities Company.

This favourable environment is further bolstered by a low interest rate scenario. However, there are certain factors that warrant monitoring, such as uncertainties stemming from bad debt and the bond market.

"In terms of cash flow, experts have observed the return of individual investors, generating a sense of excitement in the market's final days of the year. Nonetheless, it is crucial to emphasise that the market's priority lies not in an abrupt surge of liquidity, but rather in a steady improvement in cash flow guided by key groups. Sustaining a stable and improving cash flow will be sufficient to maintain a positive market movement."

In recent times, the stock market has been characterised by sideways movement within a narrow range, featuring alternating sessions of gains and losses. The positive aspect lies in the market's ability to maintain an upward accumulation trend while witnessing enhanced liquidity, he said.

On the Hà Nội Stock Exchange (HNX), the HNX-Index gained 0.07 per cent to end at 231.37 points.

During the trading session, over 76 million shares were traded on HNX, worth nearly VNĐ1.5 trillion. — VNS