The Ho Chi Minh Stock Exchange on November 18 introduced three new stock indices developed based on the investment requirements of local funds.

The Ho Chi Minh Stock Exchange on November 18 introduced three new stock indices developed based on the investment requirements of local funds.

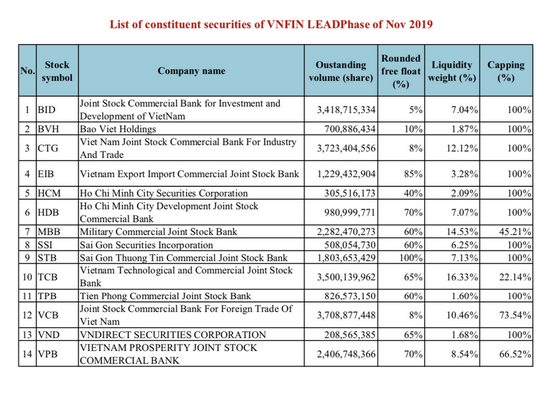

They are the Vietnam Leading Financial Index or VNFIN LEAD, Vietnam Financial Select Sector Index or VNFINSELECT and Vietnam Diamond Index or VN DIAMOND.

The first two are based on HOSE's VNAllshare Financials Index and the condition that each stock’s market capitalisation ratio will not exceed 15 per cent of the index.

VNFIN LEAD includes at least 10 constituent securities. Any company added to it must have at least VND10 billion (US$431,716) worth of daily trading and a minimum turnover ratio of 0.1 per cent.

The VNFINSELECT Index requires constituent stocks to have a minimum market cap of VND500 billion ($21.59 million) and minimum trading value per session of VND1 billion.

To be included in the VN DIAMOND Index, stocks must meet certain conditions in terms of market cap, transaction value and foreign ownership.

They should also have foreign ownership of at least 95 per cent of the permitted limit and the remaining stake that foreign investors can buy should not be worth more than VND500 billion.

The market cap of individual stocks must not exceed 15 per cent of the index and an industry must not exceed 40 per cent.

According to HOSE, the creation of indices based on the needs of investment funds is an inevitable step taken by stock exchanges around the world to meet the market’s diverse needs. — VNS