Taxes and duties are a very important source of State budget revenue and provide major finance for the Government’s socio-economic development programmes. In Viet Nam, tax revenue is starting to decline while expenditure continues to rise, threatening budget sustainability.

Taxes and duties are a very important source of State budget revenue and provide major finance for the Government’s socio-economic development programmes. In Viet Nam, tax revenue is starting to decline while expenditure continues to rise, threatening budget sustainability.

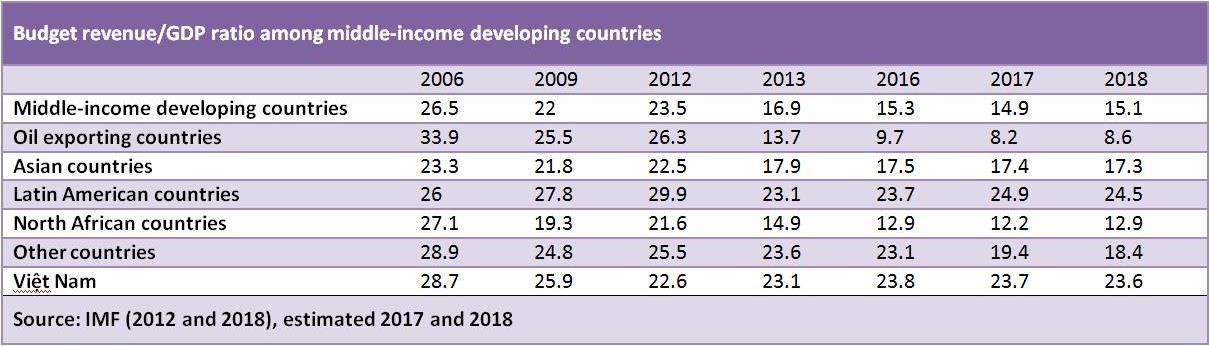

Revenue has been shrinking remarkably in recent years, from around 30 per cent of gross domestic product (GDP) in the late 1990s, to 26-28 per cent between 2006 and 2009 and 23-24 per cent in the past five years.

Though the current budget revenue to GDP ratio is considered normal, according to the Viet Nam National Economics University’s report on the national economy in 2018 and prospects in 2019, the level of budget collection is not sustainable.

Structuring revenue by taxes and fees, budget revenue consists of three main sources – value added tax (VAT), corporate income tax (CIT) and import-export tax. Apart from VAT which is already high, tax revenue on import-export activities has decreased rapidly since 2012, accounting for more than 15 per cent of the budget revenue annually in the past five years (even below 13 per cent in 2018).

This revenue source is predicted to continue declining as Viet Nam fulfils its commitments to the World Trade Organisation (WTO) as well as implements other free trade agreements.

The revenue from corporate income tax has also decreased significantly, currently making up 16.8 per cent in 2018 compared to 25 per cent in the 2006-10 period. Revenue from crude oil also fell to only 3-4 per cent in recent years, down from 20 per cent in the 2001-10 period and 13.4 per cent in the 2011-15 period.

Low corporate income tax has been blamed as Viet Nam needs policy to stimulate the development of the private sector.

Based on the collection source, the State coffers rely heavily on domestic revenues, accounting for more than 80 per cent of total budget revenue since 2016. Of which, the contribution of land fees is increasing, from 9.6 per cent of domestic revenue in the 2006-11 period to nearly 14 per cent in 2016-18.

However, collection mainly comes from one-time fees on land use rights (more than 8 per cent in 2015-18) while the tax on property transactions accounted for just 0.2 per cent of total revenue. This source of revenue is not steady when the economy slows or provinces run out of land funds.

Budget revenue is decreasing but Government spending is rising. Budget expenditure from 2005 until now has made up about 30 per cent of GDP. Although the growth rate of expenditure has decreased significantly in the past five years (from 20 per cent in the previous period to 8.2 per cent annually in 2014-18), public spending remains quite high.

Spending on development investment tends to decrease (from 42 per cent in 2009 to an estimated 25 per cent in 2018) but frequent expenditure – the largest portion of spending – is constantly increasing together with economic expansion, equivalent to around 70 per cent of total spending. Of which, payroll in Viet Nam is high compared to other countries.

Under increasing spending pressure, to stop the budget deficit from rising, the Government’s priority is to enhance the efficiency of expenditure while finding alternative sources of revenue.

Improving efficiency is associated with reforms in the State apparatus operation and payroll, as well as enhancing public investment quality. Meanwhile, expanding revenue is attached to broadening the tax base.

However, raising taxes needs to be done cautiously as this will affect savings and reduce investment in production. High tax can also encourage fraud and tax evasion and thus cause tax losses and lead to market distortion due to unfair competition practices. The reported transfer pricing scheme by foreign-invested enterprises is one example.

Viet Nam has implemented many tax reforms, including the introduction of the Value Added Tax Law in 1997 and Corporate Income Tax Law in 1999.

The current proportion of VAT, CIT and import-export tax in Viet Nam’s total budget revenue is higher than in other middle-income developing Asian countries, so the expansion of this tax source is unlikely.

Taxes that Viet Nam may expect to increase in the future include personal income tax, excise duty, natural resources tax and property tax. With personal income tax, tax collection in 2014-18 averaged only half of that of middle-income developing countries.

However, to make tax increases possible, there needs to be a mechanism to control income sources, and more importantly, to raise people’s incomes, driven by stable and faster economic growth.

Policy implications

It is essential to have a long-term view on balancing revenue and expenditure. The golden rule to ensure budget sustainability is regular revenue must be greater than current expenditure to avoid excessive deficits and being unable to pay debts, as well as building a surplus for development investment spending.

In terms of revenue, the Government needs bold measures to strengthen tax collection and reduce tax losses which are happening in new business models based on the development of technology (e-commerce and the sharing economy), foreign direct invested enterprises and even the private sector – the main taxpayers.

The private sector is the backbone of the economy but its economic contribution mainly comes from the non-official area (small business households and individuals). The Government should develop breakthrough reforms in improving the business environment, creating a fertile ground for small firms to develop.

The Government also needs to continue creating solutions to quickly reduce input costs for doing business. To cut costs for enterprises without greatly affecting budget revenue, it is necessary to focus on market factors (such as capital market, labour market and land) with lower costs.

It is important to keep a close watch on the reversal of revenue sources, to see what may increase, and what may decrease. The recent CIT and import-export tax reduction is good for trade liberalisation and domestic production. Meanwhile, excise duty, property tax and personal income tax are possible areas for revenue increase.

In terms of expenditure, the focus of fiscal policy is to reduce budget spending. It is essential to maintain the budget deficit at less than 3 per cent of GDP (Viet Nam’s budget deficit has stood at around 3.5-3.7 per cent in recent years) and reduce the size of actual budget spending.

The Government needs to restructure expenditure towards increasing the efficiency of development investment, focusing on necessary and effective projects and strictly controlling public investment to prevent waste, loss and corruption.

As revenue is not stable, the State should call on private investment for development projects (public-private partnerships).

In addition, the Government must reduce current expenditure by downsizing payroll together with streamlining State employees.

* Vo Tri Thanh is a senior economist at the Central Institute for Economic Management (CIEM) and a member of the National Financial and Monetary Policy Advisory Council. The holder of a doctorate in economics from the Australian National University, Thanh mainly undertakes research and provides consultation on issues related to macroeconomic policies, trade liberalisation and international economic integration. Other areas of interest include institutional reforms and financial systems.