After three years of implementation, digital banking has yielded promising results, contributing significantly to the establishment of a digital government, digital economy, and digital society.

Việt Nam's banking sector is in a prime position to take the lead in the country's digital transformation process, said Prime Minister Phạm Minh Chính at an event organised by the State Bank of Vietnam (SBV) to promote the development of digital ecosystems and connectivity in Hà Nội yesterday.

According to the sector's leaders, customer experience remains the benchmark for success and a key priority in the National Digital Transformation Programme as the SBV outlined in its vision towards 2030.

The SBV has selected the theme "Expanding Connectivity and Developing Digital Ecosystems" for the 2024 Banking Sector Digital Transformation.

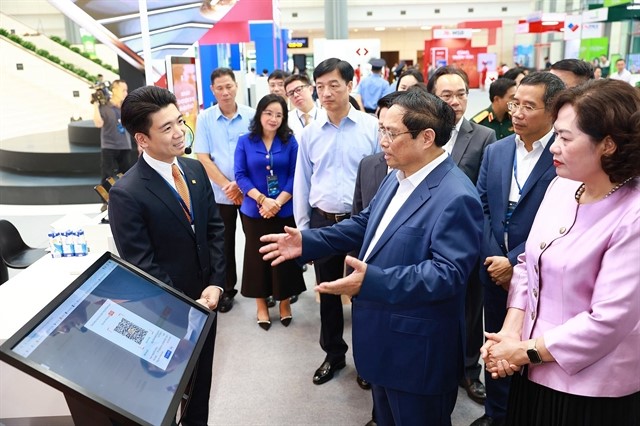

During the event, several ministries, sectors and credit institutions discussed various topics related to the digital transformation of the sector, including the application of population data to support service development, ensuring security in digital banking, connecting and integrating population data applications, developing "Make in Vietnam" digital platforms, promoting the formation of a digital ecosystem, and building an open ecosystem.

Other topics include integrating banking products and services, integrating technology in developing financial services, and solutions to deal with suspected fraudulent activities.

Participants also had the opportunity to visit numerous exhibitions by commercial banks and credit institutes that featured the latest technologies and developments in the field of digital banking.

Việt Nam has set a target to develop a digital economy based on four pillars: ICT industry, digitalisation of economic sectors, digital management, and digital data as important drivers for rapid and sustainable socio-economic development, said PM Chính.

The PM praised the central bank for its leadership in steering the digital transformation within the sector. He said the sector plays a vital role in realising said vision, as an integral part of the national digital transformation to build a digital economy and society.

He outlined three objectives for the future of the sector which included creating the most favourable conditions for customers, reducing operating costs and building a robust risk and safety control system.

The government leader also mentioned limitations in the digital transformation process such as institutional constraints, outdated digital infrastructure and platforms, challenges in ensuring security and information security, limited participation of tech companies and shortages of skilled workers, particularly in information technology.

After three years of implementation, digital banking has yielded promising results, contributing significantly to the establishment of a digital government, digital economy, and digital society.

To date, over 87 per cent of Vietnamese adults have access to bank payment accounts, with commercial banks processing over 95 per cent of all transactions through digital channels. The growth in mobile payment and QR code transactions has doubled every year from 2017 to 2023 as large investments have been made in banking technology infrastructure to ensure seamless, secure, and uninterrupted operations.

In addition, new digital technologies have been implemented to cater to the increased demands of citizens and businesses, boosting the development of innovative products and services.

Việt Nam has successfully established cross-border payment connections via QR code with Thailand and Cambodia, and is currently extending this to Laos, with plans for further expansion across ASEAN countries.

The banking sector has had close collaborations with the Ministry of Public Security (MPS) in crime prevention and control, using VNeID - the national population database - for data cleansing, identification, and precise customer information verification to support electronic lending operations and electronic guarantees, improving the safety of banking activities.

So far, 58 credit institutions across the country have implemented customer authentication via chip-embedded ID cards at counters, while 14 are experimenting with electronic identification and authentication, using VNeID, for payment transaction authentication and customer information verification.

Cashless payment transactions have continued to show strong growth in recent years. In the first four months of 2024, cashless payment transactions have increased by 56.57 per cent in volume and 31.35 per cent in value, with internet channel transactions growing by 48.81 per cent and 25.73 per cent, respectively. Mobile phone channel transactions have increased by 58.70 per cent and 33.12 per cent, respectively. VNS