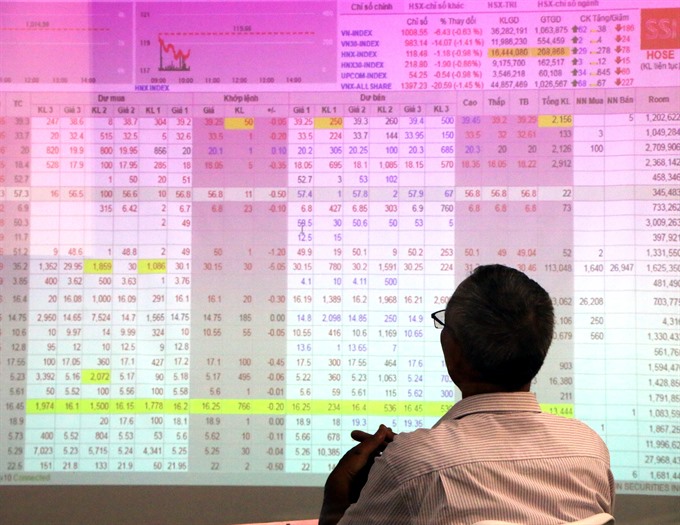

Vietnamese shares traded lower on Wednesday as blue chips were mixed and a sharp fall of trading liquidity showed investors’ caution with market conditions.

Vietnamese shares traded lower on Wednesday as blue chips were mixed and a sharp fall of trading liquidity showed investors’ caution with market conditions.

The benchmark VN Index on the HCM Stock Exchange fell 0.39 per cent to close at 948.50 points. It stepped back from Tuesday’s 2.19 per cent increase.

The HNX Index on the Ha Noi Stock Exchange was unable to stay positive, losing 1.05 per cent to end at 111.70 points. It gained as much as 0.48 per cent during the day.

The northern market index soared 5.13 per cent in the previous session, marking the strongest daily growth since its establishment in 2005.

More than 185.7 million shares were traded on the two local exchanges, worth VND5.1 trillion (US$227 million).

Trading figures on Wednesday were down 20.6 per cent in volume and 15 per cent in value from Tuesday’s numbers.

Trading conditions were negative, dominated by declining stocks which outnumbered gainers by 226 to 189 on the two local exchanges.

Of the total declining stocks, 16 of the 30 largest stocks by market capitalisation in the VN30 basket lost values, pushing the large-cap VN30 Index down 0.68 per cent to 918.64 points.

Financial-banking stocks were the main support for the markets as the banking, insurance and brokerage sector indices went up between 0.6 per cent and 1.2 per cent, per vietstock.vn.

The best performers among those stocks included HDBank (HDB), VPBank (VPB), Vietcombank (VCB), Bao Minh Insurance Corp (BMI), Bao Viet Securities (BVS) and Viet Dragon Securities (VDS).

Other sectors that also saw share prices rise were real estate, information-technology and communication and plastic and building material production.

On the opposite side, energy, food and beverages and retail stocks drove the stock indices down.

Another negative factor on the stock exchanges was foreign investors, who returned to net sellers with net sell value of VND393 billion – 23 times the number made on Tuesday (VND17.17 billion).

According to Sai Gon-Ha Noi Securities Company (SHS), the mixed performance among all stocks and sharp reduction of trading liquidity compared to previous sessions reflected investors fears about the market’s conditions.

Meanwhile, sellers continued to pose pressure on the market as they tried to offload stocks at high price levels, SHS said in its daily report, adding that negative moves of the global markets and extended net foreign selling were other factors to push stock indices down.

Bao Viet Securities Co said trading volume needs to improve in the next sessions to confirm a clearer recovery period of the market and it is likely that the market will continue falling. — VNS