As stated in StoxPlus Cement Market Report 2018, Viet Nam's cement and clinker sales volume reached 80.3 million tonnes in 2017, posting an increasing growth rate for three years in a row.

Demand: Viet Nam cement market saw the light of recovery thanks to clinker exports

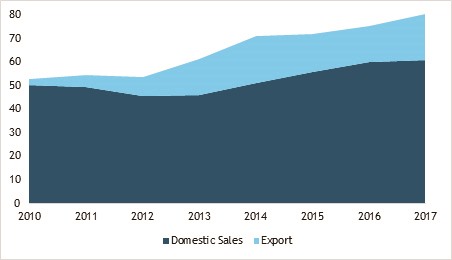

As stated in StoxPlus Cement Market Report 2018, the Viet Nam cement and clinker sales volume reached 80.3 million tonnes in 2017, posting an increasing growth rate for three years in a row. Although the domestic consumption contributed to more than 70 per cent of the total sales for several years, the recent years have witnessed a sluggish growth rate from 9.5 per cent (2015) to 1.4 per cent (2017). While domestic consumption sustained its growth, the export activity drove the market with the export volume surging up to 19.7 million tonnes, leading to a robust growth of 27.7 per cent year on year, thanks to the increasing demand from key markets, including Bangladesh and the Philippines.

Additionally, China emerged as a potential export market as the Chinese government has implemented an unprecedented pollution crackdown in November 2017, with the country shutting down tens of thousands of cement factories in an effort to address China’s air pollution. Compared to 2016, the cement export volume fell sharply by 21.4 per cent, while clinker posted a strong growth of 53.8 per cent, making it the key driver of cement exports in 2017. This could be explained by the fact that foreign countries tend to favour clinker imports over cement due to the cost, and this trend will continue to shape Viet Nam’s cement exports in the long-term prospects.

Supply: While local private companies continued to launch “mega” projects, the foreign giant strengthened its presence via M&A activities

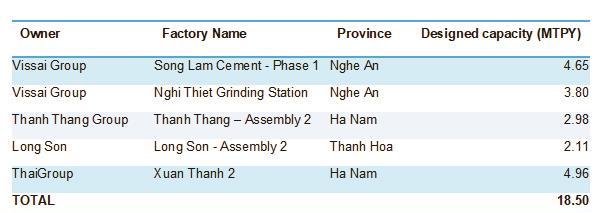

According to StoxPlus database, there are some 107 cement facilities with a total capacity of 120.9 million tonnes per year (MTPY) belonging to 93 companies in Viet Nam, of which VICEM and foreign-owned companies recorded high utilisation of more than 80 per cent. In 2017, private companies continued to operate five new “mega” projects with total capacity of up to 18.5 MTPY, resulting in a surge in the total production capacity by 18 per cent. The projects are developed not only by giant local private companies such as Vissai or ThaiGroup, but also by other local players, especially Thanh Thang and Long Son, which indicated a trend in favour of large-scale projects.

In line with StoxPlus’s analysis, cement facilities can hardly operate efficiently if the designed capacity is under one MTPY, especially when taking into account the electricity cost, maintenance expenses and other fixed costs. With regard to foreign players, 2017 witnessed active M&A prospects when SCCC and SCG invested heavily through the entire ordinary share acquisition of LafargeHolcim and VCM, respectively.

Positive signal from regulatory framework

In December 2017, the Vietnamese Government issued Decree No 125/2017/ND-CP, which is expected to boost Viet Nam’s cement export activities. The entitled zero per cent export tariff for cement has sharpened Viet Nam’s competitiveness, especially in the fierce race with ASEAN countries apart from China. It is estimated that export companies can now enjoy higher profit by US$3-4.5 per tonne under the new tariff.

Additionally, enterprises are being encouraged to participate in export activities thanks to the VAT reimbursement scheme. New regulations have taken effect immediately, which is indicated in the 4M/2018 export results. In 4M/2018, the total cement sales reached 29.83 million tonnes, recording a growth rate of 13 per cent year on year, mostly owing to the active export activities which increased by 29 per cent year on year.

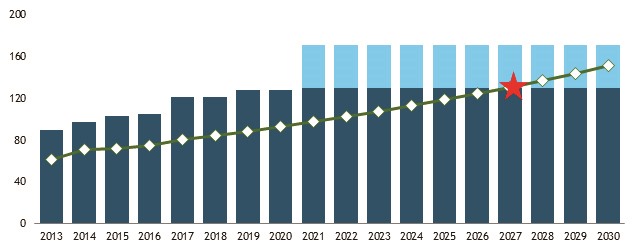

Projection: Viet Nam cement demand and supply would reach equilibrium in 2027

Based on StoxPlus analysis of macroeconomics and the historical cement demand since 2000, associated with the impact of related factors such as the status of infrastructure development and the residential house construction recently, the demand for cement is projected to grow at a rate of 5 per cent until 2030. Viet Nam is expected to face continuous supply surplus before reaching the equilibrium in 2027 at 130.8 million tonnes of cement, if the uncertain cement projects in Viet Nam are not taken into account. Even though Viet Nam’s cement sector still moves in tandem with the real estate boom and burst, this industry is still expected to enjoy healthy growth in the years to come.