Four investors have been short-listed to qualify for being strategic shareholders of the Vietnam Oil Corporation (PV Oil), PV Oil CEO Cao Hoai Duong confirmed in a meeting with shareholders on May 22.

Four investors have been short-listed to qualify for being strategic shareholders of the Vietnam Oil Corporation (PV Oil), PV Oil CEO Cao Hoai Duong confirmed in a meeting with shareholders on May 22.

Among the investors, two foreign ones are SK Group of the Republic of Korea and Idemitsu company from Japan – one of the investors of the Nghi Son oil refinery project. HDBank and Sovico Holdings are the other two eligible domestic investors.

Duong said that PV Oil received shareholder registration applications in which investors registered to buy a number of shares equal to 2.8 times the shares offered.

“In fact, some investors want to buy as much as 35 per cent of PV Oil stakes, some want to buy all of them,” he added.

Therefore, PV Oil will organise a share auction so that the State can earn as much as possible from the divestment.

If the shares are sold at the initial price equal to the average winning price of the initial public offering (IPO) on January 25, the State could earn VND9 trillion (US$398 million), Duong estimated.

Earlier, on January 25, the Vietnamese Government raised VND4.18 trillion ($184 million) through the sale of a 20 per cent stake in PV Oil’s IPO.

As requested by the Government, after the IPO, the corporation must complete the selling of 44.75 per cent, or 462 million shares, to strategic investors within three months.

However, due to some strict criteria to select strategic shareholders, PV Oil needs more time for negotiation with investors.

One of the criteria is that strategic investors have to allow PV Oil to purchase products manufactured by Dung Quat and Nghi Son refineries for ten years. Besides, strategic shareholders are not allowed to transfer shares within 10 years to ensure their commitment.

Therefore, PV Oil has petitioned the Government, the Ministry of Industry and Trade (MoIT), and the Vietnam National Oil and Gas Group (PVN) to extend the time limit, Duong said.

He added that PV Oil expects to complete selling shares to strategic shareholders in July this year and organise the first general shareholder meeting in August to ensure benefits of other investors.

If approved, PV Oil will auction its shares to strategic investors on the HCM Stock Exchange and the auction result will be submitted to the MoIT and PVN to ensure publicity and transparency.

If the auction succeeds, the State will no longer hold a controlling stake at PV Oil as its share ownership will be reduced to 35 per cent.

Previously, eight investors have expressed interest in becoming strategic shareholders in the company, with plans to enter the Vietnamese petroleum market, including Sovico Holdings of Vietnamese billionaire Phuong Thao, founder of Vietjet Air, and the others being Shell, Idemitsu, Kuwait Petroleum International, Puma, SK, PTT and Sacom Investment Fund.

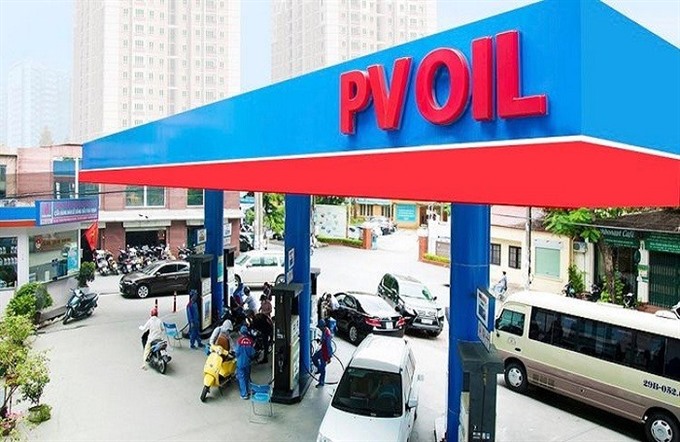

With a 20-22 per cent market share, PV Oil, a subsidiary of PVN, is the country’s sole crude oil exporter and the second largest petroleum distributor in the country after the Vietnam National Petroleum Group (Petrolimex).

PV Oil currently operates 500 petroleum stations and supplies petroleum for 3,000 other stations. — VNS