Vietnamese people optimistic about personal finances, anxieties remain about the cost of managing health

A total of 7,224 people, aged 25 to 60 years old, were surveyed in late December 2022 and early January 2023. In Viet Nam, 1,015 people were surveyed. Each respondent either owns insurance or intends to buy insurance.

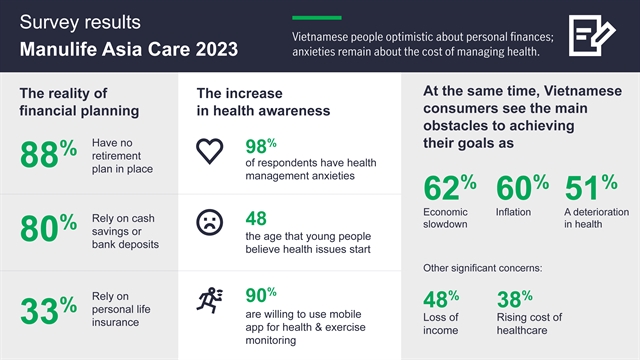

Vietnamese people are optimistic about the improvement of their personal finances but the vast majority are anxious about how they will manage their health, a Manulife survey has revealed.

According to the survey, more than half of respondents expect to see their personal income increase on average 17 per cent in 2023. This will help them achieve their financial goals, the principle of which is saving for retirement (40 per cent), followed by saving for healthcare and medical costs (37 per cent), children’s education (32 per cent) and saving for a new home (30 per cent).

The main tools for achieving personal finance goals, including saving for retirement, are cash (80 per cent), family support and inheritance (42 per cent), and personal health and critical illness insurance (37 per cent). These percentages are broadly in line with consumers in other markets across Asia.

At the same time, Vietnamese consumers see the main obstacles to achieving their goals as economic slowdown (62 per cent), inflation (60 per cent) and a deterioration in health (51 per cent). Loss of income (48 per cent) and the rising cost of healthcare (38 per cent) are also significant concerns.

Higher medical costs are the key factor in nearly all respondents (98 per cent) having health management anxieties, the survey said, outlining the rising expense of medical treatment (43 per cent) as the biggest one. The cost of consultation is also considered too high (31 per cent). Other concerns include the risk of lost income or even job loss (31 per cent) due to illness.

Close to two-thirds expect to achieve their save-for-retirement goals within 10 years however that may be optimistic given that only 12 per cent of those surveyed said they have a retirement plan in place, compared to an average of 32 per cent across Asia.

The survey also shows millennials are less concerned about saving for retirement (34 per cent) than they are about buying a home (42 per cent). Millennials also expect to retire at 56, while they think bad or chronic health issues will set in at a very young 48, suggesting eight years of bad health before retiring. In contrast, 45-plus-year-olds expect to retire at 61 and anticipate poor health at 67.

The Vietnamese edition of Manulife’s annual Asia Care Survey 2023 was conducted in the first quarter of this year via online self-completed questionnaires in seven markets including mainland China, Hong Kong, Indonesia, Malaysia, Philippines, Singapore, and Viet Nam.

A total of 7,224 people, aged 25 to 60 years old, were surveyed in late December 2022 and early January 2023. In Viet Nam, 1,015 people were surveyed. Each respondent either owns insurance or intends to buy insurance. — VNS