Viet Nam’s benchmark VN Index edged up on Wednesday as its approach towards 1,025 points triggered investors to sell in the hopes of locking in profits.

Viet Nam’s benchmark VN Index edged up on Wednesday as its approach towards 1,025 points triggered investors to sell in the hopes of locking in profits.

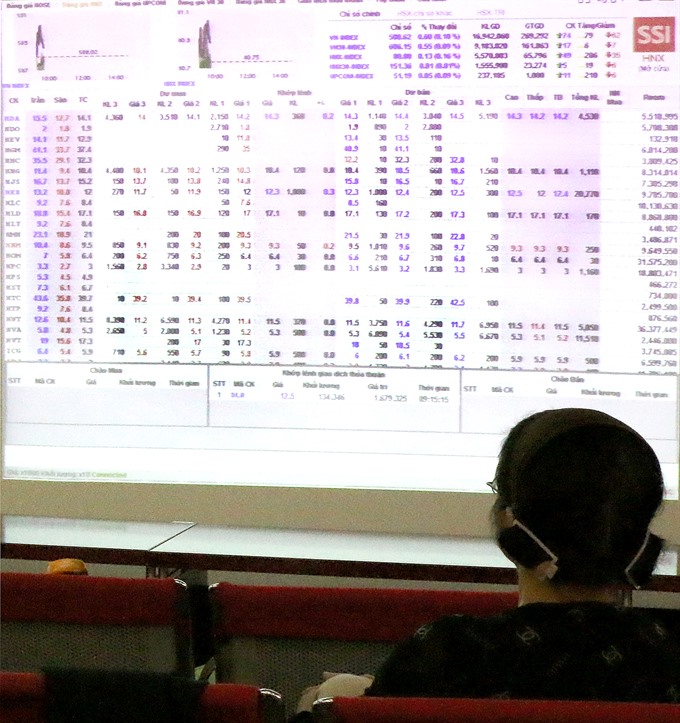

The VN Index on the HCM Stock Exchange was up 0.16 per cent to close at 1,020.40 points.

The southern market index rose as much as 0.56 per cent to touch its intraday high of 1,024.59 points during the session.

It has increased by a total of 0.74 per cent in the last two trading days.

The HNX Index on the Ha Noi Stock Exchange gained 0.26 per cent to end at 115.29 points.

Its growth was narrowed from an intraday high of 0.77 per cent reached in the early morning of Wednesday’s session.

The northern market index had fallen by a total of 1.1 per cent in the previous two sessions.

More than 221.8 million shares were traded on the two local exchanges, worth VND4.64 trillion (US$206 million).

The market breadth was quite balanced with 210 gaining stocks and 228 declining ones.

Shares of petroleum firms, banks, rubber companies, retailers and seafood businesses helped support the stock market amid strong selling pressure when the benchmark VN Index neared the 1,025 point level.

Those industry indices gained between 0.6 per cent and 1.7 per cent, data on vietstock.vn showed.

The large-cap VN30 Index also ended on the positive side, rising 0.28 per cent to close the day at 990.60 points with 14 of the 30 largest stocks by market capitalisation in the basket moving up.

Among gainers were Binh Minh Plastic JSC (BMP), Phu Nhuan Jewellery JSC (PNJ), Vincom Retail (VRE), Vietinbank (CTG), PetroVietnam Gas (GAS) and Saigon Securities Inc (SSI).

On the negative side, selling pressure hit stocks like dairy producer Vinamilk (VNM), food company Kido (KDC), consumer company Masan (MSN) and property developer Novaland (NVL).

According to analysts at Sai Gon-Ha Noi Securities JSC (SHS), trading liquidity on Wednesday declined from Tuesday’s level as both sellers and buyers were unwilling to trade.

“It proves investors are becoming more cautious and Wednesday was just a test for the market amid the unclear short-term outlook of the stock market,” SHS said in its daily report.

The benchmark VN Index has gained substantially by 3.32 per cent since September 17 to near the 1,025 point level. Overcoming this level is a challenge due to its ability to trigger selling pressure, SHS added.

Thus, the VN Index is expected to test the short-term peak of 1,025 points on Thursday and it may fall back and consolidate at 1,020 points before going up again, SHS forecast. — VNS