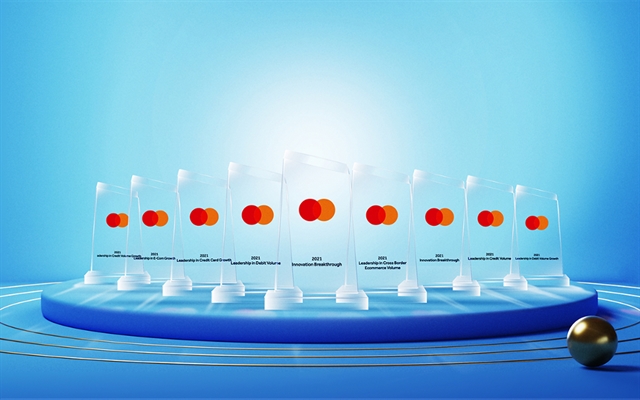

With the awards in nine categories of card innovation, growth and spending, VIB has also broken a record in the number of awards that Mastercard has ever granted to a partner.

Vietnam International Bank (VIB) has become the only bank in Viet Nam to receive nine awards from Mastercard at the same time, surpassing over 40 banks that have been issuing Mastercard cards in the country.

With the awards in nine categories of card innovation, growth and spending, VIB has also broken a record in the number of awards that Mastercard has ever granted to a partner.

Among these awards are "Breakthrough Innovation Award – The first successful Pay with Reward bank in ASEAN countries"; "Breakthrough Innovation Award – The first dual chip bank in Southeast Asia"; "The bank with the largest total credit card spending in Viet Nam"; "The bank with the highest growth rate of credit card spending in Viet Nam" and "The bank with the largest credit card growth rate in Viet Nam".

Other ones include "The bank with the highest growth rate of E-com spending in Viet Nam", "The bank with the largest overseas E-com spending", The bank with the largest total debit card spending in Viet Nam", and "The bank has the highest growth rate of debit card spending in Viet Nam".

"By winning 9 out of 13 Mastercard Banking Awards 2022, VIB has set a record that is hard to break and continues to affirm its position as a leader in card trend, actively promoting a cashless society, thereby contributing to the development of the digital economy in Viet Nam," said Safdar Khan, Division President for Southeast Asia, Mastercard.

"These awards also demonstrate VIB's superiority in the card market when it is always leading in capturing and creating new card trends not only in Viet Nam but also in the region. With VIB's strong belief and commitment to cooperating, we are opening up new opportunities that enable Vietnamese users to connect with their passions and enjoy priceless experiences."

A leader in disruptive innovation

In 2021, VIB was the first bank in Southeast Asia to issue dual-chip cards. It was also the first bank in ASEAN countries to successfully apply Pay with reward, giving cardholders more choices in using bonus miles, especially when air travel was still limited during the peak of the COVID-19 pandemic.

The VIB's simple payment method with bonus miles allowed customers to easily pay 24/7, with just a few taps on the MyVIB application on their mobile phone. Customers can also change this feature on/off at any time according to the need to accumulate and spend bonus miles.

Previously, VIB had launched a card line that integrated both credit cards and Online Plus 2in1 payment cards. This smart card could automatically save the card number in the Grab application installed on the cardholder's phone and automatically connect to this application to immediately accumulate points for all the cardholder's consumption, allowing them to have 20 times more points than regular Grab transactions.

Top bank for credit card growth

As of June 2022, VIB has cooperated with more than 20 leading partners in the fields of e-commerce, big data, fintech and retail in Viet Nam and the region to issue VIB credit cards nationwide jointly. VIB is also the leading bank with media coverage on digital marketing and traditional marketing channels in the local market.

Five years ago, it took Vietnamese consumers 1-2 weeks to fulfil many procedures and papers, and they had to go to a bank branch if they wanted to open a credit card. But two years later, VIB's virtual card technology, green pin and automatic credit limit approval paved the way for the debut of 100 per cent online credit card approval and issuance process with no papers and no time for travel needed. Customers can use their cards in 15-30 minutes.

VIB was one of five leading banks in the number of new cards issued among 40 banks in Viet Nam by the end of 2021, according to the Viet Nam Card Association's statistics. VIB also led in the growth rate of Mastercard credit cards, 5-6 times higher than the average of the whole market in quantity and quality.

Leading bank for card spending

Statistics of the Viet Nam Card Association showed that by the end of 2021, VIB was named in the Top 3 in terms of total card spending, accounting for 10 per cent, or $18.6 billion/year of the market share.

The bank also ranked second in total spending on Mastercard's cards, making up nearly 35 per cent of Mastercard's total spending in Viet Nam.

These encouraging achievements were thanks to VIB's ongoing efforts in implementing credit card personalisation with the launch of many different product lines to bring outstanding benefits to other spending needs in all areas of life from travelling, shopping, online consumption, family consumption spending, instalment payments and gas filling.

VIB said consumers' perspectives on credit cards – according to the diversity of credit card portfolios that VIB pioneered in the market – have changed a lot over the years, making a positive contribution to the development of the cashless trend in Viet Nam. — VNS